The only bad question is the one that doesn't it asked. Welcome to the neighborhood. The banking fraud & watching the US Congress peeing on itself as they took orders from Goldman Sachs to pass TARP or watch the world as they know it disappear into oblivion would make anyone think twice about casting their pearls before the swine known as Wall st. But then again you got to ask yourself what are your alternatives.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Burned more than once by the market

- Thread starter TJFogelberg

- Start date

What would you suggest as a similar risk/return alternative to bonds/funds? CD's and other cash equivalents have provided returns from 0-1% unless you go long. And bond funds were declared dead beginning in 2009 when rates were slashed, and that clarion call has been repeatedly constantly since. Meanwhile many short and intermediate bond funds have returned 2-3% per year after dividends and NAV changes for 8 years.

Everyone holding bonds should know the relationship between bond fund NAVs and interest rates.

This has been discussed many times here an elsewhere, and no one has yet come up with a clearly better alternative that isn't just trading one type of risk for another. Unless I missed it.

While not completely similar in risk due mainly to government bonds, I use high yield dividend index funds that were 4-6% at the time (3-4% now). I figure the funds contain older established companies with little likelihood of going under, no riskier than the corporate bond component of any bond index fund. Any additional risk has been offset by growth in fund value over the years.

I've always assumed I was minority here in being ~90% invested in equities in retirement (rest in cash to cover 2 years expenses). My reasons for doing so are that we have pensions, which I treat as a bond component, and we'd like to leave a legacy for the kids. I will say that if/when interest rates rise above a certain level, I'll reduce my equity portion as I want to leave a balanced asset allocation to be inherited.

Oh, and I survived 2 market downturns, losing up to 50% in value, only to come out much better in the end. The only drawback being FI at a later time, more in line with retirement plans.

Oh, and I survived 2 market downturns, losing up to 50% in value, only to come out much better in the end. The only drawback being FI at a later time, more in line with retirement plans.

Last edited:

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That's the rub. A perfectly acceptable personal choice, but the risk is simply not comparable to broad bond fund. Vanguard characterizes Total Bond Market Index Fund Investor Shares (VBMFX) risk at 2 of 5 and High Dividend Yield Index Fund Investor Shares (VHDYX) risk at 4 of 5. Doesn't serve the same purpose in an asset allocation plan at all. I can only assume suspect Dash Man was advocating market timing, that's a different discussion altogether.While not completely similar in risk due mainly to government bonds, I use high yield dividend index funds that were 4-6% at the time (3-4% now). I figure the funds contain older established companies with little likelihood of going under, no riskier than the corporate bond component of any bond index fund. Any additional risk has been offset by growth in fund value over the years.

Last edited:

.if one has enough resources to fund retirement using a 'safe return' rate, why gamble with the bulk of one's assets in the stock market? (Doesn't anyone else remember '08?) ......

You make the assumption that "gambling" the bulk of one's assets in the stock market is particularly risky in regards to running out of money. It's not always much of a "gamble". We currently have 85% of our assets in equities. But we have enough in fixed assets (cash and bond funds) to live on through a market downturn. And if things really turned south, we could also cut back expenses to the point that we could probably live off just the distributions from our assets. So having a lot of money in equities isn't much of a gamble in our situation. The added value of investing in equities supports our desired charitable donations and financial gifts to our kids.

CRLLS

Thinks s/he gets paid by the post

I am surprised at the group think on this board that seems to have most fully invested in stocks. This is my question...if one has enough resources to fund retirement using a 'safe return' rate, why gamble with the bulk of one's assets in the stock market? (Doesn't anyone else remember '08?) We're planning to spend down. At 85 we can age in place and live comfortably on SS if we're still kickin. We're not planning on catastrophic LTC costs etc, hoping to be dust in the wind before that happens.

I may be one of the "gamblers" who prefer to stay in the game. I would ask you the opposite question. "If one has enough resources to fund retirement using a safe return rate, WHY NOT continue with the bulk of one's assets in the stock market?"

If you can continue making above CD and bond rates, and the include the inevitable "big correction" or two or three in your plan, can still cover most of your expenses with non-investible incomes such as SS and pension incomes, can continue living in the same lifestyle you have up till now, why not continue with what brought you to this point? The various calculators all give the opportunity to change one's asset allocation for determining the likely hood of success. I use them.

What if you and your spouse plan to age 90, find a success rate that makes you comfortable, and then happen to live to age 105 or more, what then? You say you are not planning for LTC but what if you happen to need care? even though most don't, many do. Making historically higher returns on my equity investments only opens more security for us over the next 30+ years..... I know 30 years ago I didn't think of some expenses that I have now. Who knows what the next 10, 20, 30 years will bring?

But ours is not a set and forget plan. I can always adjust it any time I need to and probably will. I am continuing to increase my financial knowledge even at the age of 64. Who knows what my plan will look like in 10, or 20 years? So far - so good!

At least that is some of my thinking.

Markola

Thinks s/he gets paid by the post

The recovery from DOW 5000 in 2008 happened because of QE, zero interest rates, and other artificial interventions. Savers have been crushed and often persuaded to invest in "higher yielding" securities and annuities that often pay 6-8% commission to the agent who talks them into it. I'm not against stocks, just disagree with conventional wisdom that one should be heavily invested. I'm using a fixed rate of return of 2% with inflation the same. We pay no income taxes upon full retirement. Everything is paid for. Our big purchases are behind us. Health is generally above average despite problems causing desire to retire early. We definitely won't be investing aggressively to try to fully fund LTC costs. (Few spend any length of time in a LTC facility). Currently 70% CD, zeroes, ST Vang bond. 30% index stock funds, a few ind securities, and high yield and longer duration bond funds. 2 low cost annuities. We have very low fixed costs now and in retirement. A significant portion of our budget is discretionary, which is a wonderful thing. If you have 3X the money you need to fund actual cash needs, I see no harm in ramping up risk and playing the market. (You're playing with money you will never touch anyway. )

Congrats and good luck as your personal plan hits the unforeseeable jungle, which we all face. I am 80/20 with two index mutual funds and was a millionaire at 48 and am well on the way at 51 to multimillionaire. Like many, many here, I'm proof that a dirt simple common sense method works. I still have a LOT to learn from others but I have achieved enough to date that I'll only consider insults to my Bogle approach from people who have achieved more, earlier, with a repeatable method that works for my busy schedule and risk tolerance. Personally, I want nothing to do with individual stocks or annuities or CDs or, to be truthful, having any % of my net worth allocated to RVs. The nice thing about this board is it's a unique place to compare notes with other successful people. If it's group think, at least call it How the More Polite and Wealthy Group Thinks (relative to the rest of the toxic interwebs.)

W2R

Moderator Emeritus

I am surprised at the group think on this board that seems to have most fully invested in stocks. This is my question...if one has enough resources to fund retirement using a 'safe return' rate, why gamble with the bulk of one's assets in the stock market? (Doesn't anyone else remember '08?) We're planning to spend down. At 85 we can age in place and live comfortably on SS if we're still kickin. We're not planning on catastrophic LTC costs etc, hoping to be dust in the wind before that happens.

Hi, and welcome to the forum, TJFogelberg. I encourage you to look around and read various posts and threads here so that you understand what sorts of things are frequently posted here.

Of course, we have members who are retired, not retired, working part time, 25-85 years old, and with various family situations. So while many of us follow the Bogleheads philosophies, investing in broad index funds instead of stocks, there are some who do invest in stocks. There are many threads here on AA and those who report a 100:0 AA are pretty few and far between, and often in the accumulation phase.

Personally I am retired and age 68, with a 45:55 AA that is mostly invested in Vanguard's broad index funds. Being quite conservative, I also have a paid off house and no debt other than one credit card which I always pay off in full each month.

The 2008-2009 stock market crash provided a nice test of asset allocation for many of us who never sold low, rebalanced during the crash several times, bought low in the process or otherwise. Many who did this ended up recovering our pre-crash net worth pretty rapidly, some by the end of 2009 or in 2010.

athena53

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 11, 2014

- Messages

- 7,378

Welcome to the forum. I'm 64 and I'm 70% in equities and I'm OK with that. I've been investing since I was 19 so I've been through bad markets, and learned early that if you're invested in good assets you stay the course. It has its rewards.

The last crash occurred while I was still employed, so it was easier to take since I was putting large amounts of money in at bargain-basement prices. When the next one comes, and it will, I'll take stock and figure out if I want to decrease my withdrawals, which I'm trying to keep at 3%. I'm getting SS and a couple of small pensions and could live on them if I had to but the travel and charity budgets would suffer.

The last crash occurred while I was still employed, so it was easier to take since I was putting large amounts of money in at bargain-basement prices. When the next one comes, and it will, I'll take stock and figure out if I want to decrease my withdrawals, which I'm trying to keep at 3%. I'm getting SS and a couple of small pensions and could live on them if I had to but the travel and charity budgets would suffer.

Luck_Club

Full time employment: Posting here.

- Joined

- Dec 5, 2016

- Messages

- 733

I realize there are many here diversified into real estate and other opportunities, but regarding equities there is a groupthink among many members. The asset allocation crowd unwilling to budge from their particular asset allocation had always puzzled me. Things do change in the financial world that I believe requires readjusting financial assets periodically, but I'm labeled a market timer by the AA folks. Personally, after a 35 plus years bond bull market with rates near zero, why would anyone have a large allocation in bonds? Bond funds are particularly risky if there is a sharp rise in rates. But the AA crowd sticks to their allocation when bonds have no where to go but down.

Stock equities I maintain in selected individual stocks rather than funds that will follow the wild swings in a turbulent market should significant events happen. I do keep a large sum in cash to live on for several years if there is a severe market downturn. I also have real estate, insured CDs and some physical gold and silver.

Worldwide sovereign, corporate and personal debt is skyrocketing and printing more and more dollars will eventually take its toll. All it will take is loss of faith in these fiat currencies to cause a worldwide financial crisis worse than 2008. None of the causes of the 2008 crisis has really been fixed. But I guess we'll see in time.

+1

brett

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 24, 2010

- Messages

- 5,926

Moderately invested. 55-65 percent (excluding vale of DB). Range depends on market at any given time. We fell quite comfortable with this because of a secure DB pension.

Like others, we did not sell anything in the 2008 crash. We actually picked up some equities. Worked well. 2008 was a blip. We are in for the long term-25 years hopefully. No doubt there will be other blips along the way but this will not preclude us from investing in equities.

A larger concern for us at retirement was sequence of returns. Worked out well as I retired early in 2012. The bump since then has made us more confident that a 55 equity split is reasonable in our circumstances.

Like others, we did not sell anything in the 2008 crash. We actually picked up some equities. Worked well. 2008 was a blip. We are in for the long term-25 years hopefully. No doubt there will be other blips along the way but this will not preclude us from investing in equities.

A larger concern for us at retirement was sequence of returns. Worked out well as I retired early in 2012. The bump since then has made us more confident that a 55 equity split is reasonable in our circumstances.

There you go have ice water in your veins & buy when there's body parts & blood running in the streets. It's easy. If eight years later you find yourself living in a relatives basement you know you screwed up. On the other hand if you tripled your money you know your a genius & should buy a lottery ticket too.

That's the rub. A perfectly acceptable personal choice, but the risk is simply not comparable to broad bond fund. Vanguard characterizes Total Bond Market Index Fund Investor Shares (VBMFX) risk at 2 of 5 and High Dividend Yield Index Fund Investor Shares (VHDYX) risk at 4 of 5. Doesn't serve the same purpose in an asset allocation plan at all. I can only assume suspect Dash Man was advocating market timing, that's a different discussion altogether.

True, but IMO, I'd place the duration risk as being more prominent and lasting for several years if/when interest rates head up over a short period. While it doesn't serve the same purpose in an AA, it does provide an income stream similar to bonds.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

