You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Down Day in the Market !

- Thread starter frayne

- Start date

First of all depression was used centuries ago to accurately call a downturn in the economy as a depression - it was only after 1930's that politicians feared a depression would signal upcoming despair that recession was born. Panics were always used to call short term sharp drops in the market.

A brief history of economic euphemisms from the NYT:

https://www.google.com/url?sa=t&rct...gewanted=all&usg=AOvVaw0VWPtIzyx-P68dvbAblE2n

The circumlocution industry continues its vertiginous augmentation.

Is this really true? Surely the weakest hands are the first to sell. And if the market drops further but no one who's left is afraid of drops, what would prompt them to sell (and thereby pile on the panic)?If no one is afraid of drops and the stock market drops anyway, that means a level of selling by weak hands has actually not yet begun.

This makes sense. But still I don't see this exhibited in any of your excerpts.Eventually levels get hit where confidence is eroded and people feel all the years of saving is going down the tube and sell to keep something.

Perhaps it isn't "complacency" being shaken out as much as it's just a routine reversion to the mean.At the point where everyone "knows" the stock market is too risky stocks are a very good buy. It is easier to pick these points out over tops but the action I see means this was a very big top requiring a big drop to shake overwhelming complacency out of the market.

Amethyst

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Dec 21, 2008

- Messages

- 12,668

We still need stuff done on the house. If this is a real downturn, maybe contractors will start returning calls. Dead people's used jewelry might come down in price too. (I returned a 1940's necklace I received for Christmas, and lo and behold, it came back up on the web site for more than the cost to buy it for me).

easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,151

Yes, Holy Cow indeed!!! And OMG, here we go again today - - the Dow is already down over 300 points this morning. Pass the popcorn. This is amazing to watch.

Down over 400 points as I type. Might run out of popcorn.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Higher interest rate and inflation will mess both of them up, although at this point I'd rather have the drop of bonds than stocks.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Perhaps it isn't "complacency" being shaken out as much as it's just a routine reversion to the mean.

If this is your view, I believe you are in the majority position, probably 95%+ investors agree with you.

The type of drop that has occurred though is far from routine after an unprecedented historical uptrend with no declines as every small decline was met with buying and new highs , and the reaction that I find as bemusement and a total lack of concern indicates to me it is an unhealthy view of the stock market that is going to result in severe punishment for the average investor.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Were all in the feds petri dish.

Powell has not said anything yet. Is it just what investors think he will do?

Maybe the market rout will scare enough spenders so that inflation remains tame. Then interest rate will not have to be raised, and the bull market party continues?

How cruel is it that when investors get money from the market, the moment they want to "blow some dough", they get punished? You can have money, but you cannot spend it.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

I am afraid to eat popcorn now. May come down my windpipe.Down over 400 points as I type. Might run out of popcorn.

FIREmenow

Full time employment: Posting here.

- Joined

- May 9, 2013

- Messages

- 756

Whew!

W2R

Moderator Emeritus

I am afraid to eat popcorn now. May come down my windpipe.

This is more riveting to watch, than any spectator sport! The Dow is only down 45 points at the moment.

This is more riveting to watch, than any spectator sport! The Dow is only down 45 points at the moment.Attachments

shotgunner

Full time employment: Posting here.

- Joined

- Jun 18, 2008

- Messages

- 534

So as I watch the slide continue I wonder to myself what does the FED have left in it's quiver to help with any recovery of the market or the economy should it be needed?

Pilot2013

Full time employment: Posting here.

I feel for those that HAVE to pull money from accounts (forced selling). Most on here I have seen have 1-2 years of cash to ride this kind of event out.

My company does their contribution to my 401k 1 time per year, near the end of March, usually a pretty good sum. I have complained before about how they do this (once per year), but today, I am happy about it.

I am also looking to see when this turns and starts going the other way, and then I will double my semi-monthly contribution. Since I have probably 7-10 years before I need to draw (and 15 before RMD's), am still working and have about 1.5 years of expenses in cash, I'm watching with interest and not fear. Much different than I did in 2008, after learning so much more, and being part of this forum.

My company does their contribution to my 401k 1 time per year, near the end of March, usually a pretty good sum. I have complained before about how they do this (once per year), but today, I am happy about it.

I am also looking to see when this turns and starts going the other way, and then I will double my semi-monthly contribution. Since I have probably 7-10 years before I need to draw (and 15 before RMD's), am still working and have about 1.5 years of expenses in cash, I'm watching with interest and not fear. Much different than I did in 2008, after learning so much more, and being part of this forum.

QT underway inflation rising big chief jawboning stocks more debt slow growth. Ok lets talk about the negatives. North Korea still getting missles ready Iran simmering the sun is dimming bitcoin going to zero. Time to watch the Olympics

W2R

Moderator Emeritus

Unbelievable! The Dow is UP 122 at the moment. (gobbling popcorn)

FIREmenow

Full time employment: Posting here.

- Joined

- May 9, 2013

- Messages

- 756

Just saw headline: "Jeff Bezos, Warren Buffett, Bill Gates lose $10B in market plunges...."

That's a lot of Lambo's!

That's a lot of Lambo's!

Pilot2013

Full time employment: Posting here.

W2R

Moderator Emeritus

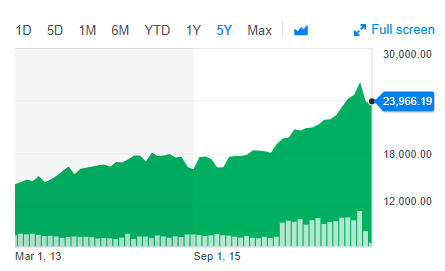

For the Doom and Gloom guys, this is why you aren't scaring me....

It's sort of like blowing the foam off the top.

So, we've gone from the end of the world to everything is beautiful, and the afternoon isn't even over.

W2R

Moderator Emeritus

So, we've gone from the end of the world to everything is beautiful, and the afternoon isn't even over.

What a day!

street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,539

It's sort of like blowing the foam off the top.

LOL! >>> Love that phrase. That mug of beer is what we paid for but when the foam settles is what we have left. LOL

Similar threads

- Replies

- 0

- Views

- 212

- Replies

- 144

- Views

- 8K

- Replies

- 16

- Views

- 555

- Replies

- 44

- Views

- 3K

- Replies

- 26

- Views

- 1K