Dan Weiner did an analysis of exactly this data point in his newsletter last week. Bottom line:

I don’t doubt this. I also hope I haven’t called anyone a dirty market timer, just emphasized my own choices to not engage in it. A few points I’ve been trying to make on this string, which are biased by my investing and informal study for, gosh, 27 years now, include:

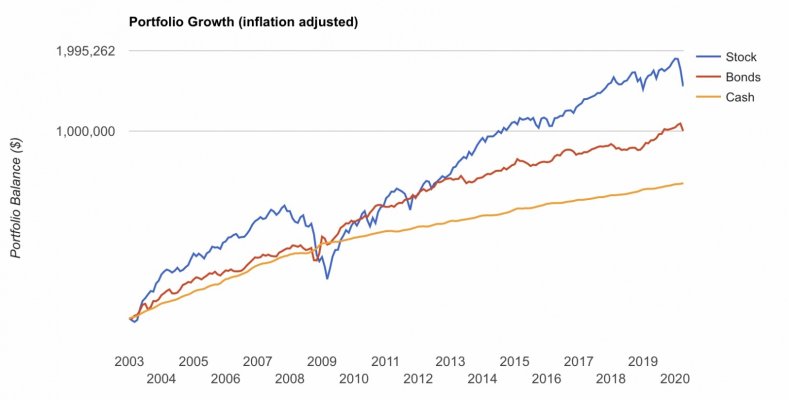

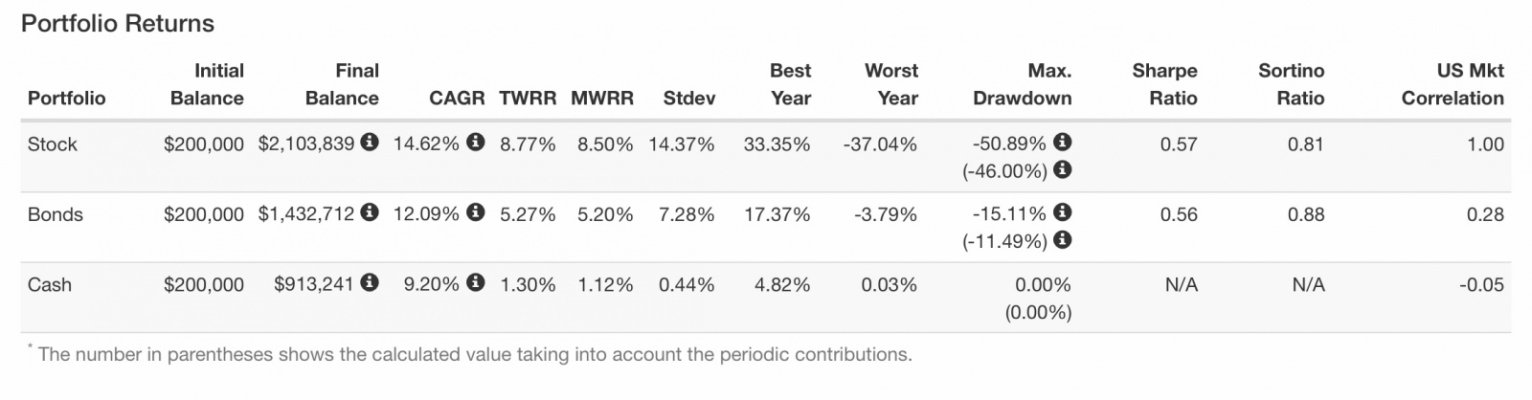

Growth and taking appropriate risk is important to keep ahead of inflation. I believe that’s best done on the equities side while bonds provide ballast.

Bond ballast is important, because every 8-10 years or so, equities keel over in a big way, like now, converting the ship into a submarine.

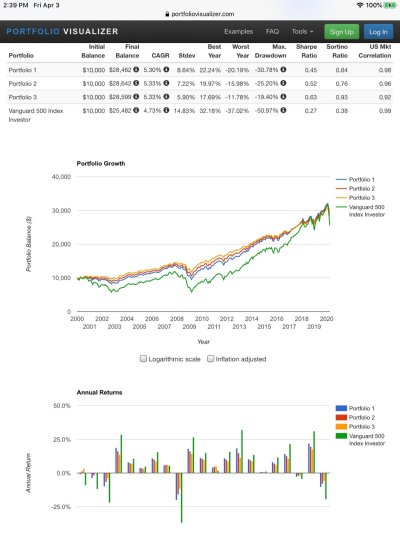

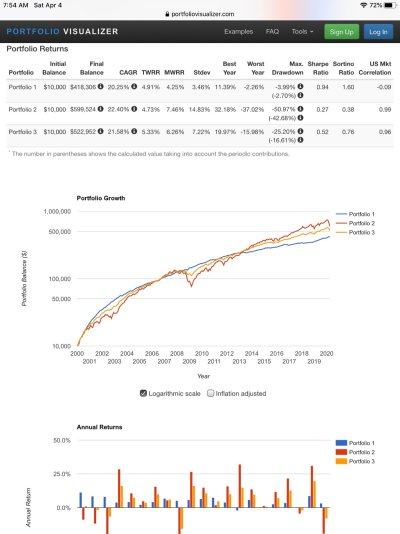

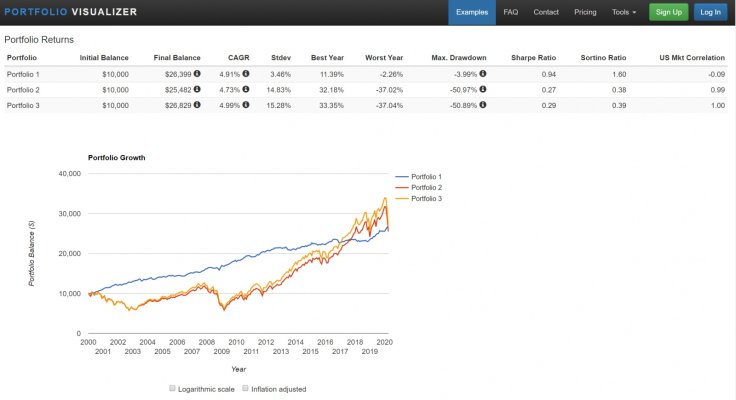

V-shaped stock recoveries are by no means assured. As the trend lines this century show, a periodic stock plunge can take many years to recover from, often not reaching the surface again until just in time for the next inevitable storm.

One can attempt to dodge the currents, dancing in and out of stocks or otherwise getting fancy. All the evidence is, this cannot be done successfully consistently and investors end up losing their butts over time. I choose to stack the odds toward reasonable growth and against losing my butt.

Doesn’t the evidence point to not trying to outsmart the markets? Isn’t the more assured way to investing success picking an asset allocation across low cost stock and bond funds, with a cash cushion large enough to allow sleep, and then sticking with it for twenty years+ so that all the various underlying asset class cycles and their inevitable reversions to mean can play out?

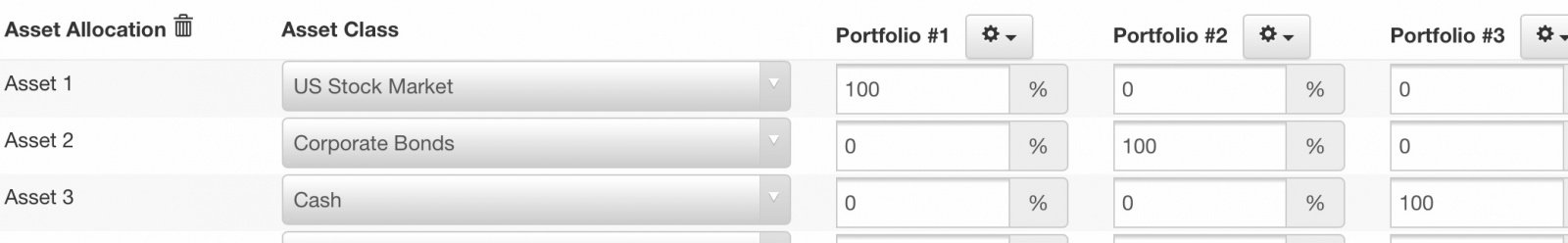

The evidence is, any blended, balanced portfolio somewhere between about 35/65 and 65/35 is not better than another. They each keep ending up at the same value periodically, as long as they aren’t fiddled with, which is hard to do in a storm like this and in stock bull markets. Isn’t a smoother ride more enjoyable than a rough one if all the routes get everyone to the same destinations at the same time?

Broad diversification is also appealing - TO ME. The international topic is heated. My own assumption is, populations are growing faster in some other countries than ours, those people will need stuff, the global economy will therefore grow and I think the best way to get a piece of it is to own my slice of the world’s economy. I re-counted the number of underlying securities that my portfolio is exposed to and it is some 28,000. I’m the kind of investor who finds strength and security in enormous diversification. I appreciate that Bogle and Buffett, et al thought/think differently.

Anyway, if I wrote my investing manifesto, it would include those points. It would also be boring, simple and entirely unoriginal. Finally, it would likely be successful, as that proven, replicable approach, along with working hard in my career and saving an above average percentage of it helped me achieve years ago my personal goal to become a millionaire, and then some. My 50/50 allocation is keeping me solidly well there through all this turmoil and I’m not concerned whether I should be DOING this or that dance right now. I’ve built my boat over many years and believe that my job and best choice is to just stay the course.

Best wishes for your own approaches.