BubbaChris

Recycles dryer sheets

I lived within an 30-mile circle from age 5 to 50. Our ‘retirement’ move out of state happened almost on a whim 10 years before retirement. We had been talking about researching/visiting 3 states, but had only vacationed in one of them in recent years. We also were in a position where neither of us was tied down to a well-paying job.

DW called me aside one day and proposed we move while we weren’t well anchored, live and work there some, and then decide if it was where we wanted to be in retirement. Our conversations started in October 2011, and we moved in March 2012. It was a huge leap of faith. The housing market was slow at the time, and that worked in our favor overall.

We ended up finding a spec home that was just 2-miles from DW’s target employer. Moving from a home we’d been in for 17-years allowed us to skip having a mortgage, and we even stashed some cash into our brokerage account at the same time.

It proved to be such a great lifestyle choice for us. DW got her target job, and my commutes ranged from 5-11 easy miles. About 2 years later we bought our first RV and discovered what a great jumping off spot we had picked. Plus in moving out of an HOA, we’ve been able to keep our RVs in our driveway.

The other really lucky aspect for us was discovering ACA coverage that was with the area’s dominant healthcare provider. That shift away from employer-provided coverage enabled us to RE in 2021.

Best regards,

Chris

DW called me aside one day and proposed we move while we weren’t well anchored, live and work there some, and then decide if it was where we wanted to be in retirement. Our conversations started in October 2011, and we moved in March 2012. It was a huge leap of faith. The housing market was slow at the time, and that worked in our favor overall.

We ended up finding a spec home that was just 2-miles from DW’s target employer. Moving from a home we’d been in for 17-years allowed us to skip having a mortgage, and we even stashed some cash into our brokerage account at the same time.

It proved to be such a great lifestyle choice for us. DW got her target job, and my commutes ranged from 5-11 easy miles. About 2 years later we bought our first RV and discovered what a great jumping off spot we had picked. Plus in moving out of an HOA, we’ve been able to keep our RVs in our driveway.

The other really lucky aspect for us was discovering ACA coverage that was with the area’s dominant healthcare provider. That shift away from employer-provided coverage enabled us to RE in 2021.

Best regards,

Chris

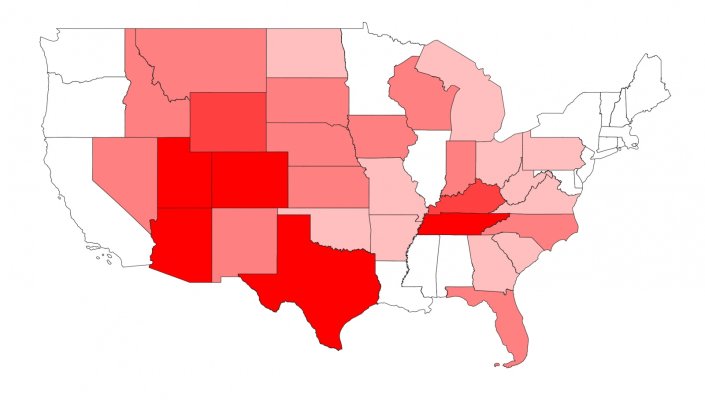

I do think some states are closer to equitable in terms of tax structure- aka everyone gets taxed lol. But that's ok: taxes aren't my sole criteria. But I will avoid moving to any state that taxes all my retirement income, but little to none of the income of fellow retirees. It would rub me the wrong way. Still leaves plenty of choices in the US, so all's good.

I do think some states are closer to equitable in terms of tax structure- aka everyone gets taxed lol. But that's ok: taxes aren't my sole criteria. But I will avoid moving to any state that taxes all my retirement income, but little to none of the income of fellow retirees. It would rub me the wrong way. Still leaves plenty of choices in the US, so all's good.