Disclaimer: I am not not a bond person by any stretch. I have followed this extremely long and confusing thread since it's inception. I haven't started buying bonds, but I did at least get out of my bond funds at a good time. So thanks for that.

I have some rental real estate that I've substituted for bonds in my asset allocation, although I also held a VG short term bond fund until last year. But I've been sitting on a fair amount of cash, trying to decide whether to start buying bonds or to wait and buy CDs, since my (often faulty) logic told me that if bond rates were increasing, CD rates should follow. It sounds like I may have waited too long on the bond issue, but that's not a bid deal for me. Recently I've been buying CDs, mostly at 5%.

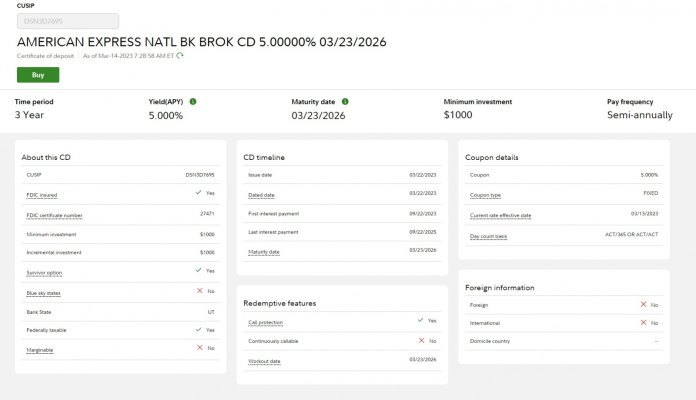

My question is, what's the difference between me buying CDs at Ally or whichever bank I choose, vs the CDs y'all talk about that you are buying from brokers. I know the brokered CDs are a secondary market, some with call dates and earlier maturity dates. So why do you buy them from a broker rather than directly from the bank that is offering them? It seems like you're adding cost and complexity to the process. But I freely admit there could be things I don't understand about it. I would appreciate any clarity any or you could provide. Thanks.

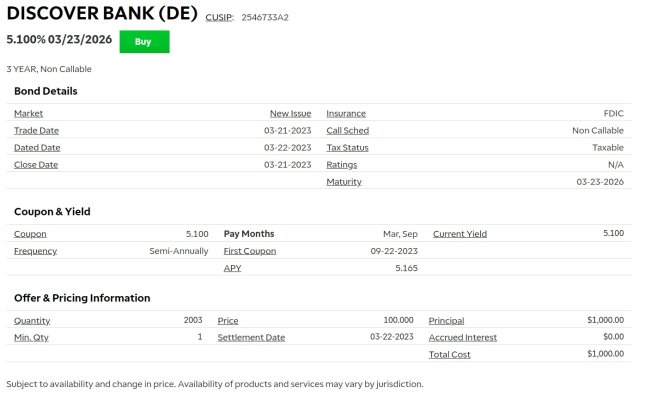

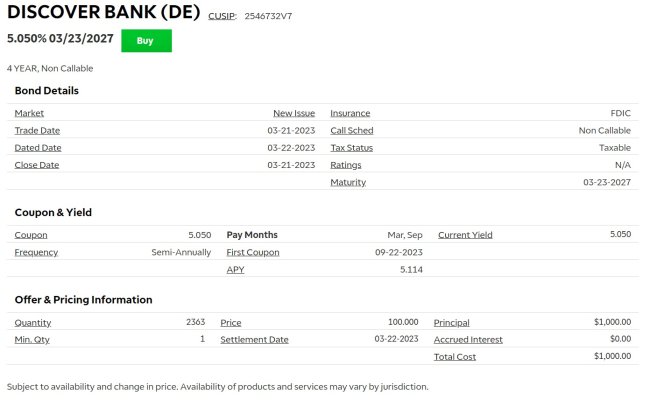

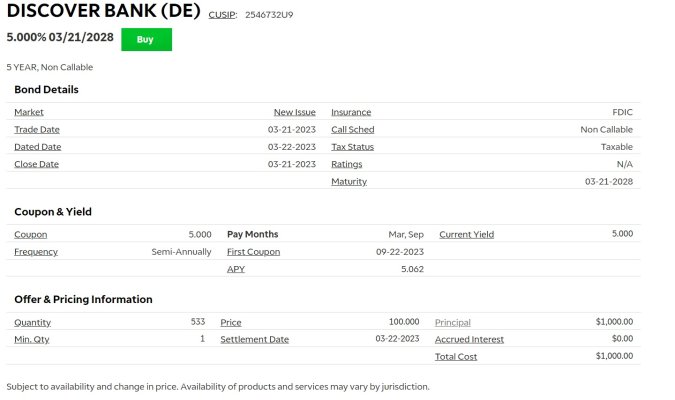

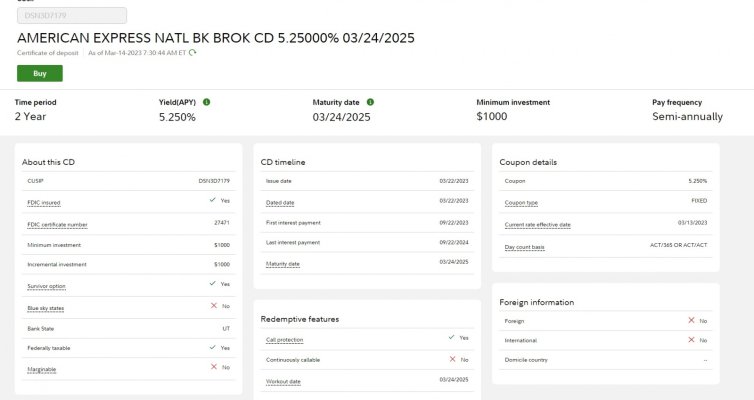

1. Some times the rates at the broker are significantly higher. Case in point is right now discover.com is 4.1% for a 5yr but at the broker discover cd's are 5% (until gone).

2. My IRA and other account stay put but can buy CDs from any institution choosing to sell brokered CDs.

3. I can mix in treasuries/agencies in with the CDs to fill rungs on the ladder.

Last edited: