easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,151

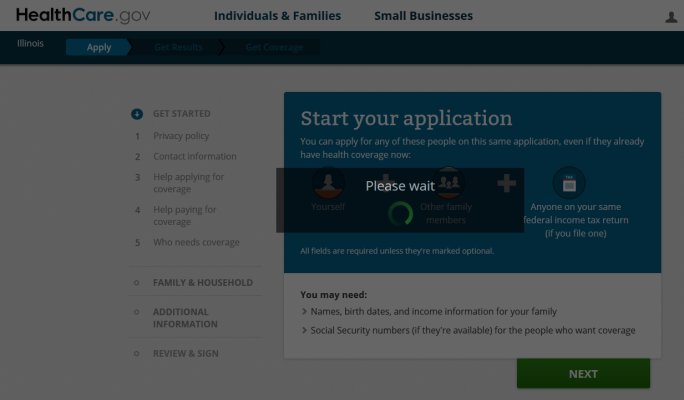

Thought I'd get the ball rolling so I signed into Healthcare.gov figuring should be pretty fast as looks like I'll have just one choice of coverage this year. But worth looking and comparing anyhow to see if there are alternatives.

Well, not so fast..as after submitting the application (same like last year, not entering my estimated income but will let any premium credit get calculated at tax filing time), I get the spinning ball, please wait.... Been spinning for about 30 minutes now.

Maybe I should have waited a few days or a week when there is less traffic.

Update: Okay, after about 40 minutes, got logged off automatically, then received an email saying my application accepted and I can pick my plan. Slow, but working, at least so far.

Well, not so fast..as after submitting the application (same like last year, not entering my estimated income but will let any premium credit get calculated at tax filing time), I get the spinning ball, please wait.... Been spinning for about 30 minutes now.

Maybe I should have waited a few days or a week when there is less traffic.

Update: Okay, after about 40 minutes, got logged off automatically, then received an email saying my application accepted and I can pick my plan. Slow, but working, at least so far.

Attachments

Last edited: