I also have a PenFed 5/5 ARM that I took out in March 2011 w/ zero closing costs, with a 3 3/8% rate. The 'bad' thing is that my plans were to wait until around 2022, then (with a future wife) sell the house or tear it down and build a new one...so a 30 year fixed with the average [-]loaded down with various fees [/-] closing costs isn't the best idea. Have some cash coming free in the form of maturing savings bonds that will pay down about 2/3 of the mortgage. Would rather invest that money and take advantage of impossibly low 30 year mortgage rates...but I'm assuming my plans will come to fruition. If not, and I stay in the house long-term, at least I have a paid off house in a few years.

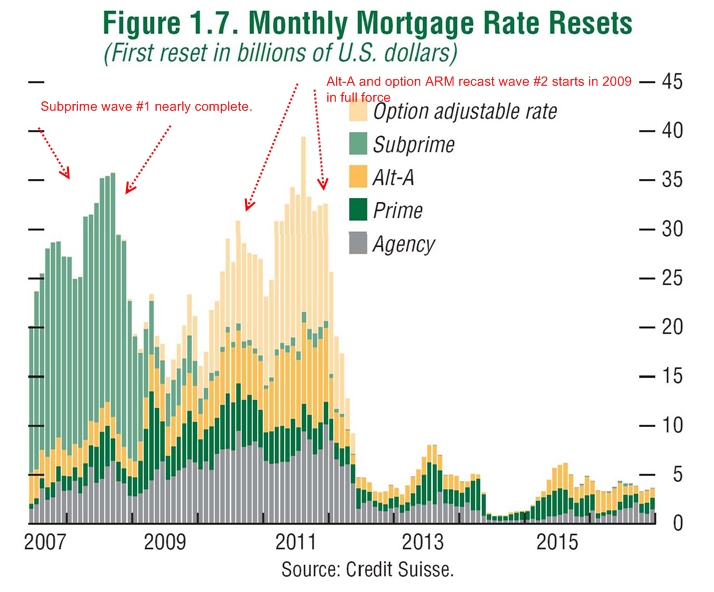

What were you expecting to happen? Remember that rates have dropped from 2006/2007/2008/2009 - so all those ARMs that reset every 1/2/5 years are likely resetting to lower rates - which means their monthly payments should probably be dropping. If there were any foreclosures from these ARMs, it would be because they lost their job or encountered some other fiscal disaster that prevented them from paying their mortgage, most likely not from a rising interest rate on their ARM, and thus higher monthly mortgage payments.