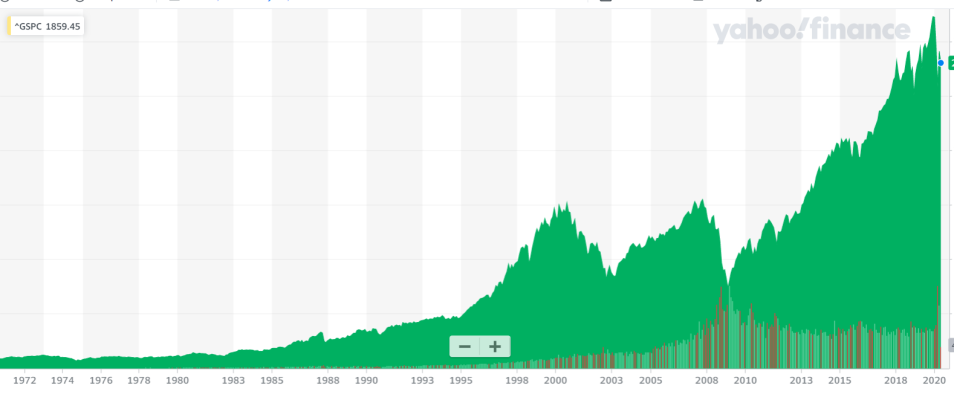

ER'd (me - 56, DW - 61) and are sitting at ~20% equities - which is ~20% higher than we'd like at this point.

That said, we're "kinda" staying the course - because when I look at our YTD return numbers, they're ugly. And I was never one to sell low and buy high.

If we get back to Dow 25K, I plan to go to a max of 10% equities.

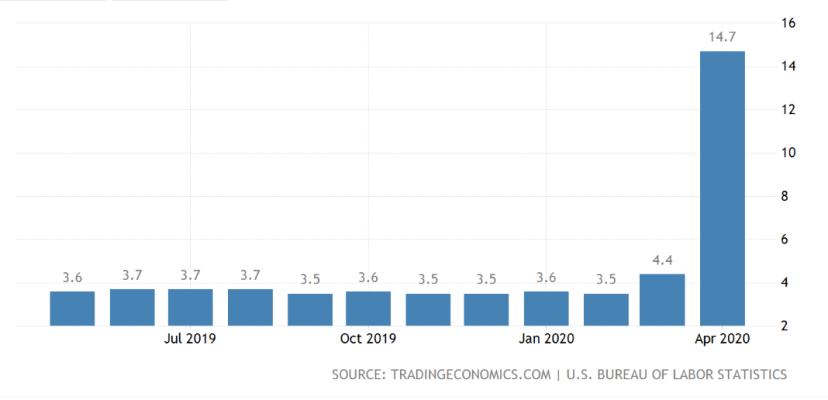

Pretty sure the virus is going to drive us to Great Depression 2.0 - hope to be totally wrong, but we shall see.

Unfortunately, I was reaching for Yield on our bond funds and have some (OK, too much) Emerging Markets, Foreign Bond, Mortgage-Backed Securities and Corporate Bond funds..I see VBTLX (heavy Treasury allocation) is up YTD, but even my bond funds are down ~10% on average.

Lesson learned on that..