You like to squeeze value out of your car, congrats! You didn't mention, but I'm going to guess you've owned that since new? And agree, you have to leave out fuel costs, but the new EV's may make that a requirement for comparison in the future.

Don't take it personally, but I don't think I'd enjoy driving that car. As I said originally, my wants are a newer car with latest technology and safety features. Nothing like getting in, plugging my phone into the USB on the car, getting Waze to pop-up on the big screen and then enjoying streaming music. But that's just my quirk, I love technology

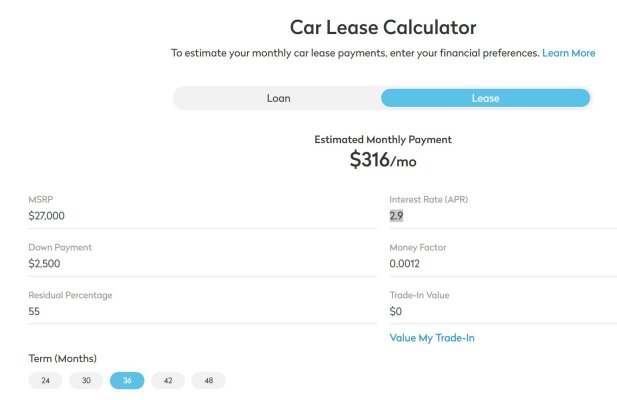

Also, with that being 24 years old and I'd always in the back of my mind be thinking what's getting ready to go out on the car -- and it seems those type of problems are never at convenient times. I guess I'll justify the incremental $165/mo I spend as cost of piece of mind and entertainment

Just to balance out your experience with new cars. My experience has been quite the opposite. With exception of some cars back in the 80's, I've had very few mechanical problems with cars. Thinking back, the last time any of my cars needed to go into the shop (other than for regular maintenance) was back in 2008. It was thought to be bad battery, turned out to be bad alternator, less than 1 year old so covered under warranty. Knock on wood, all cars since then haven't needed to go into the shop for repairs. I even had a couple hard top convertibles, or rather my wife drove them, and those are known to be problematic but never had a problem with either. Further, I look at the experience of my son and daughter and parents. Their newer cars haven't needed to go into the shop either. So even with all the technology I want, I'm still having a positive and reliable experience.