jimbohoward69

Recycles dryer sheets

- Joined

- Feb 25, 2007

- Messages

- 70

Before my VG taxable mutual fund account switched over to a brokerage account, my cost basis method was avg. cost. Sometime after the switch, I liquidated my mutual funds and had all monies parked in the VG Fed MM fund (no other mutual funds in the account).

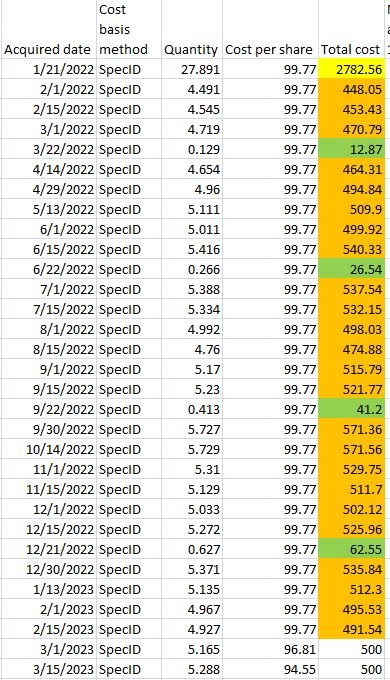

So, at the beginning of 2022, with money just sitting there in the MM not doing anything, I decided to buy an initial $3K of VSTAX and dollar cost average $500 per paycheck. When I did this, I could have sworn that I changed my method to SpecID. Well, for the heck of it, I went into the brokerage account this morning and pulled a transaction spreadsheet. While it shows SpecID as the cost basis, the cost per share is the same all the way down until 03/01/22 (avg cost). After that date, it's all SpecID.

Because I've sold no VSTAX holdings since my initial investment, can/will VG change the cost basis to SpecID for those specific transactions? To me, it looks like a mistake on their part...unless I'm missing something. I hope my post makes sense. On the spreadsheet, yellow is initial investment, brown is DCA, and green are divs.

So, at the beginning of 2022, with money just sitting there in the MM not doing anything, I decided to buy an initial $3K of VSTAX and dollar cost average $500 per paycheck. When I did this, I could have sworn that I changed my method to SpecID. Well, for the heck of it, I went into the brokerage account this morning and pulled a transaction spreadsheet. While it shows SpecID as the cost basis, the cost per share is the same all the way down until 03/01/22 (avg cost). After that date, it's all SpecID.

Because I've sold no VSTAX holdings since my initial investment, can/will VG change the cost basis to SpecID for those specific transactions? To me, it looks like a mistake on their part...unless I'm missing something. I hope my post makes sense. On the spreadsheet, yellow is initial investment, brown is DCA, and green are divs.