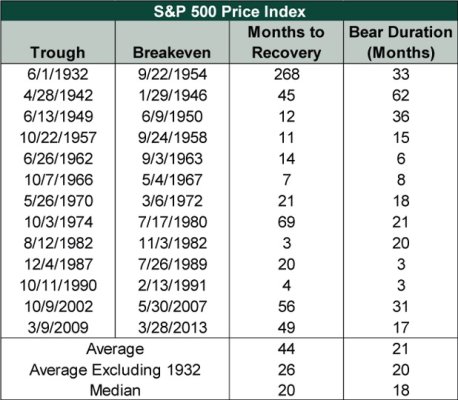

Year 1 retired and had moved from a pure Total Return approach to more of a 2 Bucket approach. At the beginning of the year I started to effectively ladder 10 years worth of individual bonds based on a higher than average spend (further flexibility built in due to over 50% highly discretionary). In my case, I felt like this approach helped me feel a little more comfortable seeing 10 years worth of spend secure and then letting everything else run in equities for both growth and maximizing legacy. This approach will probably have me swinging between a 60/40 - 75/40 AA at any given time depending upon market performance. Simple plan is to draw on bonds in years when stocks are down and draw on stock to cover spending/replenish bonds when stocks are up. My initial plan was not to touch stocks until they recovered/hit a new high from the previous high/or starting benchmark, or in my case, my portfolio balance as of 12/31/21. That said, I realize the Bulls, as measured by a 20% increase from the end of a Bear market start the party, but may take a few years to recover to a new high. The chart below illustrates this.

For those of you who use a Bucket system, what are your rules for pulling from the equity bucket? Only when it hits a new high/positive annual returns or are you hitting it once it is defined as a Bull market, despite not hitting a new high?

For those of you who use a Bucket system, what are your rules for pulling from the equity bucket? Only when it hits a new high/positive annual returns or are you hitting it once it is defined as a Bull market, despite not hitting a new high?