Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

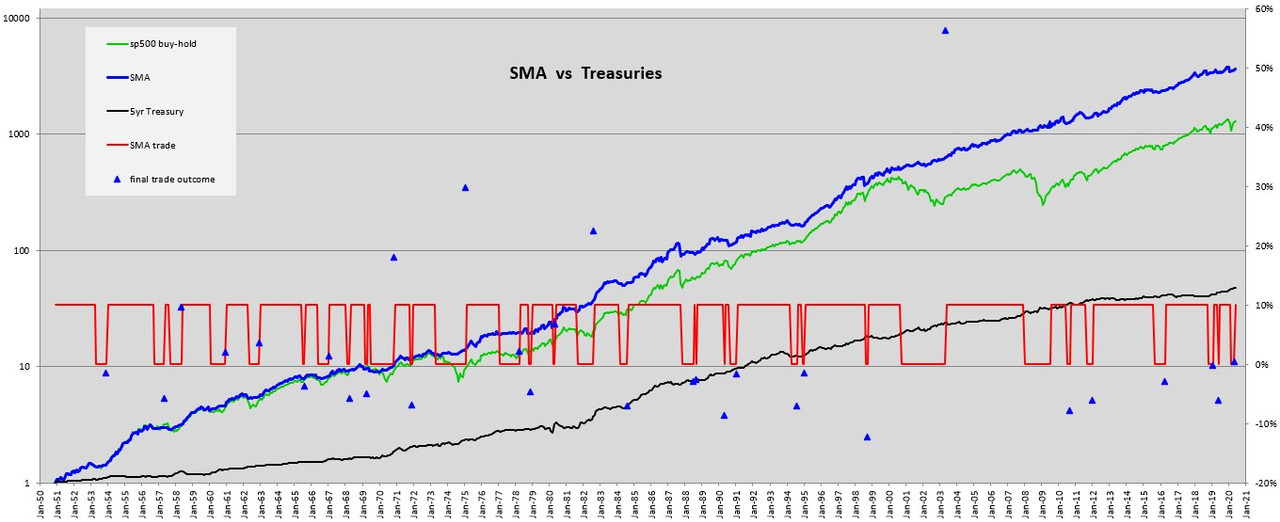

Bonds are at incredibly low yields. I think that a simple moving average (SMA) equity timing method will be a good way to reduce my bond exposure. This is used NOT to beat a buy-hold equity strategy. Rather this would just be to reduce the bond exposure and get decent returns. Usually people talk about such a timing method to replace a buy-hold equity portfolio but I think it is a better argument to use it as a way to beat bonds.

For my 60/40 portfolio I will take about 15% of the bond portion and move it to this SMA approach. So the 60/40 would move to a 60/25/15.

The timing method I am referring to is a simple moving average approach. You get out of equities and into Treasuries (or a money market account) when the SP500 index drops below its 12 month moving average and buy back when it rises above the moving average. This is nothing new and is pretty robust in that using an 8 or 10 or 12 month average will give better results then an intermediate Treasury bond return.

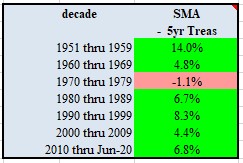

For one 12 month SMA method I’ve got backtested results for 70 years. This trades at the last day of any month. There were 32 trades in 70 years with 11 good trades and 21 whipsaws. The worst whipsaw was -12%. Here is a table showing the SMA return difference versus the Treasury. The numbers are compound annual average return (CAGR) differences.

I am posting this as a way to have a respectful dialog about this sort of thing. I recognize that some people hate market timing in any form but this part of the forum should be tolerant of such an idea.

In a response I will post a few relevant charts.

For my 60/40 portfolio I will take about 15% of the bond portion and move it to this SMA approach. So the 60/40 would move to a 60/25/15.

The timing method I am referring to is a simple moving average approach. You get out of equities and into Treasuries (or a money market account) when the SP500 index drops below its 12 month moving average and buy back when it rises above the moving average. This is nothing new and is pretty robust in that using an 8 or 10 or 12 month average will give better results then an intermediate Treasury bond return.

For one 12 month SMA method I’ve got backtested results for 70 years. This trades at the last day of any month. There were 32 trades in 70 years with 11 good trades and 21 whipsaws. The worst whipsaw was -12%. Here is a table showing the SMA return difference versus the Treasury. The numbers are compound annual average return (CAGR) differences.

I am posting this as a way to have a respectful dialog about this sort of thing. I recognize that some people hate market timing in any form but this part of the forum should be tolerant of such an idea.

In a response I will post a few relevant charts.

Last edited: