Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

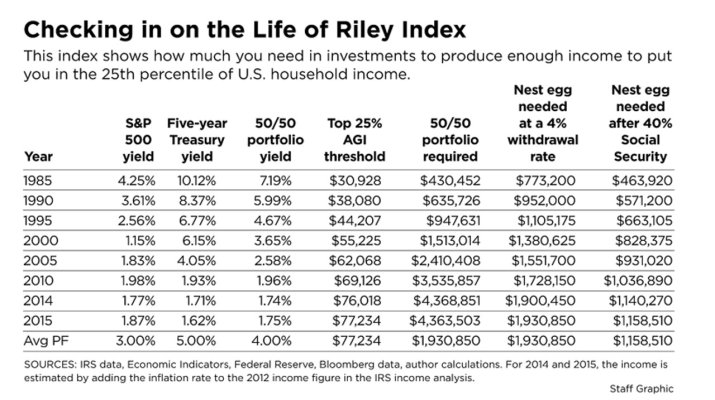

Just a fairly current benchmark/metric FWIW - no claim that it's "right," accurate, etc.

If you're alarmed at the size of the "magic number," the last two columns probably apply to many more people - and pensions and other sources of income aren't included (too variable to include).

How much money do you need to be in the upper 25%? | Dallas Morning News

If you're alarmed at the size of the "magic number," the last two columns probably apply to many more people - and pensions and other sources of income aren't included (too variable to include).

How much money do you need to be in the upper 25%? | Dallas Morning News

The cost of being independently upper middle class declined a bit in the last year. But just a bit. So don’t expect any shouts of joy in this year’s Life of Riley Index update — just an ongoing assessment of how much money we would need to be better off than most.

The magic number this year: $4,363,503.

The index, which goes back to 1985, measures the amount of income you need to enter the top 25 percent of households in the United States. This year, the estimate is $77,234.

From that, I calculate how much you would need in a 50/50 portfolio of stocks and bonds to provide that income.

Attachments

Last edited: