Thanks MichaelB for the education. One more question, what are the actual mechanics of devaluing the dollar ? Just lowering interest rates ?

That’s a very smart question, and equally difficult to answer. Because the US$ is the global reserve currency, it acts differently from other currencies.

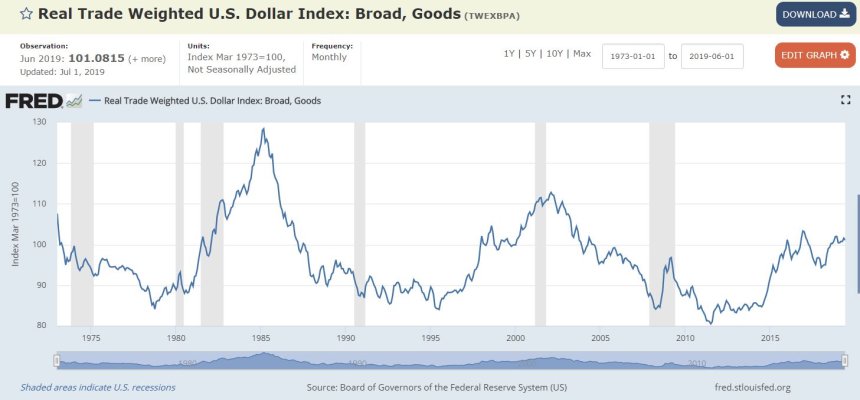

To lower the value of the US$ with respect to our trading partners

and keep it there would probably take the concerted action of all the major central banks acting together,

or it would require the US Treasury and the US Fed to act together.

The Central Banks would need to agree on a value, then all sell dollars until the US$ reached that level. This is not a likely scenario, but it has happened in the past.

The Treasure and the Fed, working together, have lots of options, but it’s very challenging without the Fed. Buying endless amounts of bonds to push down rates is one. Placing limits on capital movements is another. Restrictions on the use of dollars for non US transactions would certainly do it. Anything that restricts the free flow of US currency or liquidity would impact the value of the US$. The problem is, that is against the mandate of the Fed, and would have deleterious effect on the Fed’s ability to carry out its primary mandate, which is US monetary policy. It would certainly compromise the independence of the US Central Bank.

One tenet of economic theory is you cannot manage an exchange rate, have an independent monetary policy, and allow the free flow of capital. Any two of those conditions preclude the third. This is one of the reasons the US$ is the reserve currency - no other country is willing (or able) to do that.