@Qslaptop (and other excited folks), I think that there is a disconnect in basic assumptions here. Let me offer you some information:

Semiannually, S&P publishes two reports looking at the performance of actively managed funds like American's. The SPIVA report extensively covers the performance of funds against their benchmarks. (

https://us.spindices.com/documents/spiva/spiva-us-mid-year-2017.pdf?force_download=true) The numbers vary a little bit from report to report, but the conclusion is always the same: Few active funds outperform; over short periods more of them do but over 5- and 10-year periods only a tiny fraction do. William Sharpe's paper (

https://web.stanford.edu/~wfsharpe/art/active/active.htm) gives the mathematical basis for this result. It's an easy read, but Ken French's video (

https://famafrench.dimensional.com/videos/is-this-a-good-time-for-active-investing.aspx) recaps the Sharpe paper in five minutes.

"Fine," you say, "I understand that most funds underperform, but I am only going to invest in funds that are above-benchmark performers."

Now comes the second S&P report, analyzing manager persistence. (

https://us.spindices.com/documents/spiva/persistence-scorecard-december-2017.pdf?force_download=true) Every semiannual report comes to the same conclusion: Past manager performance is not useful in predicting future results. Again, Ken French explains this (

https://famafrench.dimensional.com/videos/identifying-superior-managers.aspx) in six minutes.

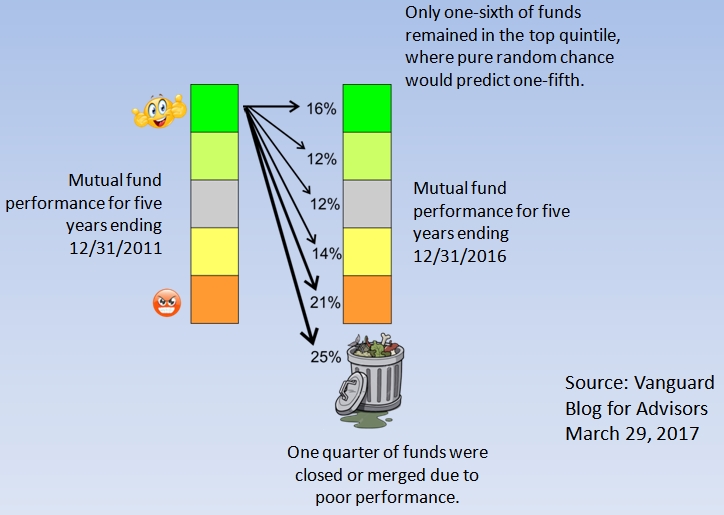

I am 99.99% certain that there is no statistical evidence that challenges the S&P results. If there were, the plethora of active management advocates would be pounding us over the head with it. Instead, we get cherry-picked "results" that are really no more than anecdotes. (And the plural of "anecdote" is not "data.") We also get a lot of arm-waving about the moral evils of indexing and we get people demonstrating a firm grasp of the obvious by pointing out that a passive portfolio will go down with the markets as easily as it goes up. Then comes the claim that actively managed funds will have less downside. That's

sometimes true, but at the cost of missing the upside as well. Again, S&P has our back on this:

https://us.spindices.com/multimedia-center/do-active-managers-reduce-risk.

Finally to the point: The fact that there are time periods where specific American funds outperform is no surprise The statistics would predict that. From a menu of 16 equity funds, something in the range of 10-20% will outperform over short periods and maybe up to 10% might outperform over 10 years. But ... from that list of 16, can we predict the funds that will outperform in the

next five and ten year periods? The Persistence report and Ken French both show us that we can't.

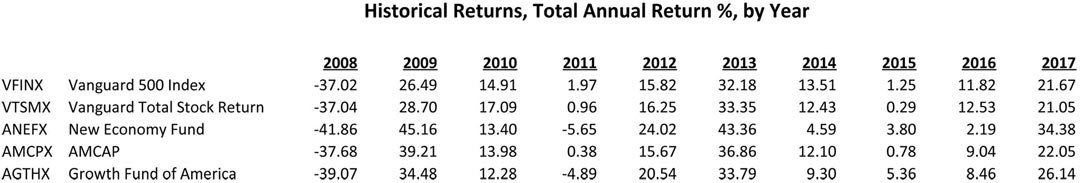

Just for grins, here is a graphic of S&P Persistence results that I use in an investing course that I teach:

I will freely admit that the persistence facts are counter-intuitive, but there is no statistical data that refutes them..