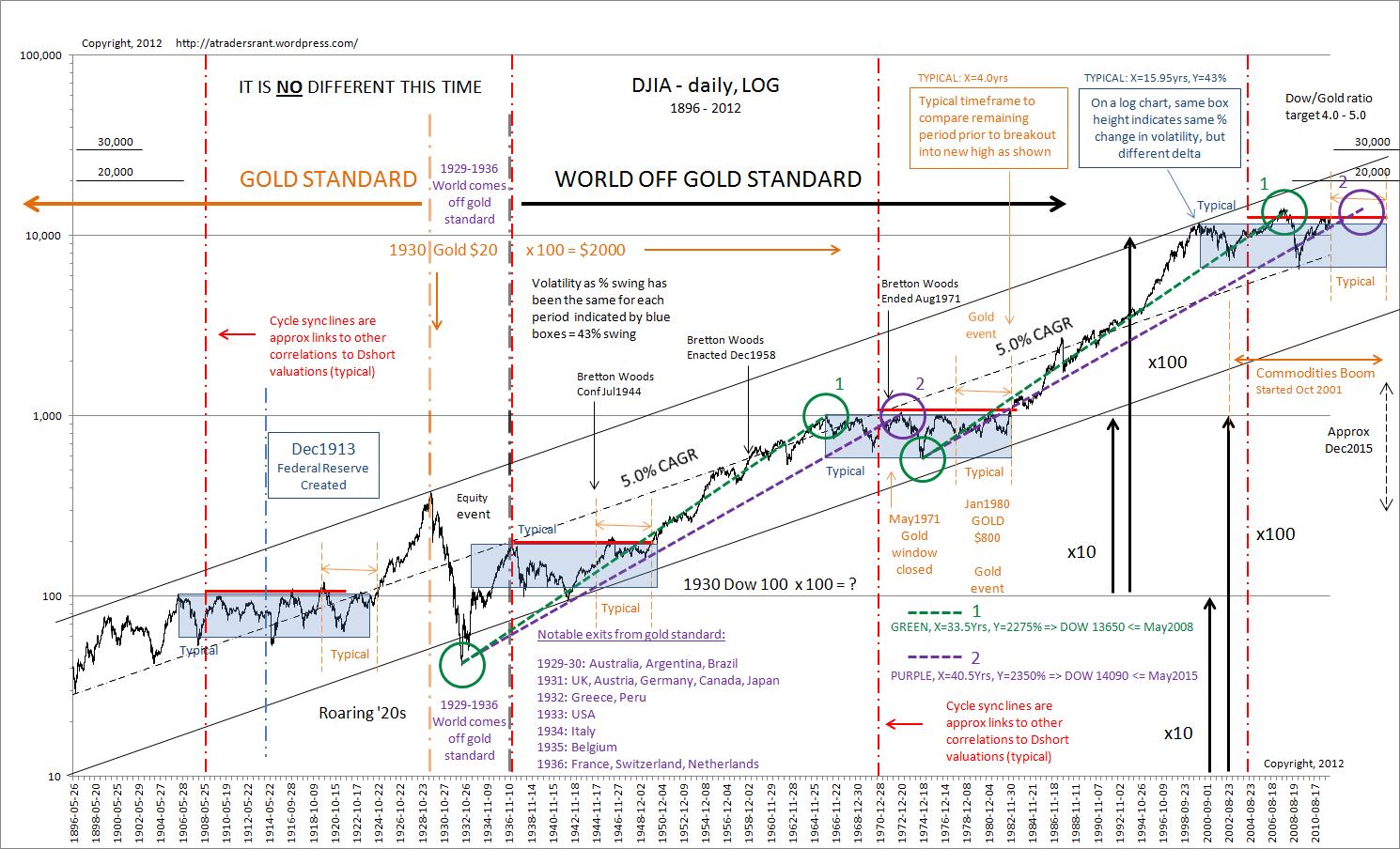

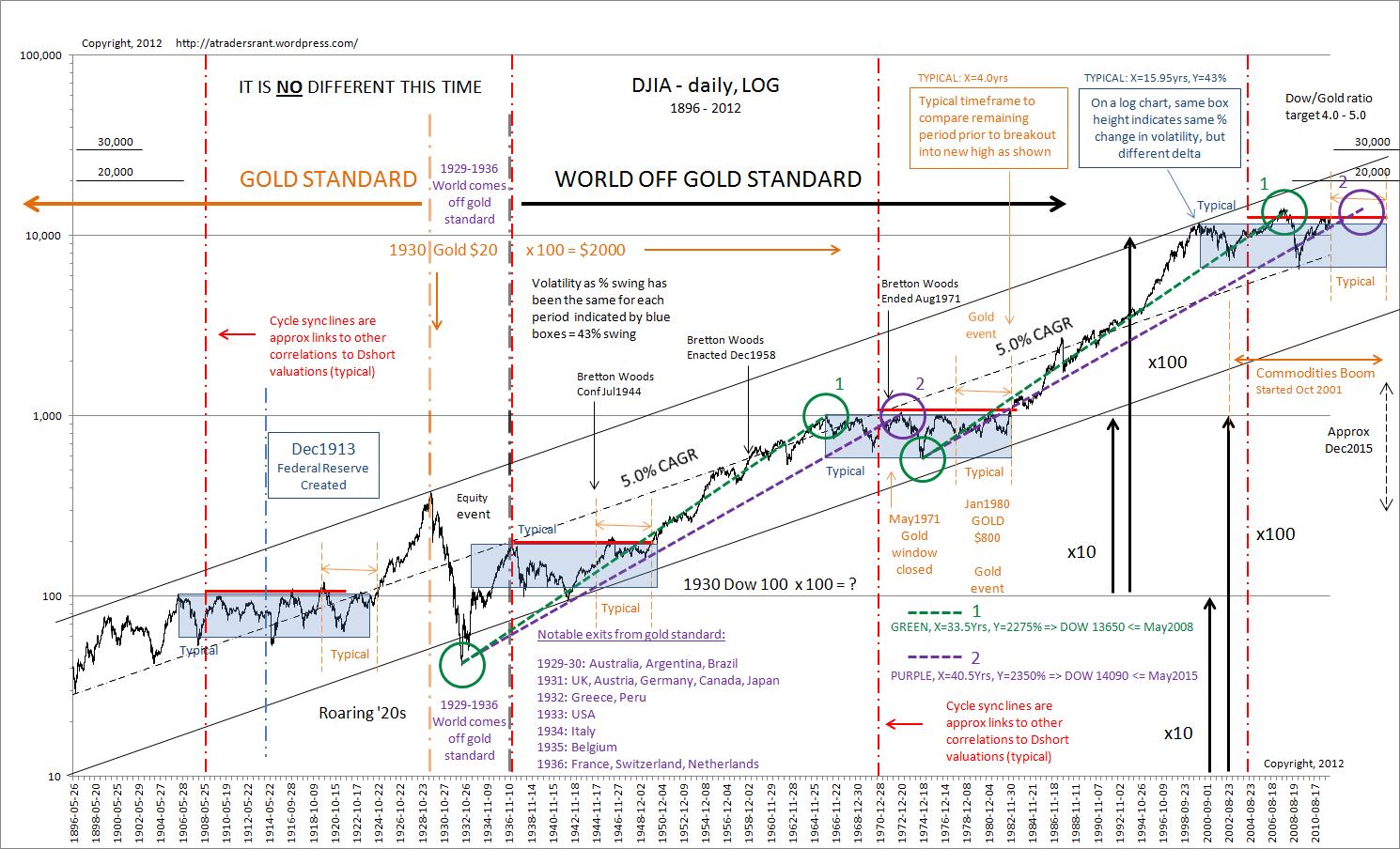

Not that it couldn't, but when how many times has that happened in the last 120 years? And which of those times didn't ultimately turn upward on go on to new highs?There you go have ice water in your veins & buy when there's body parts & blood running in the streets. It's easy. If eight years later you find yourself living in a relatives basement you know you screwed up. On the other hand if you tripled your money you know your a genius & should buy a lottery ticket too.

Blue Collar Guy

Thinks s/he gets paid by the post

so are u still 100 % in stock?

my tax guy(an old friend), had a huge hoot at my expense when he saw my 2008 year end investment loss(paper loss) i didnt sell and kept dollar cost averaging. he of course was smarter than me and timed the market and switched to a stable fund pre-crash, because he knew it was coming. this year i remembered about that so i asked him when or if he jumped back into the market, since he was a guru pre crash. he thinks the market is too hot now. he was short on details as i suspect he has missed the ride up we all enjoyed since 2009.

when did u go back to ur original asset allocation? im a little fuzzy on how this re-balance works once you go 100 % to any one item. thank you for the info

?I double down in 2008-2009. Moved all bonds to 100% stock. Paid off nicely

my tax guy(an old friend), had a huge hoot at my expense when he saw my 2008 year end investment loss(paper loss) i didnt sell and kept dollar cost averaging. he of course was smarter than me and timed the market and switched to a stable fund pre-crash, because he knew it was coming. this year i remembered about that so i asked him when or if he jumped back into the market, since he was a guru pre crash. he thinks the market is too hot now. he was short on details as i suspect he has missed the ride up we all enjoyed since 2009.

when did u go back to ur original asset allocation? im a little fuzzy on how this re-balance works once you go 100 % to any one item. thank you for the info

Last edited:

Dash man

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What would you suggest as a similar risk/return alternative to bonds/funds? CD's and other cash equivalents have provided returns from 0-1% unless you go long. And bond funds were declared dead beginning in 2009 when rates were slashed, and that clarion call has been repeatedly constantly since. Meanwhile many short and intermediate bond funds have returned 2-3% per year after dividends and NAV changes for 8 years.

Everyone holding bonds should know the relationship between bond fund NAVs and interest rates.

This has been discussed many times here an elsewhere, and no one has yet come up with a clearly better alternative that isn't just trading one type of risk for another. Unless I missed it.

