- Joined

- Oct 13, 2010

- Messages

- 10,767

Clark Howard advises people that have unused credit cards to use them twice a year. The advice comes from the fact/perception that closing accounts (changing the ratio of available credit to utilized credit) will have a negative impact on your credit rating.

My question is not to debate whether the above fact/perception is true, worth worrying about, etc (not that I can stop the conversation from going there, it's just not what I'm interested in).

My question has to do with the mechanics of using a card twice a year.

Recently, I took three old cards to the gas station, and put 1/3rd of a tank on each card, then went home and did electronic payments to the three cards for the amount I spent. I just wanted to "get it out of the way".

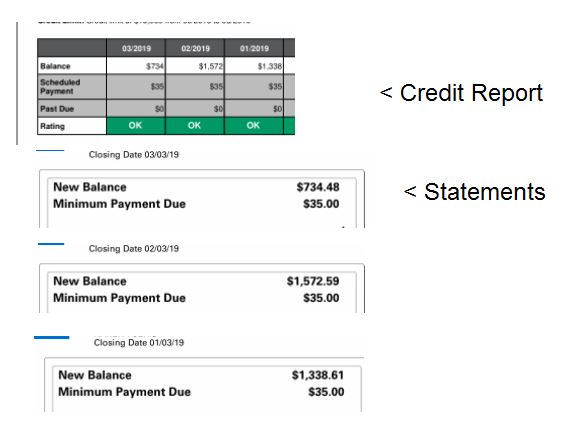

Then I got to thinking...maybe that was ineffective against my goal of keeping the cards active. Why? Well, when I look at my credit files, it shows balances of zero on those cards for the past 12 months. And if I pulled my credit file now (after using the cards), it will STILL show zero (because the balance at the closing dates will be zero since I paid them off before the bill came).

So it seems to me that this is a nuanced question about the definition of what makes a credit card active. Is a continual zero balance inactive, even though, the card did have spending? I figured maybe someone worked in the credit reporting industry or maybe had paid balances before the bill came, then noticed something on their credit file.

My question is not to debate whether the above fact/perception is true, worth worrying about, etc (not that I can stop the conversation from going there, it's just not what I'm interested in).

My question has to do with the mechanics of using a card twice a year.

Recently, I took three old cards to the gas station, and put 1/3rd of a tank on each card, then went home and did electronic payments to the three cards for the amount I spent. I just wanted to "get it out of the way".

Then I got to thinking...maybe that was ineffective against my goal of keeping the cards active. Why? Well, when I look at my credit files, it shows balances of zero on those cards for the past 12 months. And if I pulled my credit file now (after using the cards), it will STILL show zero (because the balance at the closing dates will be zero since I paid them off before the bill came).

So it seems to me that this is a nuanced question about the definition of what makes a credit card active. Is a continual zero balance inactive, even though, the card did have spending? I figured maybe someone worked in the credit reporting industry or maybe had paid balances before the bill came, then noticed something on their credit file.