I get a 100% success rate for the parameters I am using, but question the "ending portfolio balance" numbers shown on the results page. The lowest portfolio balance is always exactly the same dollar amount as whatever I input for the beginning portfolio on the first page. This seems odd to me. Has anyone else experienced this?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Lowest portfolio balance - 100% success

- Thread starter brianc629

- Start date

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Is it the same as your starting portfolio amount by any chance? If you starting amount is enough to easily achieve a 100% success rate, the lowest amount could easily be equal to your starting amount - it will never go lower. However, if your starting amount is close to the 100% success rate threshold, your lowest amount may well dip below your starting amount at some time in the early years of the portfolio. [-]That's what I'd guess without testing...[/-] Enter $18,000 as your spending on the front page and leave years=30 and portfolio=$750K - result 100% and lowest balance $750K. Now enter $19,000 as spending, leaving years & portfolio the same - result 100% and lowest balance $695K. If you enter any spending amount $18,000 or below, you'll get 100% and lowest balance $750K.I get a 100% success rate for the parameters I am using, but question the "ending portfolio balance" numbers shown on the results page. The lowest portfolio balance is always exactly the same dollar amount as whatever I input for the beginning portfolio on the first page. This seems odd to me. Has anyone else experienced this?

[-]Just increase the spending or years and/or reduce the portfolio amount incrementally to find the tipping point - and a lower balance.[/-]

Congrats, your parameters are in a very safe historical range.

Last edited:

Is it the same as your starting portfolio amount by any chance? If you starting amount is enough to easily achieve a 100% success rate, the lowest amount could easily be equal to your starting amount - it will never go lower. However, if your starting amount is close to the 100% success rate threshold, your lowest amount may well dip below your starting amount at some time in the early years of the portfolio. [-]That's what I'd guess without testing...[/-] Enter $18,000 as your spending on the front page and leave years=30 and portfolio=$750K - result 100% and lowest balance $750K. Now enter $19,000 as spending, leaving years & portfolio the same - result 100% and lowest balance $695K. If you enter any spending amount $18,000 or below, you'll get 100% and lowest balance $750K.

[-]Just increase the spending or years and/or reduce the portfolio amount incrementally to find the tipping point - and a lower balance.[/-]

Congrats, your parameters are in a very safe historical range.

Yes that's it exactly. Thank you for the explanation.

latexman

Thinks s/he gets paid by the post

Is it the same as your starting portfolio amount by any chance? If you starting amount is enough to easily achieve a 100% success rate, the lowest amount could easily be equal to your starting amount - it will never go lower. However, if your starting amount is close to the 100% success rate threshold, your lowest amount may well dip below your starting amount at some time in the early years of the portfolio. [-]That's what I'd guess without testing...[/-] Enter $18,000 as your spending on the front page and leave years=30 and portfolio=$750K - result 100% and lowest balance $750K. Now enter $19,000 as spending, leaving years & portfolio the same - result 100% and lowest balance $695K. If you enter any spending amount $18,000 or below, you'll get 100% and lowest balance $750K.

[-]Just increase the spending or years and/or reduce the portfolio amount incrementally to find the tipping point - and a lower balance.[/-]

Congrats, your parameters are in a very safe historical range.

Sorry, I suspect a bug in the program for the $750K in the text portion for "the lowest portfolio balance at the END of your retirement". First, the odds that the balance after 30 years would be EXACTLY the starting balance would be extremely low. Then, if you withdraw less and less per year the ending balance must increase, right?

Enter $18,000 (and $17,000 and $16,000 and . . .) as your spending on the front page and leave years=30 and portfolio=$750K - result 100% and lowest balance $750K according to the number reported in the text BUT LOOK AT THE LOWEST BALANCE AT THE 30th YEAR ON THE GRAPHS in each case - it changes!

I agree it's a bug in the text portion of the result. My test cases used a different method.Sorry, I suspect a bug in the program for the $750K in the text portion for "the lowest portfolio balance at the END of your retirement". First, the odds that the balance after 30 years would be EXACTLY the starting balance would be extremely low. Then, if you withdraw less and less per year the ending balance must increase, right?

Enter $18,000 (and $17,000 and $16,000 and . . .) as your spending on the front page and leave years=30 and portfolio=$750K - result 100% and lowest balance $750K according to the number reported in the text BUT LOOK AT THE LOWEST BALANCE AT THE 30th YEAR ON THE GRAPHS in each case - it changes!

I left the default entry values of 30 years and $30k annual spending but changed the initial portfolio from $750k to $7.5M. The text portion for lowest ending balance incorrectly displays the $7.5M initial value while the graph correctly displays a lowest ending balance of $13+M.

Test case #2 changed the above initial portfolio to $7.0M. The text portion of lowest ending balance incorrectly displays $7.0M while the graph correctly displays a lowest ending balance around $12.9M.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It's a bug in the reporting. Simply stated:

If the ending balance for all time periods is > starting balance it incorrectly reports the starting balance value as the lowest ending balance value.

I'm pretty sure this has been reported as a bug before, but I haven't seen any action on bug fixing or feature enhancements on FIRECalc for many years. The data gets updated once a year.

edit/add:

here's what it says when you run the defaults, but set spending to zero:

The lowest and highest portfolio balance at the end of your retirement was $750,000 to $7,141,845, with an average at the end of $3,836,624.

If you look at the graph, it is obvious that every ending value is higher than the starting value (more than double actually).

further edit/add:

I had this page open for a while, and didn't see latexman's and MBSC's posts, which said the same thing.

-ERD50

If the ending balance for all time periods is > starting balance it incorrectly reports the starting balance value as the lowest ending balance value.

