Franklin

Recycles dryer sheets

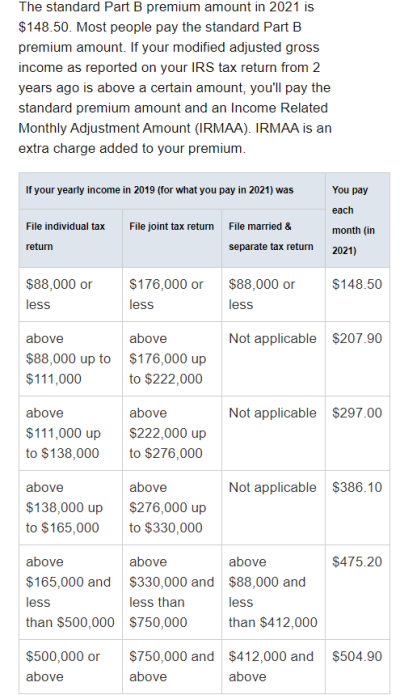

I turned 65 today and began medicare ( I am supposed to celebrate.....right?). However......it ain't as cheap as everyone has told me. I have part A and B and added Plan G (covers co pays etc) and a drug plan. Prior to all this I was on Blue Cross PPO that ran about $850 per month. So, I basically replaced that plan with the medicare I mentioned. Turns out the government took my 2019 income (had allot of deferred income) and placed me in a "high means adjusted" bracket. My new medicare plan is costing $711.00 per month. I had been hoping for something far more reasonable. Did I miss something in the medicare 101 class?