Now see that’s what I was trying to say. It seems like the bonds are different than the stocks when it comes to being selective about what you buy & what you don’t buy. The stock index is probably good for people but the bond world seems different. I can’t really say why. I don’t know enough about it.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

We are entering a "Golden Period" for fixed income investing

- Thread starter Freedom56

- Start date

- Status

- Not open for further replies.

I have a few questions about buying secondary CDs from Fidelity. I usually only buy auctioned or secondary Treasuries and neither have a markup.

Thanks.

- Is the markup typically $1 a bond?

- Does the stated yield to maturity include or exclude the markup?

- I understand paying for Accrued Interest, but just wonder if it gets handled pretty seamlessly at tax time when I download Fidelity's consolidated 1099 into Turbotax?

Thanks.

copyright1997reloaded

Thinks s/he gets paid by the post

My Friday orders filled and today's orders are now 80% filled. This "drama" won't end until issues with banks are resolved. I think the large banks are going to see an influx of new business customers. Powell is likely to follow Bank of Canada's lead and hold rates steady and let inflation fall back slowly over time.

This. I can tell you from direct experience working there in the midst of the GFC that banks like JP Morgan Chase benefit.

OTOH, they too have learned lessons that "No good deed goes unpunished". In the case of JPMC, they were almost begged to take over Bear Stearns and Washington Mutual "for the good of the country", only to years later be punished and fined for sins ....done by Bear and WaMu prior to them taking them over.

I found it interesting (and even commented somewhere here) that there were no white knights to be found before Friday's forced takeover of Silicon Valley Bank. Perhaps some of that is based on their GFC experiences.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Hopefully many folks were wise and extended maturities during the long runway of past weeks and months.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

We are entering a "Golden Period" for fixed income investing

I sure did. I try not to let perfect prevent me from getting good. I got great in October with bonds, but got greedy with CDs and missed out. Last week I made sure that mistake didnt happen locking noncallable 2-3 yr CDs around 5.25% or so, and punched out one last smaller 5.25% 2 year noncallable CD this morning from Morgan Stanley. That disappeared quickly as expected once yield curve collapsed.

Hopefully many folks were wise and extended maturities during the long runway of past weeks and months.

I sure did. I try not to let perfect prevent me from getting good. I got great in October with bonds, but got greedy with CDs and missed out. Last week I made sure that mistake didnt happen locking noncallable 2-3 yr CDs around 5.25% or so, and punched out one last smaller 5.25% 2 year noncallable CD this morning from Morgan Stanley. That disappeared quickly as expected once yield curve collapsed.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Diversify, monitor, and adjust.

We got slapped around by an unexpected event. Nobody I know even hinted at this a month ago.

We got slapped around by an unexpected event. Nobody I know even hinted at this a month ago.

If the debt ceiling doesn’t get raised will treasuries be less safe than high quality corporate bonds or CDs in well capitalized banks? I know no one believes that will happen but just supposing it did? Or is that too controversial for this site?

Ignoring all of the side effects of a default and if the treasury does some sort of prioritzation, in theory the CD would be paid by the bank that had the money and the treasury won't because, well, the treasury is defaulting on it's payments.If the debt ceiling doesn’t get raised will treasuries be less safe than high quality corporate bonds or CDs in well capitalized banks? I know no one believes that will happen but just supposing it did? Or is that too controversial for this site?

Freedom56

Thinks s/he gets paid by the post

Freedom56

Thinks s/he gets paid by the post

I believe short term rates have pretty much topped out and the long end is still far too low and will rise over time. Don't forget we have the debt ceiling drama coming up. Powell may hold off any rate increase until June or just pause for the rest of the year and see what happens to inflation and regional banks.

Which probably means leaving money in money market funds and collecting our 4.5% makes the most sense. Maybe cherry picking offerings here and there. My guess is that the yield term will slowly flatten over the next year or two with longer rates rising back towards 4% and short term rates eventually declining towards there. Tons of noise and volatitliy as the inflation hawks call for further rate increases while others warn of recession and call for rate cuts. As long as I'm getting 4%+ on my money I am very happy considering what we've seen the last 5-10 years. Everybody will always bemoan missing the high but it is much easier to call the high once we've come off it. Should be interesting to hear Powell's next statement.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Some banks rushing to shore up their deposit bases or replace fleeing deposits. CD's and special deals are the best way of doing so.

Freedom56

Thinks s/he gets paid by the post

Hasn’t money the last 15 years been unusually cheap? Isn’t what’s going on just mean reversion? At some point doesn’t cheap money & super low rates become anti capitalistic? Seems like it’s amateur hour in the financial services business because money was so easy to get.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

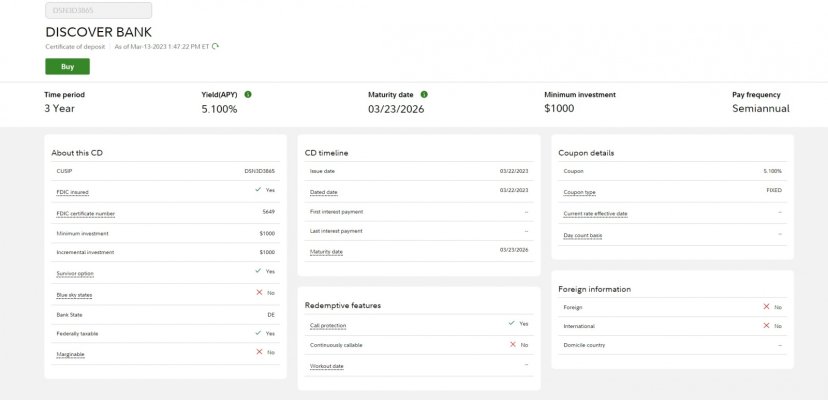

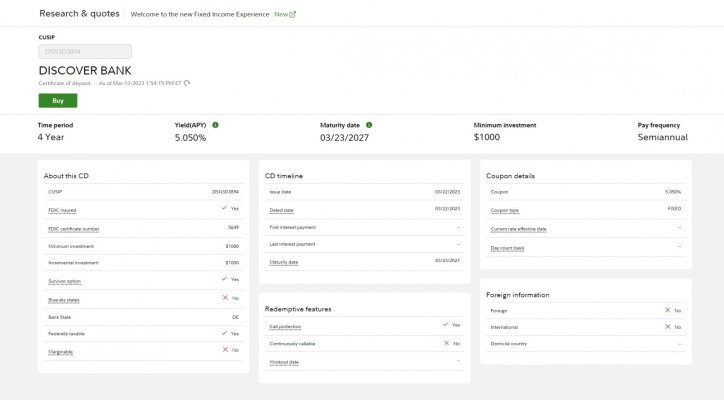

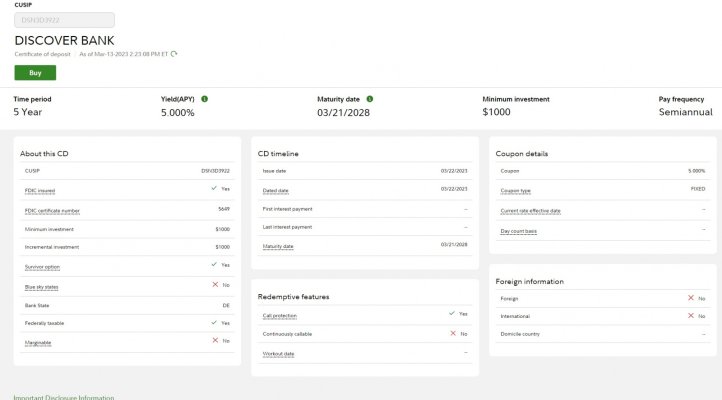

And the 5 year 5% call protected CD from Discover Bank to complete the trifecta.

I will have to check in the morning and see if I can get a little bite of this 5 year apple. The more money I can shovel in at a safe respectable yield, the more latitude I will give myself on the more aggressive buys.

And the 5 year 5% call protected CD from Discover Bank to complete the trifecta.

Not going to lie, certainly didn't expect to see a 5yr 5% call protected CD offered today after the move in yields the past 3 days. Probably like Montecfo said it is a way to quickly grab some deposits and replenish cash with so many people fleeing certain banks but not that I care. I decided to purchase some 3 and 5 year CDs (under the FDIC limit) at a better rate than I almost bought 5 year treasury notes last week.

Freedom56

Thinks s/he gets paid by the post

Which probably means leaving money in money market funds and collecting our 4.5% makes the most sense. Maybe cherry picking offerings here and there. My guess is that the yield term will slowly flatten over the next year or two with longer rates rising back towards 4% and short term rates eventually declining towards there. Tons of noise and volatitliy as the inflation hawks call for further rate increases while others warn of recession and call for rate cuts. As long as I'm getting 4%+ on my money I am very happy considering what we've seen the last 5-10 years. Everybody will always bemoan missing the high but it is much easier to call the high once we've come off it. Should be interesting to hear Powell's next statement.

I have been buying (CD, corporate bond, or treasury) every month since I started this thread in June 2022. I may have caught the high in October/November 2022 but those yields are dwarfed by what was available in March 20, 2020. We are coming to that anniversary next Monday. My MM fund stash grew too large and with the SVG issue, I decided to sweep up the best deals available on Friday through today. However I still have a lot dry powder sitting in MM funds. The mid sized banks are going to be flooding the market with CDs as the scramble to raise liquidity. So there should be plenty supply. They normally file these new issues 7-10 days in advance so the coupons for the CDs and corporate notes that will be available this week will reflect the pre SVB failure and plunge in yields. Next week we will likely see lower yields again for both corporate notes and CDs. I invest strictly for income and preservation of capital. However my capital has grown significantly since I started investing and will continue to grow as I compound returns. All Powell has to do is open his mouth and spook the markets again. He has done that well so far.

Freedom56

Thinks s/he gets paid by the post

I will have to check in the morning and see if I can get a little bite of this 5 year apple. The more money I can shovel in at a safe respectable yield, the more latitude I will give myself on the more aggressive buys.

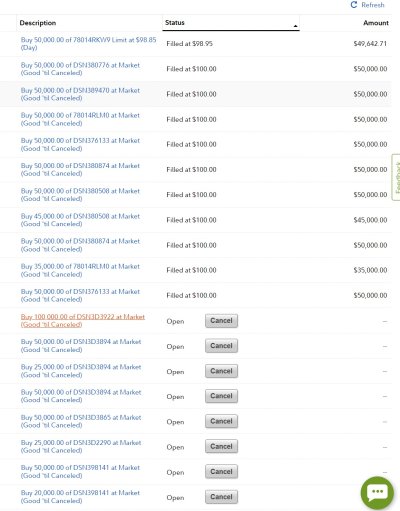

I had too much dry powder sitting on the sidelines so I placed over $1.2M in orders today. The lowball bids did not fill, but about $520K for new and one secondary market order did fill. I have a about $370K order on CDs waiting to be filled. I still have a lot of dry powder left. The good thing about fixed income is that prices for new issues don't reset immediately like stocks. It's all on a first come first serve basis.

Attachments

Freedom56

Thinks s/he gets paid by the post

Not going to lie, certainly didn't expect to see a 5yr 5% call protected CD offered today after the move in yields the past 3 days. Probably like Montecfo said it is a way to quickly grab some deposits and replenish cash with so many people fleeing certain banks but not that I care. I decided to purchase some 3 and 5 year CDs (under the FDIC limit) at a better rate than I almost bought 5 year treasury notes last week.

Issuers file 7-10 days in advance. So the the yields you see today on new issues, reflect yields from then not today. They are available on a first come first serve basis at each financial institution.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

We are entering a "Golden Period" for fixed income investing

With my brokerages the bond desks is largely a den of thieves. So when I buy, I know its a marriage as they will screw me if I needed to sell. As they control the price buying and selling… To humor myself today and see what type of Dheads they were I sent out a bid request on a New Mexico Public Service 2025…4 different sell bid requests on the same bond…all within a minute of each other…And I came back with 4 different prices up to 4% apart from high to low.

I have another bond they want to sell at $110, but offer me about $90. They truly are scumbags! But I dont care as I am not selling nor will ever need to. But still, that doesnt mean I have to like it!

I had too much dry powder sitting on the sidelines so I placed over $1.2M in orders today. The lowball bids did not fill, but about $520K for new and one secondary market order did fill. I have a about $370K order on CDs waiting to be filled. I still have a lot of dry powder left. The good thing about fixed income is that prices for new issues don't reset immediately like stocks. It's all on a first come first serve basis.

With my brokerages the bond desks is largely a den of thieves. So when I buy, I know its a marriage as they will screw me if I needed to sell. As they control the price buying and selling… To humor myself today and see what type of Dheads they were I sent out a bid request on a New Mexico Public Service 2025…4 different sell bid requests on the same bond…all within a minute of each other…And I came back with 4 different prices up to 4% apart from high to low.

I have another bond they want to sell at $110, but offer me about $90. They truly are scumbags! But I dont care as I am not selling nor will ever need to. But still, that doesnt mean I have to like it!

Last edited:

Freedom56

Thinks s/he gets paid by the post

With my brokerages the bond desks is largely a den of thieves. So when I buy, I know its a marriage as they will screw me if I needed to sell. As they control the price buying and selling… To humor myself today and see what type of Dheads they were I sent out a bid request on a New Mexico Public Service 2025…4 different sell bid requests on the same bond…all within a minute of each other…And I came back with 4 different prices up to 4% apart from high to low.

I have another bond they want to sell at $110, but offer me about $90. They truly are scumbags! But I dont care as I am not selling nor will ever need to. But still, I that doesnt mean I have to like it!

Brokerages make their money from fixed income trading. New issue bonds and CDs include a 1-1.5% commission embedded in the price. For secondary market trades, the bid/ask spread can open up quite a bit. The real money is made when the execute bond trades for funds and institutions.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

With my brokerages the bond desks is largely a den of thieves. So when I buy, I know its a marriage as they will screw me if I needed to sell. As they control the price buying and selling… To humor myself today and see what type of Dheads they were I sent out a bid request on a New Mexico Public Service 2025…4 different sell bid requests on the same bond…all within a minute of each other…And I came back with 4 different prices up to 4% apart from high to low.

I have another bond they want to sell at $110, but offer me about $90. They truly are scumbags! But I dont care as I am not selling nor will ever need to. But still, that doesnt mean I have to like it!

I am not sure what brokerage you use, but I can also put asks on the market for almost every bond I hold. I have found I can sell direct better than the brokerage bids.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

Brokerages make their money from fixed income trading. New issue bonds and CDs include a 1-1.5% commission embedded in the price. For secondary market trades, the bid/ask spread can open up quite a bit. The real money is made when the execute bond trades for funds and institutions.

Everyone has to make a living I can accept that. But those dolts need to find another fool to clip a 15% spread either way on me. I generally only buy secondary bonds, so I have to track Finra trades and flesh out dealer trades to see what a fair price is. And many times I just have to wait….and wait. Because there are only a few types of bonds I will even buy to begin with.

harley

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Disclaimer: I am not not a bond person by any stretch. I have followed this extremely long and confusing thread since it's inception. I haven't started buying bonds, but I did at least get out of my bond funds at a good time. So thanks for that.

I have some rental real estate that I've substituted for bonds in my asset allocation, although I also held a VG short term bond fund until last year. But I've been sitting on a fair amount of cash, trying to decide whether to start buying bonds or to wait and buy CDs, since my (often faulty) logic told me that if bond rates were increasing, CD rates should follow. It sounds like I may have waited too long on the bond issue, but that's not a bid deal for me. Recently I've been buying CDs, mostly at 5%.

My question is, what's the difference between me buying CDs at Ally or whichever bank I choose, vs the CDs y'all talk about that you are buying from brokers. I know the brokered CDs are a secondary market, some with call dates and earlier maturity dates. So why do you buy them from a broker rather than directly from the bank that is offering them? It seems like you're adding cost and complexity to the process. But I freely admit there could be things I don't understand about it. I would appreciate any clarity any or you could provide. Thanks.

I have some rental real estate that I've substituted for bonds in my asset allocation, although I also held a VG short term bond fund until last year. But I've been sitting on a fair amount of cash, trying to decide whether to start buying bonds or to wait and buy CDs, since my (often faulty) logic told me that if bond rates were increasing, CD rates should follow. It sounds like I may have waited too long on the bond issue, but that's not a bid deal for me. Recently I've been buying CDs, mostly at 5%.

My question is, what's the difference between me buying CDs at Ally or whichever bank I choose, vs the CDs y'all talk about that you are buying from brokers. I know the brokered CDs are a secondary market, some with call dates and earlier maturity dates. So why do you buy them from a broker rather than directly from the bank that is offering them? It seems like you're adding cost and complexity to the process. But I freely admit there could be things I don't understand about it. I would appreciate any clarity any or you could provide. Thanks.

- Status

- Not open for further replies.

Similar threads

- Replies

- 35

- Views

- 3K

- Replies

- 3

- Views

- 487

- Replies

- 17

- Views

- 786

Latest posts

-

Who FIREd the Earliest with the Lowest FIRE Score and Why You Did?

- Latest: upupandaway

-

-

-

-

-

-

-