Many here have a very low withdrawal rate (or with pension/SS don't even depend on the portfolio) and wish to maximize their portfolio.

However, as the 2000 crash indicated, "volatility is risk" (in the form of a severe extended market downterm before recovery), at least for those making significant withdrawals before pensions or SS withdrawing, and who are withdrawing at a significant withdrawal rate. Not for those who are withdrawing nothing or less than 1.5/2% from their portfolios either because of low spending/thrift or other sources of $.

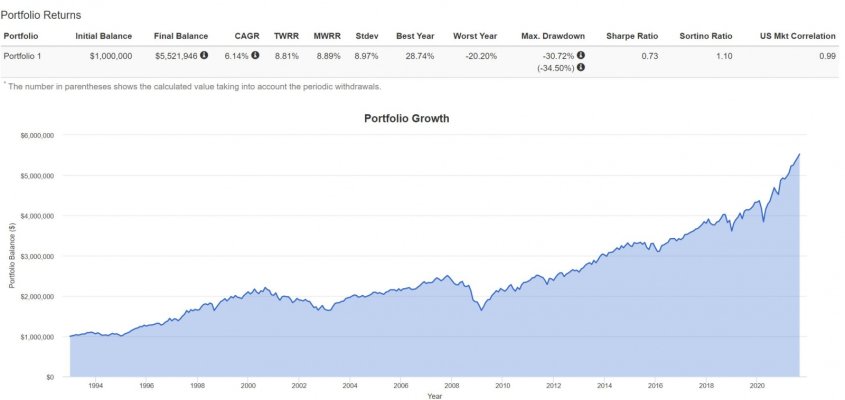

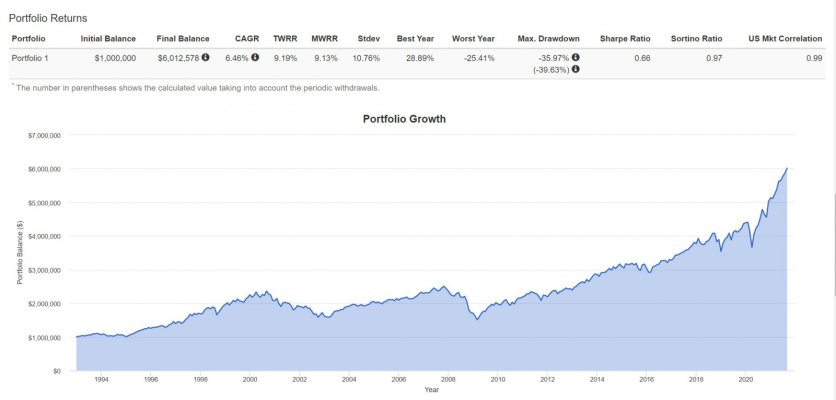

However, if you include the 2007 crash, it could have taken as long as 14 years to recover., even not considering withdrawals. I was unaffected largely because I was in accumulation mode and dumping a large % into stocks, until 2005 when I started bringing down my allocation from 90% stocks, although I did bump stock investments then to rebalance back up. For those at WR and at WRs of 2.5% or even 3% or less, this period would be a lot less significant than someone taking 4-5% WR and 80-100% stocks. A further factor is the psychological--will someone at 90% stocks and withdrawing 4% or 5% before SS in, say 8 years, be able to stick to that allocation until recovery at, say, 2012 or 2013? Many here would I guess, based on testimonials. I doubt I would, so a lower stock allocation that might harm my "ultimate" portfolio when I croak or even reduce spending 2-5% doesn't seem the correct goal, at least for me.

I am willing to let my stock allocation creep up as I get closer to SS FWA, although I'll periodically scrape stock gains over 55% allocation for sure, either during the year or during the Jan withdrawal.

And yes, one could work longer, save more and use a lower WR rate to "maximize" the ending portfolio, but this is a ER forum.

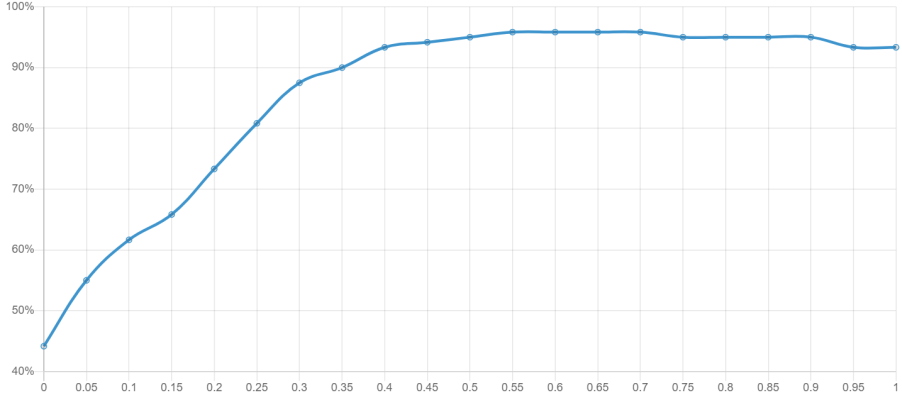

I'm attempting to maximize withdrawals and reduce SORR risk in the period over the next 7 years before my and DW's FRA/SS and am not trying to maximize the amount of $ left over when I/DW croak. This is a different goal than many, but one--given SORR risk--both rebalancing and a lower stock allocation lessen the short-term risk, no doubt at the expense of maximizing spending later. particularly "normal" stock return environments. Another fix is a variable withdrawal rate, as others have posted, particularly if you have a large "optional spending" buffer.

In my case, I am holding cash sufficient for the next 3.5 years until my SS FWA and will use bonds/rebalancing for the additional 4 years until DW's FWA. On my FWA and certainly after DW's the risk of SORR considerably diminishes, so at that point I will gradually increase the stock allocation. Could I squeeze out another 1-2% in bond income from cash--yes, but is it worth the trouble with treasuries at 1%?

Until then I usually can rebalance with January withdrawals, although I did shove more into stocks in March/April of 2020 (it seemed a good moment and one when stocks were cheaply valued compared to previous years, and I was prepared to use more cash if it continued to decline).

YMMV, particularly if your goal is to maximize a portfolio for heirs or charity, which are worthy portfolio goals. Unless we run into another 2000/2007 scenario (which I suspect is close to a worse case for the S&P), I doubt it will make much difference, as several have posted. But in one of the bad scenarios--it could make a difference and it is those bad lines at the bottom of the FireCalc chart I worry about; otherwise I would be withdrawing 7% a year.