Cut-Throat

Thinks s/he gets paid by the post

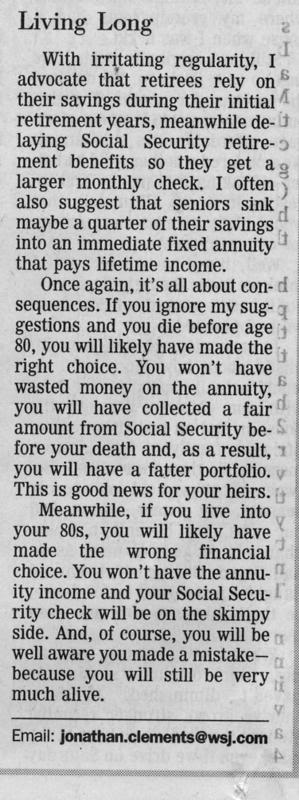

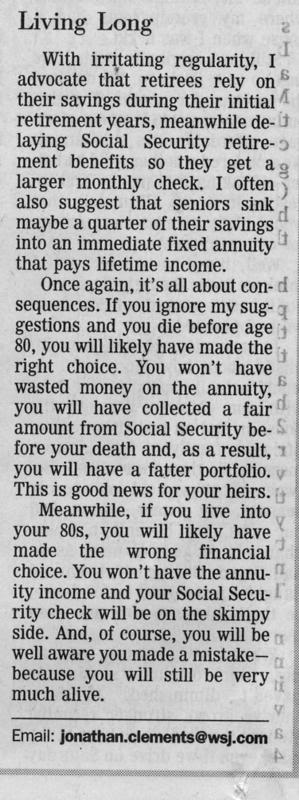

I found an article in today's paper where J. Clements expressed his reasoning on the topic of delaying S.S. and annuities. It it short and to the point. We all plan on 'worst case' scenarios and that is what he is expressing here.

To those of you that find great sport in arguing, he lists his e-mail at the bottom of the page, so that you can engage him.

To those of you that find great sport in arguing, he lists his e-mail at the bottom of the page, so that you can engage him.