So it occurs to me that now being much closer to the end of my career, than the beginning. I might want to try to give back to some of the people just starting out. Obviously we all wish we could go back in time and say “What do you think you are doing??!!”, to our younger selves, but I figure this is the next best thing.

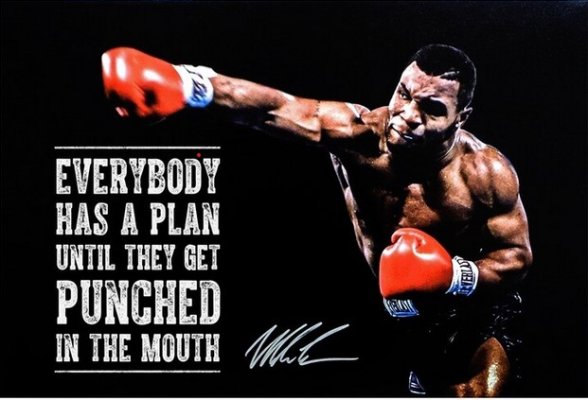

I believe the number one predictor of being able to retire early (in theory why we are all on this forum), is not luck, or skill, but actually careful, well thought out planning. Planning that went on for not days or months, but years.

Step 1. Start investing as young as you can. The power of compound interest needs decades to work, it cannot be shortcut. You have to put in early and often AND NEVER MISS A CONTRIBUTION.... ever....

Step 2. Consider the typical salary range of the profession you choose. Never pick a field you hate just for a large salary. But also understand if your passion career tops out at 30k, then you will probably not be able to retire early.

Step 3. Consider carefully how the choices you make today, might shape your life years down the road. Are you ok spending 50k on your dream car today, if it means having to work 5 years longer at some point? Life has trade offs. Pick ones that you can live with.

Step 4: Fate is comming to find you in a negative way. At some point financially or otherwise something negative will happen. Plan for that occurrence! When times are good, put some away. Remember that fate is comming to kick your butt. The best you can do is pad your butt between kickings. I learned that lesson early. I was laid off at 25. One of the darkest times in my life.

Step 5. If Eeyore is your spirit animal, you are doing something very wrong. Try to remain positive, and upbeat when possible. No one wants to deal with people that are perpetually negative in their outlook. Over the years many good things have come my way just by remembering things like “please, thanks, I really appreciate what you did” It sounds cliche but so few do it anymore it is almost like a superpower..

I believe the number one predictor of being able to retire early (in theory why we are all on this forum), is not luck, or skill, but actually careful, well thought out planning. Planning that went on for not days or months, but years.

Step 1. Start investing as young as you can. The power of compound interest needs decades to work, it cannot be shortcut. You have to put in early and often AND NEVER MISS A CONTRIBUTION.... ever....

Step 2. Consider the typical salary range of the profession you choose. Never pick a field you hate just for a large salary. But also understand if your passion career tops out at 30k, then you will probably not be able to retire early.

Step 3. Consider carefully how the choices you make today, might shape your life years down the road. Are you ok spending 50k on your dream car today, if it means having to work 5 years longer at some point? Life has trade offs. Pick ones that you can live with.

Step 4: Fate is comming to find you in a negative way. At some point financially or otherwise something negative will happen. Plan for that occurrence! When times are good, put some away. Remember that fate is comming to kick your butt. The best you can do is pad your butt between kickings. I learned that lesson early. I was laid off at 25. One of the darkest times in my life.

Step 5. If Eeyore is your spirit animal, you are doing something very wrong. Try to remain positive, and upbeat when possible. No one wants to deal with people that are perpetually negative in their outlook. Over the years many good things have come my way just by remembering things like “please, thanks, I really appreciate what you did” It sounds cliche but so few do it anymore it is almost like a superpower..