SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Thanks, all for your perspectives on this.

There seems to be two aspects being addressed: "active" as defined by card issuer, and "active" as viewed by the credit scoring agency.

I agree that the timing of the payoff (which, yes, generates a zero balance) is inconsequential when addressing "active" as defined by the card issuer.

[1] Activity status, as defined by the credit scoring agency is kind of what I was getting at, but failed to be clear about that in my OP.

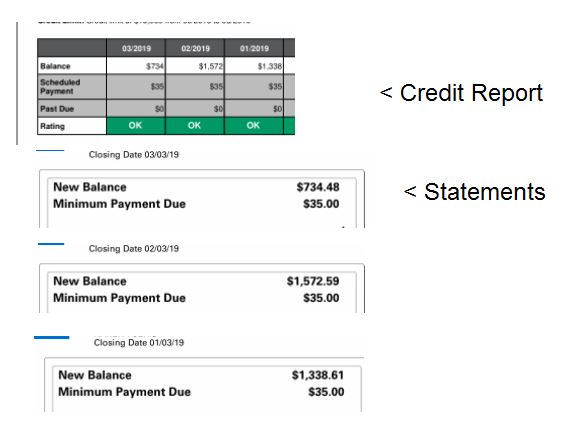

Based on some of the responses, I did a bit of digging and found that what's on the top of the statement is what's transferred to the credit bureau (at least in the example I pulled). (see image)

What that means to me is that if I went right home, paid for the once a year charge right away (making the next bill come with a zero balance), then the zero for that month would look exactly like the zero from a month where the card got no use at all.

[2] The bottom line for me, I think, is if I bother keeping these cards active, I might as well wait for the bill before I pay. This way, it won't just be $0, $0, $0, ... for many years straight and maybe will figure positively into the credit scoring formula.

All that being said, I'm well above 800 and don't need to borrow any money. The OP was more of a noodle into this realm for sport.

[3] I thought that if a card showed $0 balance for years, it would be different on the scoring than if, every now and then, it was non-zero. Just a guess, though.

Right, keeping it active with the issuer just needs a transaction and balance timing doesn't matter. It looks like the date the balance is reported varies, but if I run right home from the gas station and pay it, there's little chance anything but zero will be reported.

[4] I did the research and it's basically a reflection of the statements. I just wonder if the ratio is figured with all cards evenly, or if ones that haven't been used get less weight.

[5] The reporting date looks like the statement date for AMEX, but it could be another date too for other accounts. But if I pay it off to zero balance "too quickly" the date doesn't matter since chances are slim it would report anything but a zero.

[Numbers added for reference.]

1. CRA's don't have a definition of "active". There is "open" and "closed". As long as you have activity, your cards will stay "open". If by "active" you mean showing an entry for a particular month, like 3/2019, then that is the result of the CC generating a statement, which has already been explained and answered.

2. Historical balances have no impact on credit scoring. Current balances do have an impact.

3. Nope. Age of account matters, but historical balances have no impact on credit scoring.

4. The degree to which a card has been used doesn't matter. Current total balances vs. total available credit does matter - owing a small amount is better than owing zero (yes, this is paradoxical but true), which is better than owing a lot. Owing a high percentage of CL on an individual card also hurts your score.

5. As previously mentioned, AMEX and all other major issuers except USBank report the statement balance, and they report it within a day or two after the statement close.