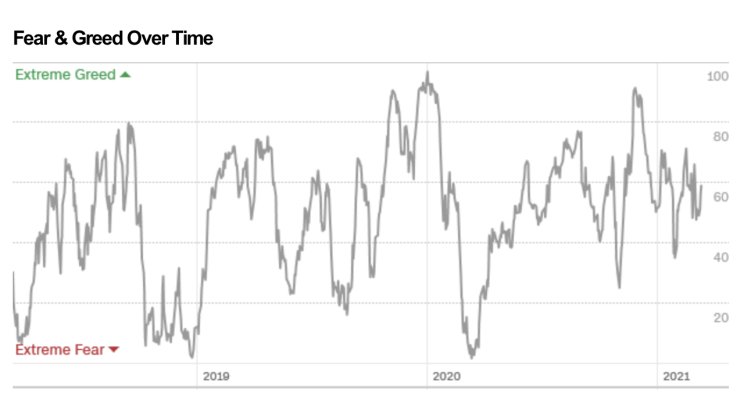

I looked at what they use to compute this "Greed/Fear Index", and found it reasonable.

How useful is this?

1) Is the current greed or fear justified?

This is the hardest thing to determined. For example, the index crashed to "extreme fear" when the news of the world-wide pandemic broke out. Of course, who was not scared at that point? Perhaps only by Covid deniers? How about the 9/11 event? The financial collapse caused by the subprime mania?

2) Will the current greed/fear index which simply reflects various current market conditions persist?

Back in mid last year, could anyone predict that there would be several vaccines available less than a year later? Could anyone exactly predict what the death rate and the economic damage would be? This index is telling the current status, not predicting what will happen ahead, and how soon it will happen.

3) Even if any index claims to predict the future, which this one does not, it will not be widely followed.

It's hard to overcome greed/fear. Who does not know that exercise is good for you? Why do we still have so many lethargic and overweight people? Same with investing.

I found this "Greed/Fear Index" interesting. How useful is this? I don't know yet. Again, this tells you about the current status, not about when something will reverse. Do I think the bitcoin and EV mania is ridiculous? Yes. But do I dare short them? No. But are these buyers greedy? You know my answer.