flintnational

Thinks s/he gets paid by the post

New Economy and Growth Fund beat both VFINX and VTSMX at 5 years without a load; Amcap beat VTSMX without a load at 5 years.

New Economy with a load beats VFINX in 10 years.

New Economy and Amcap without a load beats both VFINX and VTSMX in 10 years.

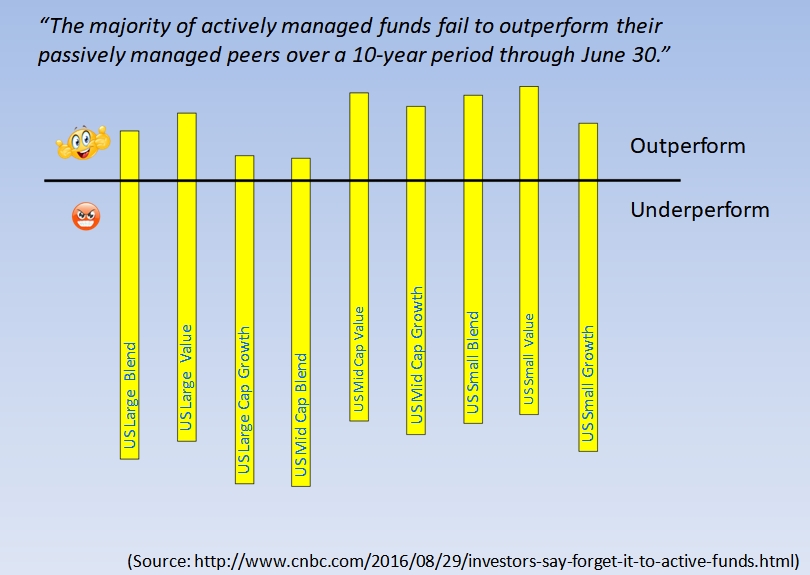

New Economy is not one of the five funds mentioned in the article that is the topic of this thread. None of the five funds mentioned in the article beat the index over 1, 5 or 10 years with loads included, per American Funds own data as stated in the ad. See the American Fund chart from the ad at post #64. The blend of the five funds, American Funds chosen metric, also under performed the index at 1, 5 and 10 years with or without loads. Once again, all of the under performance is clearly stated in the American Fund ad.