latexman

Thinks s/he gets paid by the post

This article takes an interesting statistical, back-testing approach to the much debated question of when/what age to claim Social Security.

An excerpt:

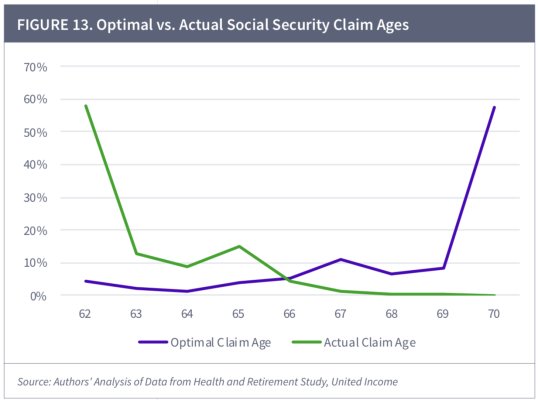

“Statistically speaking, there is a best age to claim Social Security benefits. In 2019, online investment management and financial planning company United Income released a study that analyzed the retired-worker claiming decisions of approximately 20,000 respondents using the University of Michigan's Health and Retirement Study.

The purpose of this analysis was to determine if these roughly 20,000 retirees had made an optimal claiming decision. For United Income, an "optimal" decision was one that resulted in the highest possible lifetime benefits for a claimant. Note, highest lifetime benefit may not be synonymous with highest possible monthly benefit.

What United Income's study showed was that claiming age and optimal claiming decisions were almost a perfect inverse of each other. In other words, there were very few optimal claims, with seniors regularly leaving large sums of Social Security income on the proverbial table.”

This approach is definitely not perfect. I think I’d prefer a more diverse, larger sample.

What do y’all think?

I’m trying to find the original study.

An excerpt:

“Statistically speaking, there is a best age to claim Social Security benefits. In 2019, online investment management and financial planning company United Income released a study that analyzed the retired-worker claiming decisions of approximately 20,000 respondents using the University of Michigan's Health and Retirement Study.

The purpose of this analysis was to determine if these roughly 20,000 retirees had made an optimal claiming decision. For United Income, an "optimal" decision was one that resulted in the highest possible lifetime benefits for a claimant. Note, highest lifetime benefit may not be synonymous with highest possible monthly benefit.

What United Income's study showed was that claiming age and optimal claiming decisions were almost a perfect inverse of each other. In other words, there were very few optimal claims, with seniors regularly leaving large sums of Social Security income on the proverbial table.”

This approach is definitely not perfect. I think I’d prefer a more diverse, larger sample.

What do y’all think?

I’m trying to find the original study.

Last edited: