corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

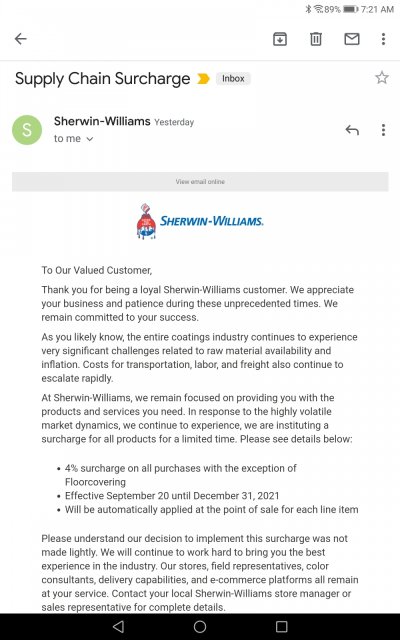

Did you notice cedar prices? The home store folks told me a month ago that pressure treated was falling but they expected cedar prices to remain high.

Cedar is still sky high. A 1x6x10 board is $20. Would cost us $3k to do our closet. So we are waiting.