pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Ok, so I thought I would try too, with FireCalc. I got my numbers for DW and I from the ssa.gov site, for ages 67-70.

Plugging 77% (haircut) of each them into FC, I got:

Age Average Amount

67 $9.11M

68 $9.17M

69 $9.25M

70 $9.42M

So, for the average of 117 scenarios, age 70 comes out ahead (for us). I *still* standby our plan to pull at 70.

I had always assumed that the values at various ages take the extra 8% per year into account. Is that true? But, I would not think it takes COLAs into account, since that is unknown yet.

I haven't done the work but I suspect that age 70 SS will work out better for anyone under FIRECalc because typically the FIRECalc time horizon is until mid to late 90s and well past the breakeven point.

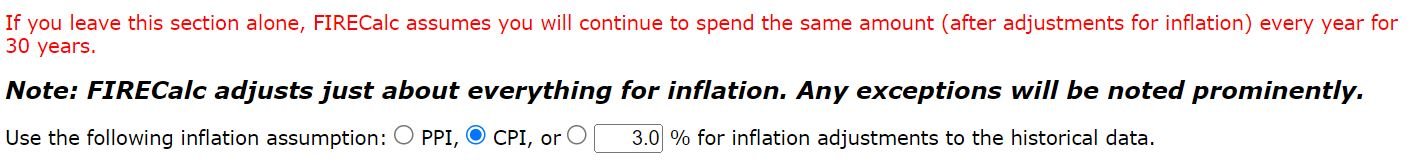

On the last part, I think FIRECalc does take SS COLAs into account... remember that FIRECalc scenario runs are based on actual past history... so for each year FIRECalc increases spending for inflation and if you have SS or a COLA pension then it would increase the income from those sources for inflation the same way it increases spending for inflation as well. What I'm not sure of is whether FIRECalc uses the actual SS COLA for that historical year or just the same inflation rate used for spending.