Just over a *year* since my last post. I was 28 when I started this thread and a total trainwreck, now I'm 38.

As of 10/24/21 - $184,043 is my net worth not including my vehicle, any items I own or $800 sitting in my checking account. I pay rent about 2-3 weeks before it's due so that is one less thing to worry about.

I did have $5k sitting in a money market account for a year and moved to my $3.6k to the Roth IRA this month to max out for 2021. Plan to get the emergency fund back up again in the coming months. Still have access to $6k of investments I could pull from without paying any penalties aside from taxes. Also diversifying a bit more with crypto as a hedge against inflation and the possibility of more rapid growth vs an index fund. It's still only 1.3% of my overall net worth. Eventually I'd like to get that up to 5%.

Crypto - Solana, Bitcoin, Etherium, Polygon, Shiba Inu, Litecoin. Then I got $55 total in free ones on coinbase by watching several 5 segment education slides - Stellar Lumens, Compound, The Graph, Fetch.ai, Balancer, NKN, Ampleforth Governance, Clover Finance, Crates, Ankr, Amp, BarnBridge

10/24/21

401K: $155,878.58

Roth IRA: $20,499.11

Inv Acct: $3,473.33

Crypto: $2,349.28

Buffer: $279.18

HSA: $1,563.57

Total: $184,043

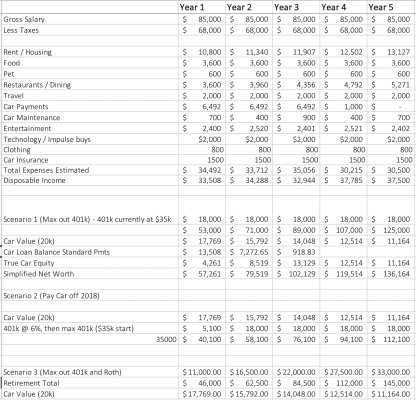

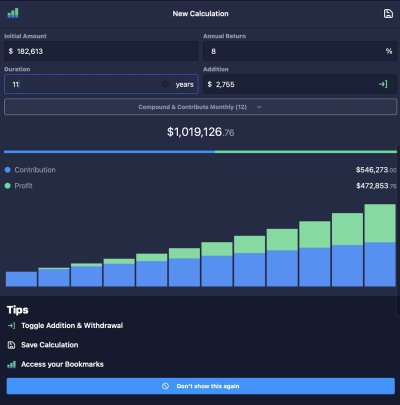

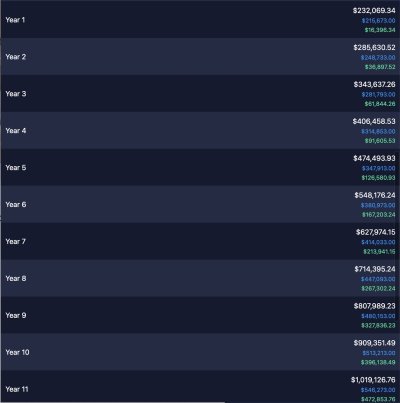

My goal is to have a net worth of $1MM by the time I turn 50 in 2033. I don't know if I'd actually retire by that point but always nice to know it's an option. Based on inflation I might need considerably more or add a couple years before hitting FatFIRE. Between my 401k contributions and matching, maxing out the Roth IRA, and my taxable investment account that's $2,664 per month that is going to investments. I've been in a 1br apartment since 2014 living with just the dog and my $965/mo rent. Got a raise this year but it was less than I had hoped especially with recent inflation.

I might take my pedal off the gas a little bit. Early this year I lost a 34yo friend due to covid in February less than a month before vaccines became widely available. One of my aunts with long term health issues also passed in January. Balancing aggressive investing with enjoying life and the occasional splurge here and there. Just to recap and iterate... June 2013 I had $0 in retirement and a -$45k net worth, so up 5x since starting out. Up about $84k or 84% since my last response on this thread. Assuming things don't crash and burn I'll clear $200k in 2022.