I think a lot of people believe there always has to be a better alternative, which may not always be the case. CDs at least preserve principal less inflation loss. Cash in a savings account may only pay 1% but again preserves principal less inflation. TIPs are an alternative to help protect against inflation, and if deflation hits at least you retain the principal if held to maturity. Mutual funds run the risk of market panic selling and liquidity problems. A small percentage of gold can help protect against hyperinflation, but won't earn you anything in the mean time. Stocks in companies with low debt that provide goods and services people need to live their daily lives are safer than stocks that consumers use discretionary money for. Rental properties can provide inflationary protection, but can also hurt you as seen in the 2008 crisis.

There's always risk in investing, and you have to weigh your tolerance against the financial realities of the world. Keeping diversified can include some cash or gold that may not earn anything at the moment, but will be there when you need it. $50 trillion in global debt scares me that something we don't see coming will trigger a financial avalanche far worse than 2008.

It's true the system by hook or by crook has ultimately gone on to new highs so far. I'm sure the Incans Myans Romans & Soviets never thought their empires would turn to dust but they did. Of course they didn't have the luxury of having the world's reserve currency fractional banking & a federal reserve who can create inflation or deflation while it presides over the wealth of a nation. The powers that be have rolled out the red carpet for anyone willing to take risk like never before. It shows me they almost lost their system. So it shows me these folks can make major errors. Errors are going to happen. Question is how & how well do you recover from your error. The financial system is in uncharted waters but then again it's always in uncharted waters. Supposedly your compensated for this risk. Buffet keeps lots of cash around for those maalox moments that you know are just a keystroke away.

calmloki

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I realize there are many here diversified into real estate and other opportunities, but regarding equities there is a groupthink among many members. The asset allocation crowd unwilling to budge from their particular asset allocation had always puzzled me. Things do change in the financial world that I believe requires readjusting financial assets periodically, but I'm labeled a market timer by the AA folks. Personally, after a 35 plus years bond bull market with rates near zero, why would anyone have a large allocation in bonds? Bond funds are particularly risky if there is a sharp rise in rates. But the AA crowd sticks to their allocation when bonds have no where to go but down.

Stock equities I maintain in selected individual stocks rather than funds that will follow the wild swings in a turbulent market should significant events happen. I do keep a large sum in cash to live on for several years if there is a severe market downturn. I also have real estate, insured CDs and some physical gold and silver.

Worldwide sovereign, corporate and personal debt is skyrocketing and printing more and more dollars will eventually take its toll. All it will take is loss of faith in these fiat currencies to cause a worldwide financial crisis worse than 2008. None of the causes of the 2008 crisis has really been fixed. But I guess we'll see in time.

Just plunked some bucks into a California double tax-free bond fund - VCADX. Scraped up dollars from Vanguard settlement accounts, checking and savings accounts at different banks, and even some from a Discover account making 0.95%. Fund isn't making much, but is doing better than the places we're funding it from. Rentals and contracts/loans do better, the stock holdings do better yet, but stocks seem so unreal to me.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If I'm reading this correctly, 1929 to 1954 - so it took ~25 years for the Dow Jones to recover?Not that it couldn't, but when how many times has that happened in the last 120 years? And which of those times didn't ultimately turn upward on go on to new highs?

Last edited:

Olbidness

Recycles dryer sheets

I'm not too fond of the term "group think" but what I can say is if you want to be thin, hang out with thin people. Want to be wealthy? Hang out with wealthy people.

Dash man

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If I'm reading this correctly, 1929 to 1955 - so it took ~26 years to recover?

The 70s weren't good years after Nixon had to take us off the gold standard after he basically defaulted on Denmark's attempt to redeem a billion dollars for gold after multiple other countries had exchanged dollars for gold. 1998 had excitement with the Asian crisis. Argentina and Brazil each had a crisis and now a serious problem in Venezuela. Greece, Cyprus...who's next?

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If I'm reading this correctly, 1929 to 1954 - so it took ~25 years for the Dow Jones to recover?

And is the chart inflation corrected? Does it include dividends?

Blue Collar Guy

Thinks s/he gets paid by the post

they dont include dividends

if dividends were included it was much much much shorter, i read that somewhere

The 70s weren't good years after Nixon had to take us off the gold standard after he basically defaulted on Denmark's attempt to redeem a billion dollars for gold after multiple other countries had exchanged dollars for gold. 1998 had excitement with the Asian crisis. Argentina and Brazil each had a crisis and now a serious problem in Venezuela. Greece, Cyprus...who's next?

if dividends were included it was much much much shorter, i read that somewhere

Similar threads

- Replies

- 144

- Views

- 9K

- Replies

- 53

- Views

- 7K

- Replies

- 22

- Views

- 895

- Replies

- 7

- Views

- 558