F.I.R.E User

Thinks s/he gets paid by the post

Well, the pro's might, I look at the DJIA each day get what the markets have done for the day.

My unorthodox way isn't the usual way to success. It seems everything everyone does here is opposite of what I did/do. I made it through with taking a different road and thought pattern to win the game.

Keep plugging along it won't be long and cheering you on for your next Milestone.

Do you have investments in DOW?

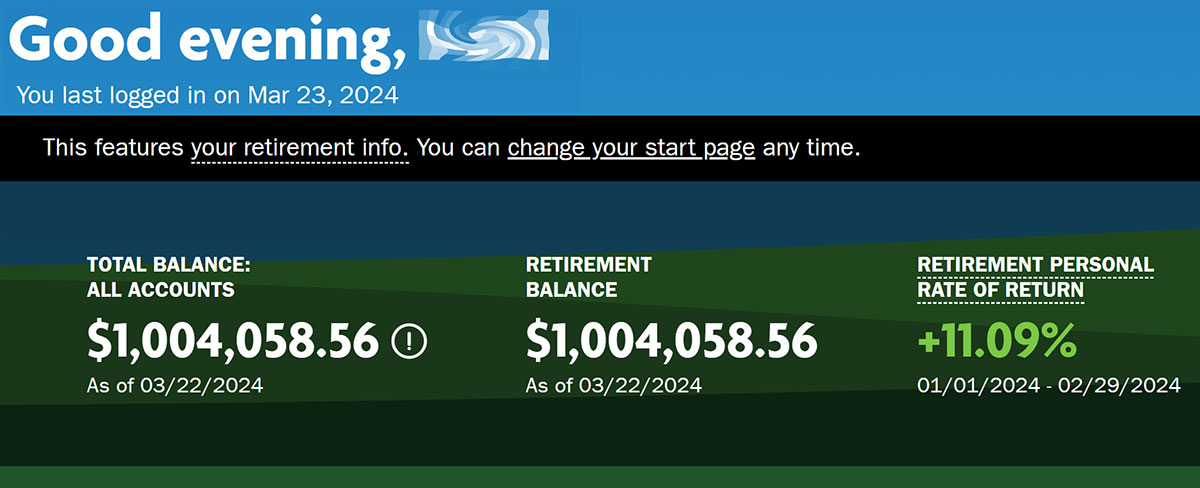

Congrats.Broke through the $2.5MM mark... The last one is from the past 5 years.