ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

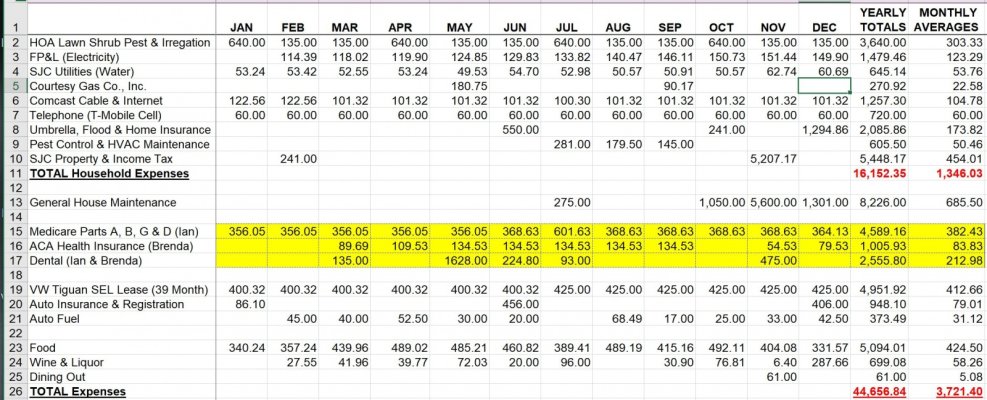

OK. Our 2022 expenses are how locked in. It does not include discretionary expenses such as travel, eating out as in our case I track very little eating out expenses unless I remember to do so, but does not mean we do not eat out. Takeout food is included in the food expenses. Home maintenance was a lot higher than normal this year as not much had been done for the last 5 years.

Honestly, this type of expense chart is meaningless unless it is quoted with respect to where one lives, what type of home one is maintaining, whether it is owned, Rented or mortgaged and how many people in the household, so I have included those parameters. I do not think it is bad for an average middle class home in an average middle class neighborhood. It is almost exactly the same as 2021 if one takes off home maintenance costs as there were insignificant last year.

Please see attached spreadsheet for totals.

Location: Coastal Northeast Florida

Home: 3,300 sqft. single Family with No Mortgage

Car: One New Leased car (costs included on spreadsheet)

Honestly, this type of expense chart is meaningless unless it is quoted with respect to where one lives, what type of home one is maintaining, whether it is owned, Rented or mortgaged and how many people in the household, so I have included those parameters. I do not think it is bad for an average middle class home in an average middle class neighborhood. It is almost exactly the same as 2021 if one takes off home maintenance costs as there were insignificant last year.

Please see attached spreadsheet for totals.

Location: Coastal Northeast Florida

Home: 3,300 sqft. single Family with No Mortgage

Car: One New Leased car (costs included on spreadsheet)

Attachments

Last edited: