audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I just sold a hundred and sixty grand worth of equities to fund 2022 -

You must have a nice lifestyle.

I try!

None of us are getting any younger!

I just sold a hundred and sixty grand worth of equities to fund 2022 -

You must have a nice lifestyle.

I try!

Why not? Linear is a lot harder to read.

None of us are getting any younger!

True, the market did nothing at all from 1871 to 1970 is what you would get glancing at that lol. That a is a long FIRE

Netflix got creamed today. Last I checked it was down over 20% (100 points or so). Subscriber growth overseas didn't meet expectations.

None of us are getting any younger!

I don't know how much to trust after hours quotes.

You must have a nice lifestyle.

+1 Although there is enough in the stock market to easily see us through until it all becomes inherited there is also enough in cash for the same. If the market really drops sufficiently like it did about 12+ years ago then I might but a few more shares. For now I will keep watching my investments keep adding to my stash.Right! I moved a lot of bond fund money into 3 month Treasuries so I have a huge amount of spending dry powder. Also the RMD's are set aside in cash equivalents.

Exactly, two of my close friends had serious, paralyzing strokes in the last 12 months, and both were in excellent physical shape. I look at every day through a different set of eyes anymore.

That is so sad about your friends. Were there any signs beforehand?

Joe, thanks for posting this. We think similarly to you - some years ago we thought the market was getting overvalued, plus we had close to enough money, so we took some out of equities. Since then, watched the market go up and up even though there were many calls of overvaluation. So much for market timing!

We still kept some equities, just less. Were still working at that time.

Then, as interest rates started to go down, our income portfolio opportunities(private placement debt stuff) started to dry up. A lot of those high yield debts were called. So more went into cash and less opportunites appeared.

As those dried up, we bought some VCLT to shore up our income. Got some share price increase as interest rates fell to the basement, then sold it to protect those gains as interest rates started to increase. More cash.

Now with all that cash, we are starting to look at getting more into equities. Time in the market rather than timing the market. (This is 30 year money - not for us, but for our kids.) Half of me hopes for a market crash, which I've been waiting for for years, to reinvest, and the other half hopes that our equities will not lose too much.

It will be interesting to see what plays out!!

I'm keep looking.... Have 2 different chunks of cash i would like to put to work...

ones our grandson's savings account.

Damn. That’s tough. Health is everything. Enjoy the day, as you said that’s the “lens” we should all have.Well, from what I know, they both were having balance and speech problems the morning the stroke was suspected. Then their spouses called 911 and off they went to the hospital. Strokes are generally cause by a blood clot clogging an artery (cartoid) that leads to the brain. Then the brain is starved for blood and that's it. Both friends were quite healthy and still playing golf regularly.

Well, from what I know, they both were having balance and speech problems the morning the stroke was suspected. Then their spouses called 911 and off they went to the hospital. Strokes are generally cause by a blood clot clogging an artery (cartoid) that leads to the brain. Then the brain is starved for blood and that's it. Both friends were quite healthy and still playing golf regularly.

2nd leading cause of death. Strokes happen every 40 seconds in U.S. Tools and techniques exist to resolve many of these cases. Challenge is time.

Remember: FAST! F-facial drooping, A-weakness in arm or leg, S-inability to speak, and T-time (call 911).

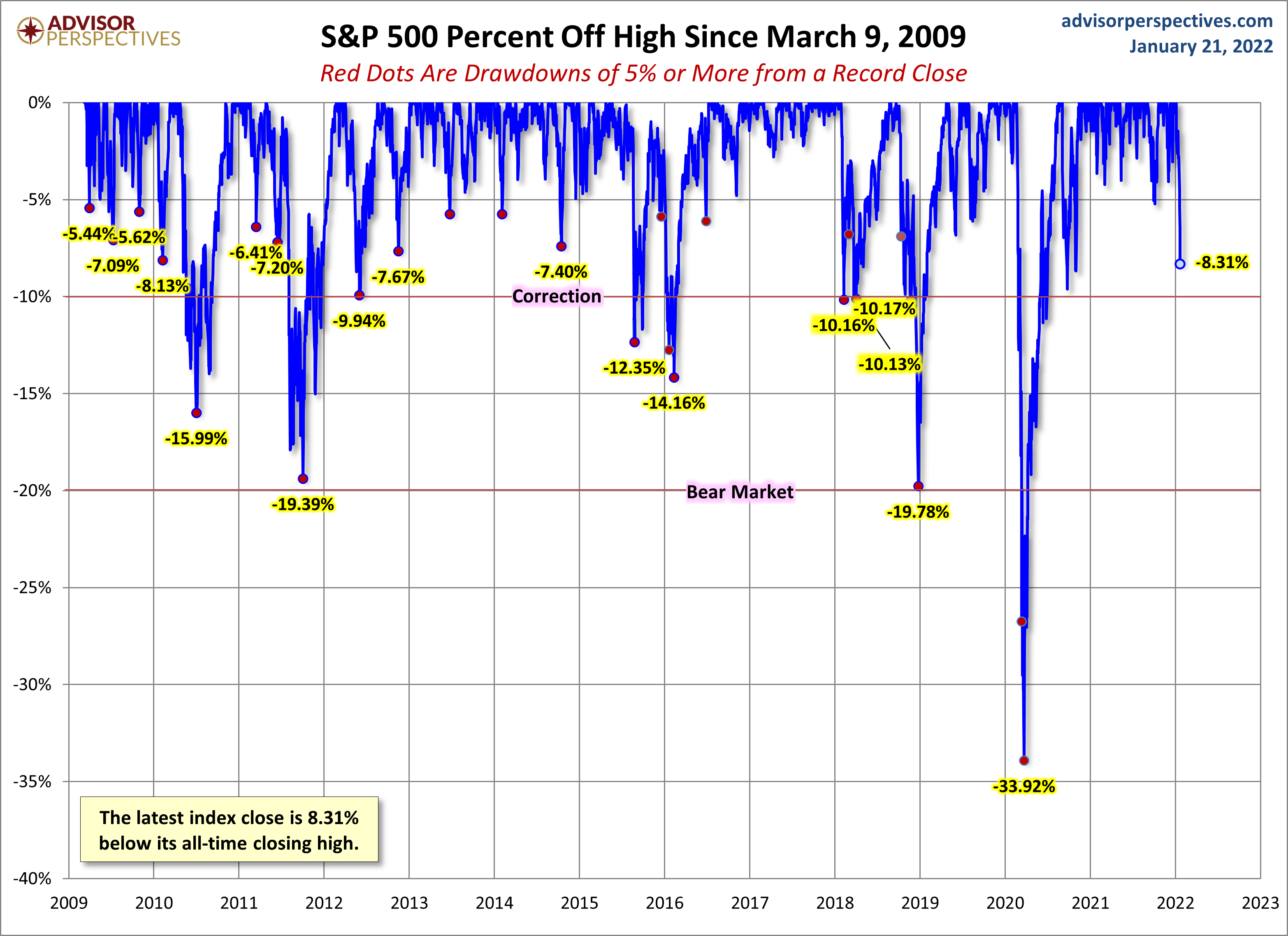

I am curious by some of the savvy vets and members of this site if they’re rethinking of how their portfolios are vested?

Took a look at my 401k and although I anticipated some losses due to the overall market performance for the week, I was shook with a 5% loss. Maybe an overreaction on my part but I am curious by some of the savvy vets and members of this site if they’re rethinking of how their portfolios are vested?