I have OMY before I turn in my 90 days notice (55yo). My golden handcuffs (250K in retirement benefits) will keep me at my j*b of 32 years until then. My spreadsheet says I will make $3k per day for the 178 days I have to work until then (normal pay is $100k per year).

I have:

$1.3M in a 401K fixed fund paying 3% ($39K per year)

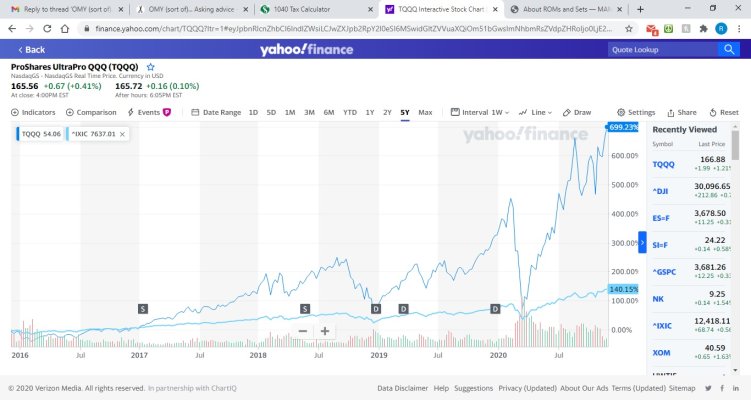

600K in leveraged ETF's (normal brokerage account 3xS&P, 3xDOW, 3xQQQ)

100K HSA in Vanguard S&P (will use this for healthcare)

0 dependents/heirs (except my wife)

Our normal household expenses are around $40k per year and I don't expect that to change (we are FRUGAL). This could easily be covered by our 401K. BUT, our game plan is to stay in the bottom two tax brackets ($74k) for 0% taxes and sell off our 3x ETF's for expenses to get in something a little safer (SPY?). I'll probably adjust us to a 60/40 and try to stay there.

Question #1 - Does this sound like a good game plan.

Question #2 - Does selling a 3xS&P and moving to SPY qualify as a sideways movement?

Question #3 - We have always talked about going to a fee only adviser when we were in our last year BUT you guys would probably do just fine. Do I need to visit one or just use GOOGLE?

Edit:

1) I believe staying below $74K (in profits on long term investments) means 0% taxes. I would have big gains on the 3x ETF's.

2) My employer will pay $1,000 per month for healthcare until 65 if I stay another 15 months (until 55). That is where my golden handcuffs come in to play.

I have:

$1.3M in a 401K fixed fund paying 3% ($39K per year)

600K in leveraged ETF's (normal brokerage account 3xS&P, 3xDOW, 3xQQQ)

100K HSA in Vanguard S&P (will use this for healthcare)

0 dependents/heirs (except my wife)

Our normal household expenses are around $40k per year and I don't expect that to change (we are FRUGAL). This could easily be covered by our 401K. BUT, our game plan is to stay in the bottom two tax brackets ($74k) for 0% taxes and sell off our 3x ETF's for expenses to get in something a little safer (SPY?). I'll probably adjust us to a 60/40 and try to stay there.

Question #1 - Does this sound like a good game plan.

Question #2 - Does selling a 3xS&P and moving to SPY qualify as a sideways movement?

Question #3 - We have always talked about going to a fee only adviser when we were in our last year BUT you guys would probably do just fine. Do I need to visit one or just use GOOGLE?

Edit:

1) I believe staying below $74K (in profits on long term investments) means 0% taxes. I would have big gains on the 3x ETF's.

2) My employer will pay $1,000 per month for healthcare until 65 if I stay another 15 months (until 55). That is where my golden handcuffs come in to play.

Last edited: