You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Opinions on worst case real returns...

- Thread starter LARS

- Start date

James Mackintosh, "Investors who give up their pretensions to know where the economy is going can find ways to construct sensible portfolios." (wsj.com)

Aswath Damodaran, "My advice is that if you have an investment thesis that leads you to buy the stock, do so and stop worrying about what the talking heads on CNBC or Bloomberg tell you about it. If you have so little faith in your reasoning that you doubt it and are ready to abandon it the moment it is contested by a big name, you should consider investing in index funds instead."

Aswath Damodaran, "My advice is that if you have an investment thesis that leads you to buy the stock, do so and stop worrying about what the talking heads on CNBC or Bloomberg tell you about it. If you have so little faith in your reasoning that you doubt it and are ready to abandon it the moment it is contested by a big name, you should consider investing in index funds instead."

In worst case scenario I am thinking across overall portfolio. As to time horizon, greater than 20 years.

Again the exercise is to consider worst case scenario to determine bullet proof nature of projections. So as to stocks for example a boom/bust cycle that trends negative overtime. And as to interest rates (bonds), rate environment continues like today (interest rates not keeping pace with inflation).

I recognize this is an exercise in pessimism...

Again the exercise is to consider worst case scenario to determine bullet proof nature of projections. So as to stocks for example a boom/bust cycle that trends negative overtime. And as to interest rates (bonds), rate environment continues like today (interest rates not keeping pace with inflation).

I recognize this is an exercise in pessimism...

DrRoy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I can see a case where long term equity return may be lower than they have been over the last 100 years. My reaction is to shoot for a lower equity allocation over time based on my needs and risk tolerance. Even so, at this point I do not expect my equity portion to go below 50%. Everyone has to do what makes sense to them, and no one knows what markets will do in advance.

eta2020

Thinks s/he gets paid by the post

- Joined

- Sep 13, 2013

- Messages

- 1,248

In worst case scenario I am thinking across overall portfolio. As to time horizon, greater than 20 years.

Again the exercise is to consider worst case scenario to determine bullet proof nature of projections. So as to stocks for example a boom/bust cycle that trends negative overtime. And as to interest rates (bonds), rate environment continues like today (interest rates not keeping pace with inflation).

I recognize this is an exercise in pessimism...

Portfolio of 100% Equities? 100% S&P 500? Or 50% US 50% international?

Or 50/50 Equities/Bonds?

Portfolio of 100% Equities? 100% S&P 500? Or 50% US 50% international?

Or 50/50 Equities/Bonds?

Right - we need to know the composition of the portfolio.

IMO, the chances of a well-diversified portfolio (let's say 60/40, 25% ex-US) providing returns less than 0% are 0% (over 20 years).

Sojourner

Thinks s/he gets paid by the post

- Joined

- Jan 8, 2012

- Messages

- 2,597

I don't know of any reason to assume that a 60/40 well-diversified portfolio would return anything less than, say, half of what it has done historically. So that would make my worst case scenario roughly 5%. Sure, one can imagine edge cases where the overall return would be below that, but statistically those would be quite unlikely.

I don't know of any reason to assume that a 60/40 well-diversified portfolio would return anything less than, say, half of what it has done historically. So that would make my worst case scenario roughly 5%. Sure, one can imagine edge cases where the overall return would be below that, but statistically those would be quite unlikely.

Real return?

Sent from my iPad using Early Retirement Forum

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

No - he means nominal I believe. Still, if you figured inflation running 3%, that would give you 2% real.

Worst case I can imagine?

Complete economic collapse rendering all financial institutions insolvent and massive social uprising, chaos, etc.

Has happened in the past and happening in some countries right now.

Worst I expect? Slightly worse than last 100 years.

The question is... what do I do?

Try and spend reasonably (around 2-3% SWR) and not think about it too much.

Sent from my HTC One_M8 using Early Retirement Forum mobile app

Complete economic collapse rendering all financial institutions insolvent and massive social uprising, chaos, etc.

Has happened in the past and happening in some countries right now.

Worst I expect? Slightly worse than last 100 years.

The question is... what do I do?

Try and spend reasonably (around 2-3% SWR) and not think about it too much.

Sent from my HTC One_M8 using Early Retirement Forum mobile app

Well, if we're talking worst case, this come close

.

.

.

.

Worst Case I can imagine: SMOD https://twitter.com/smod2016?lang=en In which case, no worries!

Japan? That might be among the nontrivial possibilities (I exclude Zimbabwe, 1946 Hungary, Weimar germany, Venezuela...https://en.wikipedia.org/wiki/Hyperinflation). Nikkei closed at 38916 on Dec. 29, 1989, and is presently at 16,831.... (but you got some dividends along the way). If you retired that day and had 100% in that index, bad news.

Diversification is my response. On the equity side, 50/50 US/foreign (and Merriman slice/dice within that) Like Petershk, reasonable spending and keeping nondiscretionary costs as low as feasible. If 1-2% real return on our portfolio, we'll be fine--not fat and happy, but fine.

Japan? That might be among the nontrivial possibilities (I exclude Zimbabwe, 1946 Hungary, Weimar germany, Venezuela...https://en.wikipedia.org/wiki/Hyperinflation). Nikkei closed at 38916 on Dec. 29, 1989, and is presently at 16,831.... (but you got some dividends along the way). If you retired that day and had 100% in that index, bad news.

Diversification is my response. On the equity side, 50/50 US/foreign (and Merriman slice/dice within that) Like Petershk, reasonable spending and keeping nondiscretionary costs as low as feasible. If 1-2% real return on our portfolio, we'll be fine--not fat and happy, but fine.

eta2020

Thinks s/he gets paid by the post

- Joined

- Sep 13, 2013

- Messages

- 1,248

Right - we need to know the composition of the portfolio.

IMO, the chances of a well-diversified portfolio (let's say 60/40, 25% ex-US) providing returns less than 0% are 0% (over 20 years).

Pretty much unless humanity experiences something like Nuclear war in which case who cares about portfolio return.

Well, if we're talking worst case, this come close

As long as we don't go here, we can manage:

GravitySucks

Thinks s/he gets paid by the post

Pretty much unless humanity experiences something like Nuclear war in which case who cares about portfolio return.

+1. Non portfolio related risks seem the most troublesome. Once we are dead I'll stop checking the S&P....

Over the next 20 years I think a real return of 6% is way more likely than1%, but I gotta keep spending like the 1% is going to happen for now.

photoguy

Thinks s/he gets paid by the post

- Joined

- Jun 15, 2010

- Messages

- 2,301

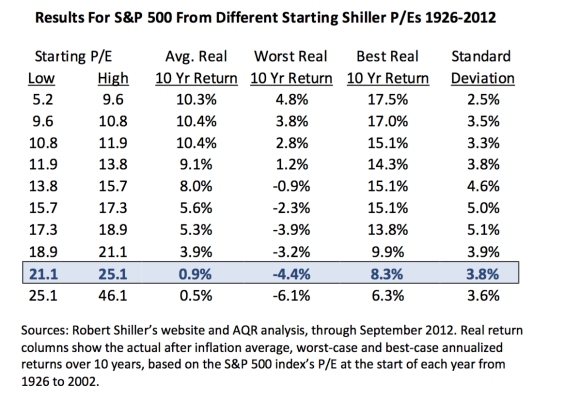

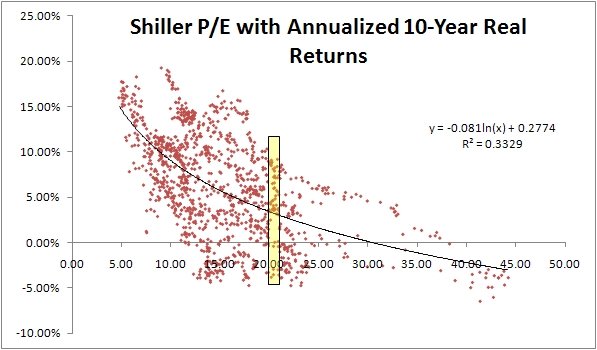

Table from https://www.aqr.com/~/media/files/papers/aqr-an-old-friend-the-stock-markets-shiller-pe.pdf. Scatter plot is from Meb faber's website.

Attachments

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

+1...IMO, the chances of a well-diversified portfolio (let's say 60/40, 25% ex-US) providing returns less than 0% are 0% (over 20 years).

Pretty much unless humanity experiences something like Nuclear war in which case who cares about portfolio return.

+1. Non portfolio related risks seem the most troublesome. Once we are dead I'll stop checking the S&P...

The personally worst case scenario for each of us is that we get diagnosed with a terminal disease, then die in one or two years.

Meanwhile, the S&P keeps setting new highs and takes off into a new bubble territory, but we are so much in pain and sadness to even notice, let alone care.

photoguy

Thinks s/he gets paid by the post

- Joined

- Jun 15, 2010

- Messages

- 2,301

The challenge with that chart and past data is there were so few periods with Shiller P/E above 21, and only one basically above 30 (dotcom period).

That's true that the amount of data is limited (and the rolling periods makes it seem like we have more than we do).

But we can use all of the data to establish the trendline. I.e. increasing PE10 monotonically results in crappier worst cases. So even though there might be only a few points with PE10 > 20, the extrapolation doesn't seem unreasonable to me.

Svensk Anga

Recycles dryer sheets

- Joined

- Dec 23, 2012

- Messages

- 94

I have two references for the worst case to expect. Both are for blended portfolios with retirement withdrawals and adjusted so that a level return assumption can be used and still account for sequence of return risk. This is handy for plugging into your planning spreadsheet and not having to deal with Monte Carlo analysis.

First, Jim Otar in "Unveiling the Retirement Myth", chapter 20, claims that a 50/50 portfolio undergoing 2% withdrawals has only 10% chance of doing worse than 3.4% nominal over 30 years. He assumes 3% inflation, so that's 0.4% real. (There may be other cases for allocation and w/d rate.) median was 5.2% nominal and "lucky" case - best 10% was 7.2%.

Wade Pfau did and article for Advisor Perspectives. Link here: New Research on How to Choose Portfolio Return Assumptions - Advisor Perspectives

He estimates, based on history from 1926 to 2011, that the worst 1% case over 30 years is -0.4%. (See table 2.) Pfau gets 1.9% real for his 10th percentile case, which differs a bit from Otar. YMMV.

These both start with historical returns, so you still have to ask yourself is it really different this time? Is our future to be worse than the Great Depression?

My plan works with Pfau's -0.4% real, the 1st percentile horrible case. If it is worse than that, will just have to adapt.

First, Jim Otar in "Unveiling the Retirement Myth", chapter 20, claims that a 50/50 portfolio undergoing 2% withdrawals has only 10% chance of doing worse than 3.4% nominal over 30 years. He assumes 3% inflation, so that's 0.4% real. (There may be other cases for allocation and w/d rate.) median was 5.2% nominal and "lucky" case - best 10% was 7.2%.

Wade Pfau did and article for Advisor Perspectives. Link here: New Research on How to Choose Portfolio Return Assumptions - Advisor Perspectives

He estimates, based on history from 1926 to 2011, that the worst 1% case over 30 years is -0.4%. (See table 2.) Pfau gets 1.9% real for his 10th percentile case, which differs a bit from Otar. YMMV.

These both start with historical returns, so you still have to ask yourself is it really different this time? Is our future to be worse than the Great Depression?

My plan works with Pfau's -0.4% real, the 1st percentile horrible case. If it is worse than that, will just have to adapt.

Most of the studies I see with various strategies have pretty high success if you're fairly consistent with using them.

I suspect what crushed people is psychology stopping consistency.

50/50 looks good... then next year go to 80/20 then suddenly switching to gold, etc.

I'm trying to optimize for what I can stick to since there seem to be many successful strategies.

Sent from my HTC One_M8 using Early Retirement Forum mobile app

I suspect what crushed people is psychology stopping consistency.

50/50 looks good... then next year go to 80/20 then suddenly switching to gold, etc.

I'm trying to optimize for what I can stick to since there seem to be many successful strategies.

Sent from my HTC One_M8 using Early Retirement Forum mobile app

papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

Bogle has an insight and opinion too.

I do believe the 7% historical equity portfolio return is too often quoted without looking at the realities of the 2000 to 2016 time - where the market return has clearly been far below that magic 7% rate.

2% to 4% seems most likely but if you're asking for a worst-case -then certainly something negative along the lines of -1% to -4% nominal return seems absolutely rational.

the question then would be whether or not our portfolios will survive with that level of wealth destruction. It would require significant belt tightening and/or increased portfolio beta.

Personally I have always planned at 4% nominal (of which 2.5% is dividend yield 1.5% is market return) , 3% inflation,

Netting 1% real equity returns.

I hold a 90% equity portfolio comprising 75% broad USA equities and 25% intl equities.

I hold 10% in gold ole cash but not opposed to going to 5% cash if an opportunity presents itself.

Zero bonds.

I do believe the 7% historical equity portfolio return is too often quoted without looking at the realities of the 2000 to 2016 time - where the market return has clearly been far below that magic 7% rate.

2% to 4% seems most likely but if you're asking for a worst-case -then certainly something negative along the lines of -1% to -4% nominal return seems absolutely rational.

the question then would be whether or not our portfolios will survive with that level of wealth destruction. It would require significant belt tightening and/or increased portfolio beta.

Personally I have always planned at 4% nominal (of which 2.5% is dividend yield 1.5% is market return) , 3% inflation,

Netting 1% real equity returns.

I hold a 90% equity portfolio comprising 75% broad USA equities and 25% intl equities.

I hold 10% in gold ole cash but not opposed to going to 5% cash if an opportunity presents itself.

Zero bonds.

eta2020

Thinks s/he gets paid by the post

- Joined

- Sep 13, 2013

- Messages

- 1,248

Bogle has an insight and opinion too.

I do believe the 7% historical equity portfolio return is too often quoted without looking at the realities of the 2000 to 2016 time - where the market return has clearly been far below that magic 7% rate.

What were the best and worst 20-year periods to own US stocks? Well, if you bought in:

1941: the return was about 15% per year for the next 20 years, or

1979: 18% annual return

The worst years to buy were:

1928: the return was about 2.5% for the next 20 years

1958, 59 & 61: about 5-5.5% annual return

On average, 20-year returns were the same as 10-year returns -- around 10% per year.

Similar threads

- Replies

- 35

- Views

- 2K

- Replies

- 26

- Views

- 1K

- Replies

- 11

- Views

- 683

- Replies

- 12

- Views

- 2K

Latest posts

-

-

What new series are you watching? *No Spoilers, Please*

- Latest: ShokWaveRider

-

-

-

-