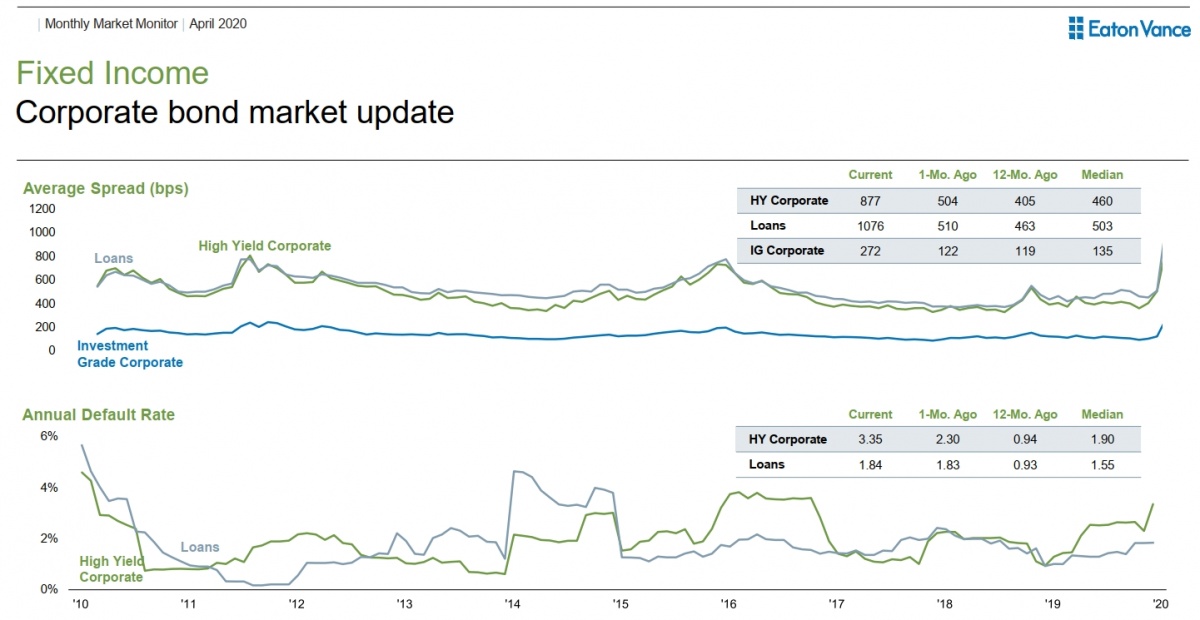

There is an obvious no-brainer buy signal in a crash, generally when spreads get over 1500BP. You can then either pick through the wreckage for unconsidered trifles, or buy a broad index and let the huge excess spread cover the inevitable default losses.

I have a background as a credit analyst so I like picking bonds. To offer a simplified example, imagine a company that has 1Bn in EBITDA in good times and that crashes down to 400MM in a recession. The equity trades down to a pittance and the 3Bn of bonds plummet to 50 cents on the dollar. If your analysis indicates that 400MM is likely the trough EBITDA number give or take, you might be interested in the bonds. Why? If the company makes it, the bonds will cruise back to par giving you a double on your principal and a double digit cash on cash yield along the way. If the company hits a wall and goes bankrupt (maybe 1Bn of the bonds comes due and they cannot refinance), you hold the bonds through bankruptcy. Why would you do that? Simple. at 50 cents on the dollar, the bonds are worth 1.5Bn at market. If 400MM is the trough EBITDA and the bonds are converted to the equity f a debt free company, you just bought equity in a business likely to see rising EBITDA for a less than 4X multiple. Since most companies trade at a 6 to 12X multiple and EBITDA will likely rise, you will generally do very well.

I haven't really seen attractive opportunities in junk yet. I have bought a grand total of one small position where the bonds were a little more expensive than I would have liked, but they were mortgage bonds where the collateral at market value covered the market value of the bonds and cash flow was very good. Need the junk market to go over Niagara Falls in a barrel again before I start buying. It will probably happen soon enough, so I can be patient.