MBAVisionary

Recycles dryer sheets

Just realized through my job I have $57k in life insurance and an additional $57k in AD&D. Yes that goes away if I change jobs but still. One could argue some coverage vs none at all but double coverage makes no sense in my situation. That's 26.51/mo.

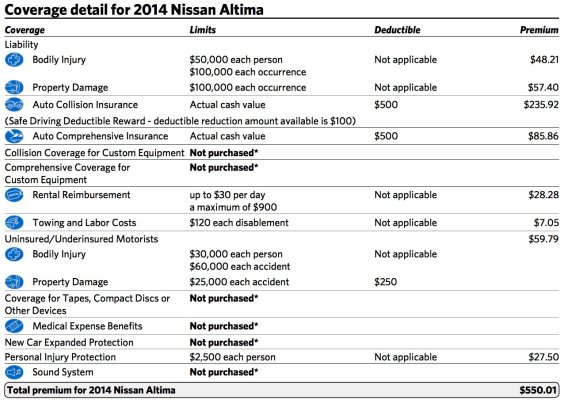

Contacted Allstate to cancel the $200k policy I have with them. I've paid out $583 since getting it in 2013.

Contacted Allstate to cancel the $200k policy I have with them. I've paid out $583 since getting it in 2013.

Last edited:

At least it's a dependable 4 cyl car not a V8 Pick Up or something else crazy like that. Plan to keep the car for the next 15+ years. If you can't pay the credit card off in full every month then cut it up and throw it away. Start only paying the minimum on your student loans and put the extra toward paying off you credit card and increasing your emergency savings to at least 3 times your expenses... lets say $10K or more. You're spending $500/mo on food for 1 person? That should easily be cut in half. I spend $200/mo or less and i'm a big guy. Cable TV is a luxury for those who can afford it. You are not one of those people. I've never had a take home pay as high as yours yet I still had savings of over $100K at age 31 and that's also the year I paid off my $40K condo and haven't had any debt since(now age 36). My car is 11 years old and i'll likely drive it for another 5-10 years before paying cash for a USED car. You can do much better and I wish you the best. Good luck.

At least it's a dependable 4 cyl car not a V8 Pick Up or something else crazy like that. Plan to keep the car for the next 15+ years. If you can't pay the credit card off in full every month then cut it up and throw it away. Start only paying the minimum on your student loans and put the extra toward paying off you credit card and increasing your emergency savings to at least 3 times your expenses... lets say $10K or more. You're spending $500/mo on food for 1 person? That should easily be cut in half. I spend $200/mo or less and i'm a big guy. Cable TV is a luxury for those who can afford it. You are not one of those people. I've never had a take home pay as high as yours yet I still had savings of over $100K at age 31 and that's also the year I paid off my $40K condo and haven't had any debt since(now age 36). My car is 11 years old and i'll likely drive it for another 5-10 years before paying cash for a USED car. You can do much better and I wish you the best. Good luck.