You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Who's your broker?

- Thread starter livingalmostlarge

- Start date

Been with E*Trade for more than 20 years with no complaints. Like their web interface and how it can be customized. Free trades. Use their bank and their bill pay, both work great. No fees to transfer money back and forth with Ally when Ally pays higher rates. No fees to use ATM's when needed.

They even gave me a dedicated line to call and an inside contact if needed. He calls once a year or so to see if I have any questions or need help. Never tries to sell me on anything.

They even gave me a dedicated line to call and an inside contact if needed. He calls once a year or so to see if I have any questions or need help. Never tries to sell me on anything.

2cheap2eat

Recycles dryer sheets

- Joined

- Oct 22, 2014

- Messages

- 117

Fidelity has most of my 401k, IRA, and HSA. Vanguard fir Roth & Education IRA, TDA for rollover IRA and taxable investment account.

I’ve been thinking about consolidating, but they all have their pros/cons.

I’ve been thinking about consolidating, but they all have their pros/cons.

I believe amended 1099 Forms are caused by the individual companies which are reporting the information to the broker. That sometimes a company or fund takes a long time to finalize their financials and provide incomplete information the first time around (Feb 15th). For example I have seen that with companies that later shifted some of their qualified dividend payment into a Return-of-Capital category or vice-versa. I might imagine there is some knock-on-effect going on within a complex fund that is waiting for certain reporting information to be received by the end of January (or Feb 15?) and this causes them to issue updates weeks after that.We have E-Trade and I would not recommend them to anyone. Their fees are competitive but reports of consolidated 1099 Forms are horrible and they amend them usually for 2 - 3 times per Tax season.

But it is very troublesome for individual tax filers who receive an updated 1099 the first week in April, or even worse a few weeks after that. I sold one fund in 2021 in large part because it caused an updated 1099 in late April, causing me to file an amended tax return. It was a small position and had caused similar problems in prior years, so no longer worth the hassle.

FANOFJESUS

Thinks s/he gets paid by the post

We have E-Trade and I would not recommend them to anyone. Their fees are competitive but reports of consolidated 1099 Forms are horrible and they amend them usually for 2 - 3 times per Tax season.

amend them usually for 2 - 3 times per Tax season

That's bad I did not know that. Anybody else notice this?

Just did a quick review and my E-Trade brokerage had one amended consolidated 1099 in the past 7 years. That was for the 2018 tax year.amend them usually for 2 - 3 times per Tax season

That's bad I did not know that. Anybody else notice this?

Badger

Thinks s/he gets paid by the post

- Joined

- Nov 2, 2008

- Messages

- 3,411

We have all tIRAs and RothIRAs as well as MM with Vanguard, stocks are with TD Ameritrade, and one stock with BB&T. I really don't like BB&T so I am having it moved into TD Ameritrade.

I have Admiral accounts with Vanguard but they keep changing my rep. as they move up the ladder but I really haven't used them much now that I don't buy or sell except for annual RMD.

My go to person at TD Ameritrade has been with me since the Scotrade days and I like the personal attention and personality. Unfortunately he is working at home since the pandemic and the convenient TD Ameritrade location has been closed. His future location at a Schwab office is located 20 miles away. If he eventually ceases to be my go to person with Schwab then I will seriously consider moving everything to Vanguard.

Cheers!

Cheers!

I have Admiral accounts with Vanguard but they keep changing my rep. as they move up the ladder but I really haven't used them much now that I don't buy or sell except for annual RMD.

My go to person at TD Ameritrade has been with me since the Scotrade days and I like the personal attention and personality. Unfortunately he is working at home since the pandemic and the convenient TD Ameritrade location has been closed. His future location at a Schwab office is located 20 miles away. If he eventually ceases to be my go to person with Schwab then I will seriously consider moving everything to Vanguard.

Cheers!

Cheers!

We're probably around 70% FIDO(soon to be close to 80%) for IRA's and Roth's and the rest is at TD Ameritrade which I generally use for more active trading.

I have been with TD since way back when I opened an account when they were called DATEK back in 1990 or so.

Have 4 separate accounts with them (2 roths, 2 regular) and have been perfectly happy with them.

As others mentioned I really like the Thinkorswim platform and have been using it for years. I typically open it up at 7 am on weekdays and don't close it out till 6 or 7 pm. I have many watch lists in there that I like to keep track of and watch the ebbs and flows of the markets based on news items etc.

Have no complaints with FIDO either. Have also used them for over 30 years as they were the company choice at my long term employer and I saw no reason to switch.

I have been with TD since way back when I opened an account when they were called DATEK back in 1990 or so.

Have 4 separate accounts with them (2 roths, 2 regular) and have been perfectly happy with them.

As others mentioned I really like the Thinkorswim platform and have been using it for years. I typically open it up at 7 am on weekdays and don't close it out till 6 or 7 pm. I have many watch lists in there that I like to keep track of and watch the ebbs and flows of the markets based on news items etc.

Have no complaints with FIDO either. Have also used them for over 30 years as they were the company choice at my long term employer and I saw no reason to switch.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We use Vanguard (Roths, SEP, IRA) and Schwab (401(k) rollovers).Which brokerage account do you use? Did you switch before or after retirement? I stupidly moved my money out of TD ameritrade in September because i thought I was refinancing with BofA to ML. I ended up not doing that and now I am considering moving back I don't like ML website or dashboard. But since I'm now not stuck at TD, I figure I might as well research moving to somewhere else. Possibly Fidelity or Vanguard.

What do you have? Did you switch? And what are the pros and cons?

I think "re-financing" is confusing terminology.

Fidelity, Schwab and Vanguard are the big three mentioned here most often.

Flyfish1

Recycles dryer sheets

TD Ameritrade , because that was literally the only option for our self directed 401K plan a few years ago. I'm actually very happy with them and their tools for self managed accounts.

Very good customer service and the web site is excellent if you are an active investor - unlike Vanguard. I'm looking forward to the Schwab merger. I have no need for local offices or RIA's. I've been at Interactive Brokers before, but prefer TD Ameritrade.

Very good customer service and the web site is excellent if you are an active investor - unlike Vanguard. I'm looking forward to the Schwab merger. I have no need for local offices or RIA's. I've been at Interactive Brokers before, but prefer TD Ameritrade.

gayl

Thinks s/he gets paid by the post

I moved everything to Schwab and have been very happy with their '1st floor' advisors when open / phone advisors during the last year. I find their ETFs to have very low costs (0.03%) but I imagine Fido is quite similar.

Still keep a checking / savings at USAA.

Still keep a checking / savings at USAA.

Athermos4u

Dryer sheet aficionado

- Joined

- Jan 11, 2021

- Messages

- 47

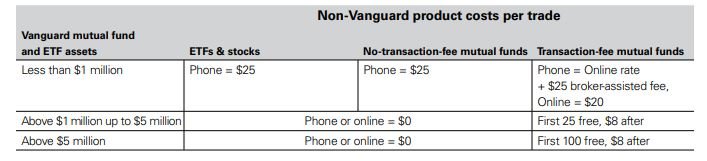

I just got an email from Vanguard, they will begin charging $25 usd for transactions requiring a phone representative. I'm already extremely unimpressed with the functionality of their website. It seems I may be taking my seven- figure investing business back to Fidelity. They have an office 2-3 miles from my house, and they don't charge when you walk in.

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

I just got an email from Vanguard, they will begin charging $25 usd for transactions requiring a phone representative. I'm already extremely unimpressed with the functionality of their website. It seems I may be taking my seven- figure investing business back to Fidelity. They have an office 2-3 miles from my house, and they don't charge when you walk in.

Before you pull a Roseann Roseannadanna, take a look at the link in that email and you'll find that anyone having a seven-figure investment with Vanguard gets a pass on most if not all of those phone assisted trade charges. See schedule below:

Attachments

I just got an email from Vanguard, they will begin charging $25 usd for transactions requiring a phone representative. I'm already extremely unimpressed with the functionality of their website. It seems I may be taking my seven- figure investing business back to Fidelity. They have an office 2-3 miles from my house, and they don't charge when you walk in.

I got that and was slightly alarmed at first. That is specific to Transaction Fee mutual funds. No impact to me and probably most of us.

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

+1I got that and was slightly alarmed at first. That is specific to Transaction Fee mutual funds. No impact to me and probably most of us.

Romer

Recycles dryer sheets

I know this is an older thread, but thought it best to add it here and ask my question

my IRAs are at TD Ameritrade and have been with them through one iteration or another for 20 years and never had an issue. I do have someone check in on me as named rep but have told him I am fine as I manage my own investments. Is there something I am missing in not using this rep? I have asked him a couple of questions and gotten quick answers and he did point out that you can only do one rollover out and back into your IRA in a year. I took a lot of out $$ To help my daughter between houses and paid it back in 38 days

The other question I have since I own stocks and funds, what risk is there having only 1 broker vs those of you who have several accounts. My reading of the legal documents is even if they go under, I still own my stocks, Bonds and funds.

I didn't see a reason to diversify brokers or is it because of the different products they sell? Do you get a better deal on Vanguard funds if your money is there?

As a side note, my 401K is with Empower

my IRAs are at TD Ameritrade and have been with them through one iteration or another for 20 years and never had an issue. I do have someone check in on me as named rep but have told him I am fine as I manage my own investments. Is there something I am missing in not using this rep? I have asked him a couple of questions and gotten quick answers and he did point out that you can only do one rollover out and back into your IRA in a year. I took a lot of out $$ To help my daughter between houses and paid it back in 38 days

The other question I have since I own stocks and funds, what risk is there having only 1 broker vs those of you who have several accounts. My reading of the legal documents is even if they go under, I still own my stocks, Bonds and funds.

I didn't see a reason to diversify brokers or is it because of the different products they sell? Do you get a better deal on Vanguard funds if your money is there?

As a side note, my 401K is with Empower

copyright1997reloaded

Thinks s/he gets paid by the post

If you are paying TDA a % of assets, then you are paying way too much for what you get from them.

I don't believe Romer is stating this.

I have a seven-figure Ameritrade account and get occasional calls from my rep (whose name I don't even know) asking me if everything is good, can they help with something etc. No fee involved. I'm sure they are looking for opportunities to do a managed account etc., but are polite and non-hassling.

Romer

Recycles dryer sheets

If you are paying TDA a % of assets, then you are paying way too much for what you get from them.

I don't believe Romer is stating this.

I have a seven-figure Ameritrade account and get occasional calls from my rep (whose name I don't even know) asking me if everything is good, can they help with something etc. No fee involved. I'm sure they are looking for opportunities to do a managed account etc., but are polite and non-hassling.

Yup. I pay zero fees and no fees on buying anything unless the Fund manager charges a Fee

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

TDA is a good, low cost broker that has been bought out by (merged with) Schwab. Schwab is also a good low cost broker. They may not have merged/moved accounts over from the TDA platform but it's probably coming. You should have heard something on this.I know this is an older thread, but thought it best to add it here and ask my question

my IRAs are at TD Ameritrade and have been with them through one iteration or another for 20 years and never had an issue. I do have someone check in on me as named rep but have told him I am fine as I manage my own investments. Is there something I am missing in not using this rep? I have asked him a couple of questions and gotten quick answers and he did point out that you can only do one rollover out and back into your IRA in a year. I took a lot of out $$ To help my daughter between houses and paid it back in 38 days

The other question I have since I own stocks and funds, what risk is there having only 1 broker vs those of you who have several accounts. My reading of the legal documents is even if they go under, I still own my stocks, Bonds and funds.

I didn't see a reason to diversify brokers or is it because of the different products they sell? Do you get a better deal on Vanguard funds if your money is there?

As a side note, my 401K is with Empower

I've used both, but when I switched from individual stocks to mutual funds, I moved that money to Vanguard. ETFs were pretty limited IIRC so at the time it was better to buy VG funds at VG. If the VG funds you want have a corresponding ETF, you can buy the ETF from Schwab at about the same fees. Admiral (lower cost) funds are still only available from VG as far as I know.

I doubt you're missing anything with your rep. I think you have to pay for portfolio advice (true at VG, not sure about Schwab), so they are just there for any questions you have. Sounds TDA did great for you on that, hopefully Schwab will too.

I'd say the biggest risk of using just one broker is that if their site is down for an extended time, perhaps due to a cyber attack, you might not have access to your money for awhile. I've got about 5% of my money elsewhere. It's not a set plan of keeping a certain amount somewhere else, but I do make sure I have some fairly liquid assets available elsewhere.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yes, same thing for us at Schwab, where Romer will eventually end up. The only difference is I work to make sure my rep knows my name, undertands what we are doing, etc. I show interest in his life and kids. I believe I get better service for questions and assistance with administrivia when I am not some faceless voice on the phone....

I have a seven-figure Ameritrade account and get occasional calls from my rep (whose name I don't even know) asking me if everything is good, can they help with something etc. No fee involved. I'm sure they are looking for opportunities to do a managed account etc., but are polite and non-hassling.

You're getting good info here; I'll just comment on the 401K. There's no reason to move it unless (1) you are getting charged fees over and above the expense charges in your mutual fund choices. These can be cleverly hidden; verify with your HR department that you are not paying "account service fees" or something like that. ("Zero" is the only acceptable answer.)... As a side note, my 401K is with Empower

(2) Typically your investment choices in 401Ks are limited, often just to funds offered by the account administrator. If you like the funds offered, you are golden. If not, that might be a reason to move.

...

I didn't see a reason to diversify brokers or is it because of the different products they sell? Do you get a better deal on Vanguard funds if your money is there?

....

We have funds at vanguard, Fidelity, Schwab, and BoA/Merrill_Edge. In my experience, all are solid choices. As noted by Running Bum, I'd be uncomfortable with only one vendor because of possibility of access being cut off by bad actors.

Why 4 right now? Trying to figure which to consolidate at in addition to BoA/Merrill. My factors are idiosyncratic: 1. only Fidelity has HSA option right now. 2. Fido and Schwab both have free international ATM usage, which has been nice over the past 4 years; 3. Vanguard is a bit of inertia from back when flagship meant something and it is likely to be the hardest for DW to deal with in the likely event that I'm first to die. Hence, it is likely to be terminated; 4. BoA is our banking hub, has useful credit card perqs, and the Merrill accounts maintain the platinum honors level for us; and 5. Trying to determine which vendor (not BoA!) is best for international wires and for transfers to our children.

Bottom line is that there are several good options, and I will end up choosing 2 on the basis of supplemental factors.

Similar threads

- Replies

- 2

- Views

- 224

- Replies

- 3

- Views

- 307

- Replies

- 4

- Views

- 443