I'm pretty sure this has been reported as a bug before, but I haven't seen any action on bug fixing or feature enhancements on FIRECalc for many years. The data gets updated once a year.

edit/add:

here's what it says when you run the defaults, but set spending to zero:

The lowest and highest portfolio balance at the end of your retirement was $750,000 to $7,141,845, with an average at the end of $3,836,624.

If you look at the graph, it is obvious that every ending value is higher than the starting value (more than double actually).

further edit/add:

I had this page open for a while, and didn't see latexman's and MBSC's posts, which said the same thing.

-ERD50

Last edited:

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The lowest and highest portfolio balance at the end of your retirement was $750,000 to $7,141,845, with an average at the end of $3,836,624.

Just an error in verbage......

It should say:

"The lowest portfolio balance during your retirement and the highest portfolio balance at the end of your retirement are $750,000 to $7,141,845 with an average at the end of $3,836,624."

Firecalc verbage mentions the lowest portfolio value during your retirement but calls it the lowest portfolio value at the end of your retirement. Frequently, and always for scenarios with less than a 100% success rate, the lowest portfolio value is at the end. But, not always for scenarios with a 100% success rate.

It's not a big deal once you understand.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Just an error in verbage......

It should say:

"The lowest portfolio balance during your retirement and the highest portfolio balance at the end of your retirement are $750,000 to $7,141,845 with an average at the end of $3,836,624."

Firecalc verbage mentions the lowest portfolio value during your retirement but calls it the lowest portfolio value at the end of your retirement. Frequently, and always for scenarios with less than a 100% success rate, the lowest portfolio value is at the end. But, not always for scenarios with a 100% success rate.

It's not a big deal once you understand.

Sure, you can say it's an error in wording rather than a bug - depends on your point of view.

But your wording would also be incorrect in many (most) cases, and certainly with the defaults, modifying only spending to a low or zero level. "The lowest portfolio balance during your retirement" - in those cases the low would not be the starting value. Even with low/zero spending, a 75/25 default AA will have cycles that drop below the starting value. So the low during your retirement would be less than $750,000. That wording would need to report the interim low in the text, to match the "during" description.

-ERD50

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That wording would need to report the interim low in the text, to match the "during" description.

-ERD50

And it does. The low value reported is the lowest value occurred from start to end, whether that's the initial value or some subsequent lower value.

I find it more useful to point out the lowest value over the course of the retirement trip than the lowest value at the end. Though, of course, for outcomes with less than 100% confidence, the low point is always at the end.

Edit: ERD50 - in the test you're running using the default values but with spending reduced to zero, try incrementing the number of years. You'll see as you go below 20, the low value reported is no longer the beginning value but the interim lower (than the beginning) value.

Last edited:

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

And it does. The low value reported is the lowest value occurred from start to end, whether that's the initial value or some subsequent lower value.Originally Posted by ERD50 View Post

That wording would need to report the interim low in the text, to match the "during" description.

-ERD50

I find it more useful to point out the lowest value over the course of the retirement trip than the lowest value at the end. Though, of course, for outcomes with less than 100% confidence, the low point is always at the end.

Edit: ERD50 - in the test you're running using the default values but with spending reduced to zero, try incrementing the number of years. You'll see as you go below 20, the low value reported is no longer the beginning value but the interim lower (than the beginning) value.

I think you are still seeing the problem as I described it (at least that's what I see on my screen):

ERD50 said: If the ending balance for all time periods is > starting balance it incorrectly reports the starting balance value as the lowest ending balance value.

Regarding your EDIT, yes, it reports a lower than starting balance in those cases, but it isn't necessarily an interim low. If you look at the chart for a 10 year and $10,000 spend (all else default), the ending lows are below the starting lows (because at least one 10 year period got hit by a downturn, and has not recovered above the starting balance - that takes a longer time period). That condition is outside the description I gave, because an ending value is lower than the starting value. The problems still seems to exist (unless I'm not seeing it correctly).

Ahhh, here's a condition that shows it clearly:

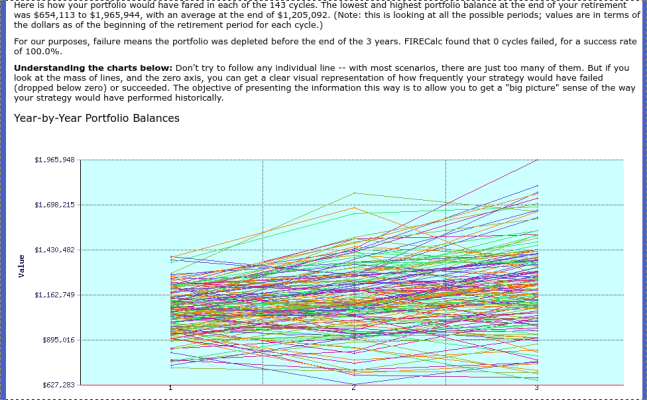

Defaults, then change start portfolio to $1,000,000, spending to $0, and years to 3.

With this short time frame, we get better resolution and info. You can see the interim low is right at the labelled $627,283 line. Yet it reports the low as $654,113, which appears to be the low of the ending balances. So no, it is not reporting interim lows - not that I can see. So it is still a bug, or the text would need to be worded in a twisty fashion to match how the code works - I'll call it a bug.

Here's a screenshot:

-ERD50

Attachments

Similar threads

- Replies

- 17

- Views

- 2K

- Replies

- 15

- Views

- 1K

- Replies

- 192

- Views

- 12K

- Replies

- 15

- Views

- 477

- Replies

- 26

- Views

- 1K