tominboise

Recycles dryer sheets

I have a complicated spreadsheet (don't we all?) and reran our numbers yesterday, with the current inflation rate and rates of return. It looks like we have a risk of running out of $$ around 2054 (I will be 94 then, DW 92).

This assumes inflation stays constant over that time, as does our spending and rates of return, so not very realistic on any of those. We are at about a 4% withdraw rate currently, not on SS yet (waiting until age 70 for that, so 7.3 more years).

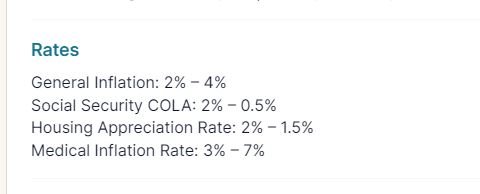

What are people using for inflation rate for predicting over a long period of time? What about average rate of return? (7% for the stocks, like history has proven?)

Current asset allocation is 58/34/8 (stocks/bonds/short term cash). Stocks are virtually all index funds and bonds are funds as well. We are diversified small to large cap, both domestic and international. We are down ~-18.5% this year.

This assumes inflation stays constant over that time, as does our spending and rates of return, so not very realistic on any of those. We are at about a 4% withdraw rate currently, not on SS yet (waiting until age 70 for that, so 7.3 more years).

What are people using for inflation rate for predicting over a long period of time? What about average rate of return? (7% for the stocks, like history has proven?)

Current asset allocation is 58/34/8 (stocks/bonds/short term cash). Stocks are virtually all index funds and bonds are funds as well. We are diversified small to large cap, both domestic and international. We are down ~-18.5% this year.

Last edited: