You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Length of time to recover our lost money?

- Thread starter Orchidflower

- Start date

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I am with you Rustic, I think it will be quicker than most people predict. Heck at today's rate we should be back to 14,000 by next Monday

Glad you are with me on my 5 day plan.

Canadian Grunt

Recycles dryer sheets

Some of the people with financial backgrounds probably can guesstimate this one, but I understand that, during the Great Depression starting in 1929, those who left their money in stocks took alllll the way to 1954 to recoup the losses. Please correct me if I am wrong on that statement.

Anyway, is it going to take another 25 years to recoup all the losses many of us are taking right now, too? I am assuming so, but would love to hear what the finance professionals here think.

Interesting post. I averaged down through the selling, bleeding red ink all the way. Sold off all my bonds as I was getting equal or better returns on stocks and ETF's during this sell off.

After one big 1500 point day on the TSX I am back in the black.

So for me 1 day, although I am not certain the market will stick but it proved my averaging was worthwhile because I am positive the market will go up by 1500 point over the next few years. Greed will get the better of all those people sitting on the sidelines with cash.

Ding! Ding! Ding! We have a winner.I think the recovery will be faster than most are predicting. In the Great Depression, folks in the stock market lost everything they owned. It was not the case of holding on or selling to come in again at a later time. Most were in on margin and were way over their heads. I believe the average person could buy on as little as 10%. When the market dropped their margins were called and positions sold. They were sold out broke no money to reinvest. In fact many lost everything they owned.

As this is not the case now, it would appear that market recovery is more dependent on greed overcoming fear. As the market begins to go up, democrats elected, so the press can begin to tout the economy, rather than slam it, the market will rise.

We've been subjected to 18 months of bad-mouthing by the media who want a Democrat in office. If Someone keeps telling you you're sick, you will be sick. Try that at your office sometime. Get everyone to ask ole Joe why he looks so bad, is something the matter? By lunch he'll be headed for home.

Once what's-his-name gets into office, the media will reverse estimations and tell us we're cured. There will be very little difference, but we will believe, confidence will be restored, and I can go back to checking Vanguard every other day. I guess we're gonna have a recession, so getting above 12000 will be slow. But my initial allocation saved most of my pile anyway. Paper losses don't exist until you sell. I can wait.

This mess has taught me one thing. Rebalance once a year without exception. Lock in whatever gains you have.

Wasn't it Bush and his crew that said we are facing the worst financial crisis since the great depression? It wasn't the media.Ding! Ding! Ding! We have a winner.

We've been subjected to 18 months of bad-mouthing by the media who want a Democrat in office. If Someone keeps telling you you're sick, you will be sick. Try that at your office sometime. Get everyone to ask ole Joe why he looks so bad, is something the matter? By lunch he'll be headed for home.

Once what's-his-name gets into office, the media will reverse estimations and tell us we're cured. There will be very little difference, but we will believe, confidence will be restored, and I can go back to checking Vanguard every other day. I guess we're gonna have a recession, so getting above 12000 will be slow. But my initial allocation saved most of my pile anyway. Paper losses don't exist until you sell. I can wait.

This mess has taught me one thing. Rebalance once a year without exception. Lock in whatever gains you have.

Rustic23

Thinks s/he gets paid by the post

Yes Bush said it, after many years of the press saying it!

As an instructor pilot, one of my students had a doctorate in economics. He went on to head the Air Force Academy's Economics Department. I ask him if the constant news in the press about the sorry state of the Economy could in itself bring on a sorry economy. He said it was actually an economy theory known as the "Anticipation theory". By the way that was in 1979!

As an instructor pilot, one of my students had a doctorate in economics. He went on to head the Air Force Academy's Economics Department. I ask him if the constant news in the press about the sorry state of the Economy could in itself bring on a sorry economy. He said it was actually an economy theory known as the "Anticipation theory". By the way that was in 1979!

Yes Bush said it, after many years of the press saying it!

!

So the media was dead on. It's funny how some folks blame bad news on those that bring it to us. Could you explain to me me how the media caused the world credit crisis?

Most people who click on this link are interested in the original thread topic.

Me? I have no clue how long the pain will last, but I'd also like to sign up for the "5 day plan," please. O.k., so Tuesday needs remedial action. Let's see that Wednesday makes up for it. Good? Good!

Cheers.

Me? I have no clue how long the pain will last, but I'd also like to sign up for the "5 day plan," please. O.k., so Tuesday needs remedial action. Let's see that Wednesday makes up for it. Good? Good!

Cheers.

