Freedom56

Thinks s/he gets paid by the post

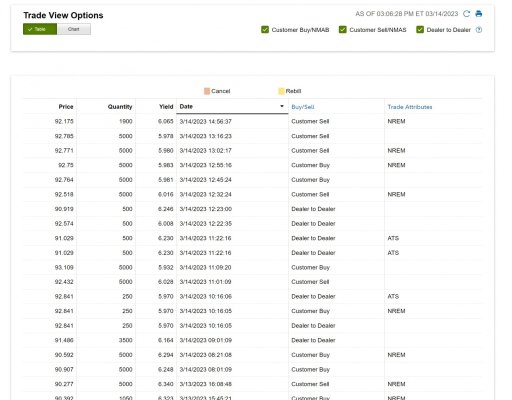

That is where me being a rookie in buying after market CDs was exposed. I put in a bid last night after Freedom posted it. But I got this big warning banner about transaction wouldnt occur until market opened and price could change. While I didnt think they could or would change the terms it scared me off until market opened so I would know for sure what I was buying. A 4 year is fine for me though.

I'm glad you and others got some. There are more in the pipeline this week and then a reset down.