W2R

Moderator Emeritus

Sounds good to me! Tomorrow I'd love to regain a little more of what my portfolio lost on paper last week.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

I'd like to be optimistic, but in surfing, I found this (a blog by someone who is admittedly quite a bear):

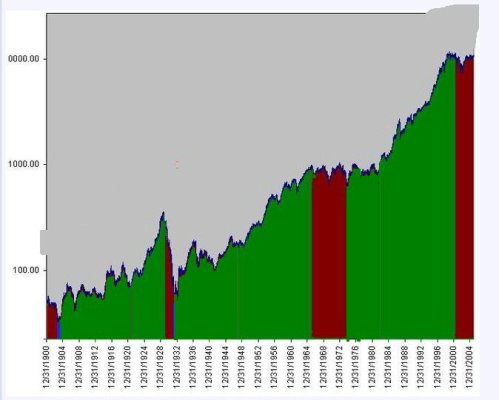

Fred's Intelligent Bear Site - Inflation Adjusted DJIA

...

They say "the market always goes up in the long term," but at an average return of 1.9% per year, it can take many years to recover from a large decline. The peak in 1929 was not ultimately exceeded until 1992. When the market touched the bottom of the channel in 1982, its value was about equal to the value at the beginning of the chart in 1910.

...

Can anyone comment on this? The guy is making sense to me, even though he is quite the bearish contrarian. But it goes against everyone I've read and against most of what people on here think....

Many years ago, I was perplexed by the apparent contradiction between the assertion that historical stock return being 9-10% annual and some stock charts showing the DOW being flat for decades. Somebody is obviously lying, or very mistaken.

I was relieved to find the answer in a book, entitled "How to buy stocks" by Louis Engel and Brendan Boyd. It described an effort by the Center of Research in Security Prices at the Graduate School of Business of the University of Chicago. This endeavor was to compile stock prices and dividend payout of ALL stocks that have been listed since 1926, prior to the Great Crash. Note my capitalization of ALL stocks. They tracked down all stocks that were ever listed, including ones that had been merged or delisted or gone bankrupt.

This effort started in 1958, took 5 years, and cost $250K back then. Remember that then, historical records were not available on computer for easy retrieval and dissemination as we take for granted now. This work was continued at least until 1980, the most recent date quoted in this book (edition 1983).

The following quote from page 257 of this book will answer TM's question.

"Probably the most significant figure in the table is that 9.9% at the bottom of the first column. That figure means that an investment of an equal amount of money in each of all the Big Board stocks on December 31, 1925 would by December 31, 1980, with the reinvestment of dividends, have yielded a return equal to 9.9% interest per annum compounded annually".

Now, I looked at the chart at the Web link provided by TM. Right in the center of the chart is the caveat "Excluding Dividends". Right there is the cause of the disconnect between charts like this, and the results from the University of Chicago study. People may not appreciate the fact that until recent times, stocks paid lots of dividends, sometimes as high as 10% annual, with an average of around 6% until 1950. Exclude them, and you can spin another story out of the same data. See attached links that illustrate the dividend yield.

Political Calculations: The History of S&P 500 Dividends in Pictures

Bespoke Investment Group: Historical Dividend Yield of the S&P 500: 1925-Present

I think one of the causes of the modern-day low dividend yield was the tax policy that favored capital gains over dividend, up until recently. Companies and its shareholders prefer retention of the earnings to grow the business instead of paying out. The dark side of that is of course flim-flam book-keeping practices, and the squandering of earnings on dubious "investments" such as dot-coms and take-overs.

Before I close, I must include another sentence from the above book that relates to the OP question, "length of time to recover lost money".

"The longest span of years showing losses is the 14-year period from 1928 to 1942." p.257.

And here is a lucrative (and elusive) goal for market timers who want to get in at the bottom:

"If you had bought in 1932, there was never a year in which you would not have realized a profit of at least 10% - usually much more - until 1974".

By the way, I believe all these numbers were before inflation. If I find out differently, I will post a follow-up.

The problem with relying on historical data is that there is no guarantee that history will repeat exactly the same way. I have just finished reading "Fooled by Randomness" and "The Black Swan" by Nassim Taleb, which are long overdue on my reading list. The gist is (my words) "No one knows, and those who claim to know either knowingly lie or are full of it". His books make you think!

PS. Taleb said the current liquidity crisis is a white swan, meaning its occurence is doomed to occur by the action of the culprit bankers and those in the know. I did not find out what his thinking is about the "outcome", meaning the effect on the economy and the stock recovery. I think he would shrug and said "I dunno".

Last edited:

jIMOh

Thinks s/he gets paid by the post

People may not appreciate the fact that until recent times, stocks paid lots of dividends, sometimes as high as 10% annual, with an average of around 6% until 1950. Exclude them, and you can spin another story out of the same data. See attached links that illustrate the dividend yield.

Political Calculations: The History of S&P 500 Dividends in Pictures

Bespoke Investment Group: Historical Dividend Yield of the S&P 500: 1925-Present

Both were good reads, thank you for sharing.

Here is a question- the article posts a yield for S&P 500. I know that yield will be payout/value, what is the way to measure payout of the index? Justing adding up the payout of the 500 stocks? Then just adding up the price? I know it's not that simple... but please explain.

I generally invest most of my large cap positions in dividend paying mutual funds. What I have seen is the good ones (Windsor II and T Rowe Equity Income PRFDX are the two I look at the most, I own PRFDX) yield around 2.5%. VFINX usually has a yield posted of 2.2%, yet the article is suggesting that 1.1-1.9% is the yield of the index.

I realize the yield of the index will change based on market performance...

My issues as I learn more are that I want a way to measure payout and verify it is consistent year over year. My preferred withdraw strategy is to be 80-20 stocks bonds, with 75% of the stock position in dividend paying mutual funds which have a consistent and slowly rising payout per share.

This way the 80% equity position still grows and the increasing payout is my inflation hedge.

I want to measure my yield relative to S&P 500 (because many equity income funds have a stated goal of yielding more than the S&P 500). I have looked at other index funds which yield higher, but there does not seem to be enough data to know how the indexes are contructed or how consistent the payout of those funds are.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Both were good reads, thank you for sharing.

Here is a question- the article posts a yield for S&P 500. I know that yield will be payout/value, what is the way to measure payout of the index? Justing adding up the payout of the 500 stocks? Then just adding up the price? I know it's not that simple... but please explain.

The total payout would depend on the weighting of the stocks in the index, which I've got to admit I do not know (or ever care enough to find out). However, I believe the dividend payout of SPY or a low-expense index fund like Vanguard would come close to the theoretical yield shown in the charts.

By the way, the Chicago study assumed equal money invested in all listed stocks, big or small. That would weight small stocks WAY more than the S&P500. I have not seen a mutual fund allocation that way. Has anyone?

jIMOh

Thinks s/he gets paid by the post

The total payout would depend on the weighting of the stocks in the index, which I've got to admit I do not know (or ever care enough to find out). However, I believe the dividend payout of SPY or a low-expense index fund like Vanguard would come close to the theoretical yield shown in the charts.

By the way, the Chicago study assumed equal money invested in all listed stocks, big or small. That would weight small stocks WAY more than the S&P500. I have not seen a mutual fund allocation that way. Has anyone?

My issue is that if I want dividends (and lots of them) I have not found

a) a yield high enough to be a reasonable withdraw rate (2.2% on S&P 500 does not cut it)

b) a managed fund with a payout of more than 3% (many investors here get 3%+ when investing in individual stocks, MF are not getting that... why? PRFDX- T Rowe Equity Income and Windsor II are the two I look at most.

c) an index fund which I understand (I know Vanguard has index funds with 3% yields, but I have not heard of the indexes or seen long enough history to know payouts will be consistent

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

My issue is that if I want dividends (and lots of them) I have not found

a) a yield high enough to be a reasonable withdraw rate (2.2% on S&P 500 does not cut it)

b) a managed fund with a payout of more than 3% (many investors here get 3%+ when investing in individual stocks, MF are not getting that... why? PRFDX- T Rowe Equity Income and Windsor II are the two I look at most.

c) an index fund which I understand (I know Vanguard has index funds with 3% yields, but I have not heard of the indexes or seen long enough history to know payouts will be consistent

Gee, you really want a lot! Just kidding, because who wouldn't want some.

a) As the charts of historical yield show, it is not common for companies to pay out big dividends like they did in the 30-60s.

b, c) The stocks paying higher than average dividends tend to be boring consumer staples and utility stocks, and gasp, financial stocks, until recently that is. I heard of but do not own the two MFs you mentioned. I cannot speak for the MF managers, but suspect they do not want to put too much into the above mentioned sectors. I own a couple of conservative, long-tenured MFs that crashed harder than the SP500 because they mistakenly loaded up on financial stocks. Sigh....

If you want to buy individual dividend-paying stocks (I always have 1/2 of my equity investment in MFs, 1/2 in individual stocks), with the recent rout, there are now plenty of utility and consumer staples stocks (good for defensive stance in the next few years) that pay good dividends.

Examples include KFT (4.1%), UL(5.6%), SO(4.7%), PNW(6.7%). If their price goes up, and their yield drops, would you be complaining? Capital gain or dividend, they are both convertible to FERN (Federal Reserve Notes

Will their dividend hold through the tough period ahead? Who would know? I just held my nose and bought some. Do your own homework, please.

tangomonster

Full time employment: Posting here.

- Joined

- Mar 20, 2006

- Messages

- 757

Thanks, NW! I understand the issues much better now, although the influence of dividends (and the probable lack thereof) is discouraging.....

The OP asked how long it would take to recoup the losses. Not only are dividends excluded as has been pointed out, but are we considering "recoup the losses" to mean return to the market peak? Very few people bought all of their holdings at the peak... I personally see losses as a negative from where I bought, not a negative from the peak value of my account. I think most of us agree that the market was overpriced at its peak (looking back  ), so why would we use that as the point of reference as opposed to how long it would take the market to return to its historical average or something similar?

), so why would we use that as the point of reference as opposed to how long it would take the market to return to its historical average or something similar?

), so why would we use that as the point of reference as opposed to how long it would take the market to return to its historical average or something similar?

), so why would we use that as the point of reference as opposed to how long it would take the market to return to its historical average or something similar?TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

Up to 5 years...........

Canadian Grunt

Recycles dryer sheets

The OP asked how long it would take to recoup the losses. Not only are dividends excluded as has been pointed out, but are we considering "recoup the losses" to mean return to the market peak? Very few people bought all of their holdings at the peak... I personally see losses as a negative from where I bought, not a negative from the peak value of my account. I think most of us agree that the market was overpriced at its peak (looking back), so why would we use that as the point of reference as opposed to how long it would take the market to return to its historical average or something similar?

Agreed,

Waiting for the market to return to former highs means you are counting on market forces to do all the heavy lifting. If we are in a Japanese style recession it could be a long wait for positive returns.

Positive returns will come quicker if an investor lowers the cost base on the portfolio by averaging down. This way a portfolio's return will become subjective to the aggressiveness of purchases at the lowest average cost. An investor who is unwilling to invest on lows becomes a captive of market events.

dex

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 28, 2003

- Messages

- 5,105

Positive returns will come quicker if an investor lowers the cost base on the portfolio by averaging down. This way a portfolio's return will become subjective to the aggressiveness of purchases at the lowest average cost. An investor who is unwilling to invest on lows becomes a captive of market events.

Very good points.

I'm looking at a strategy of putting more money in Vanguard's High yield bond fund and then using the dividends to purchase stock funds.

Trombone Al,

Thank you. I had the same issue with the original plot. It appeared to be an almost arbitrary selection of bands to make the specious (?) point that bear markets can last a very long time. That, of course, can be true, but probably not to the degree of that made in the original chart.

On another point: personally, I don't wish to count dividends towards a "recovery" since there's an opportunity cost to being in the market as opposed to a CD ladder, etc. A case could easily be made that dividends are lower than that opportunity cost.

Thank you. I had the same issue with the original plot. It appeared to be an almost arbitrary selection of bands to make the specious (?) point that bear markets can last a very long time. That, of course, can be true, but probably not to the degree of that made in the original chart.

On another point: personally, I don't wish to count dividends towards a "recovery" since there's an opportunity cost to being in the market as opposed to a CD ladder, etc. A case could easily be made that dividends are lower than that opportunity cost.

One last point: One can continue to buy on down days (as today is shaping up to be). That may or may not prove be a bargain. But eventually one runs out of cash or one is taking on more risk than preferred. A part of me would prefer to give up those potential gains just to be even around now.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

But eventually one runs out of cash or one is taking on more risk than preferred...

Agreed. There is a difference between buying low and throwing good money after bad! One has to face the internal struggle between greed and fear.

About the market action today, a pundit said that institutional investors are still deleveraging. That was the reason many good and "innocent" stocks got slammed hard today. Come to think of it, if an individual is broke or short of cash, does he pawn his garage knick-knack, which no one wants, or his wife's jewelry, which is the most valuable thing he got left?

I bought some, just to see they drop. I am holding back, and step to the sideline for now.

PS. About dividend payout, one should include it as part of the return. Dividends were a lot higher after the Depression, and have been admittedly quite meager recently compared to the other opportunity cost. Will that change? Of course no one knows. Hence we have to be diversified.

Last edited:

Canadian Grunt

Recycles dryer sheets

Agreed. There is a difference between buying low and throwing good money after bad! One has to face the internal struggle between greed and fear.

About the market action today, a pundit said that institutional investors are still deleveraging. That was the reason many good and "innocent" stocks got slammed hard today. Come to think of it, if an individual is broke or short of cash, does he pawn his garage knickkack or his wife's jewelry, which is the most valuable thing he got left?

I bought some, just to see they drop. I am holding back, and step to the sideline for now.

PS. About dividend payout, one should include it as part of the return. Dividends were a lot higher after the Depression, and have been admittedly quite meager recently compared to the other opportunity cost. Will that change? Of course no one knows. Hence we have to be diversified.

I believe dollar cost averaging is the way to go until the market rises agian. Dollar cost averaging works best in a declining market, not so well at the top.

Regarding dividends, they allow the investor to purchase more stock at a lower price in a bear market...

Similar threads

- Replies

- 116

- Views

- 11K

- Replies

- 77

- Views

- 9K

Latest posts

-

-

-

What new series are you watching? *No Spoilers, Please*

- Latest: ShokWaveRider

-

-

-

-