I've been convinced by John Bogle and Warren Buffett that over long periods of time, stock prices basically reflect corporate earnings growth + dividends, discounted by prevailing interest rates.

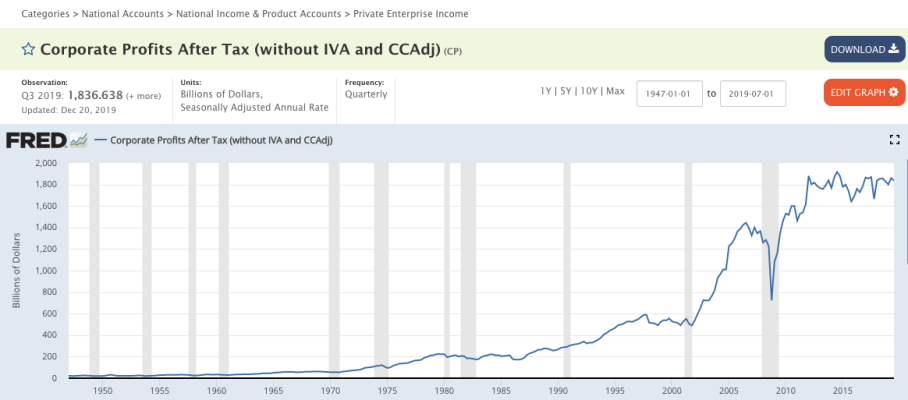

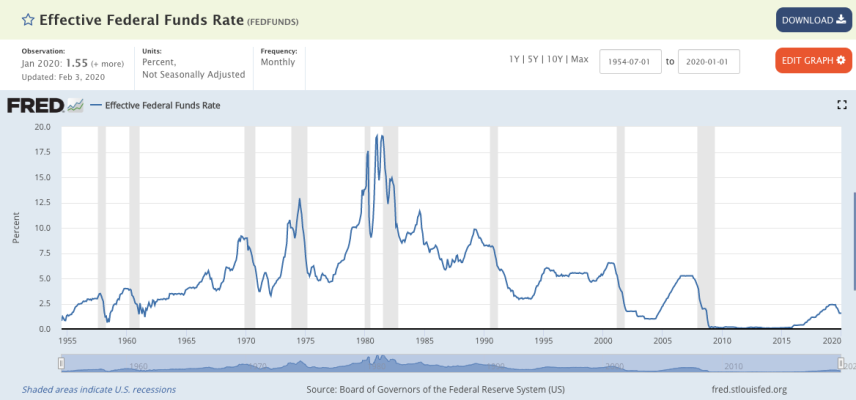

The two screenshots attached are from the Federal Reserve of St. Louis.

One shows aggregate corporate profits. At least to my eye, they look pretty flat since around 2012. The other shows the Fed funds rate. It's up a bit since around 2012.

Meanwhile, the S&P 500 is roughly 2x - 2.5x as high as it was in 2012, going from the mid 1300's to the low 3,000's.

How is that not a bubble?

I know some people will tell me "share buybacks" justify the jump, but I don't buy that either. If Company X has 100 shares outstanding earning $10/share, it has $1,000 of earnings. If it buys back 50 of those shares, then it has 50 shares outstanding each earning $20/share. Still $1,000. Yes, each share is worth more, but with fewer shares outstanding, the market cap (total value of the company) should remain steady.

Next I'm sure I'll hear about helicopter money and how trillions of dollars have been printed. I get that. But ultimately if earnings aren't increasing, doesn't it just mean that each dollar printed is worth less? Wouldn't that imply that the better bet is to find a store of value, like a commodity, precious metal, etc. to keep our assets from devaluing?

Anyway, I welcome constructive feedback both from those who disagree with me and those who agree. I want to figure out if I have legitimate blind spots in my thought process.

The two screenshots attached are from the Federal Reserve of St. Louis.

One shows aggregate corporate profits. At least to my eye, they look pretty flat since around 2012. The other shows the Fed funds rate. It's up a bit since around 2012.

Meanwhile, the S&P 500 is roughly 2x - 2.5x as high as it was in 2012, going from the mid 1300's to the low 3,000's.

How is that not a bubble?

I know some people will tell me "share buybacks" justify the jump, but I don't buy that either. If Company X has 100 shares outstanding earning $10/share, it has $1,000 of earnings. If it buys back 50 of those shares, then it has 50 shares outstanding each earning $20/share. Still $1,000. Yes, each share is worth more, but with fewer shares outstanding, the market cap (total value of the company) should remain steady.

Next I'm sure I'll hear about helicopter money and how trillions of dollars have been printed. I get that. But ultimately if earnings aren't increasing, doesn't it just mean that each dollar printed is worth less? Wouldn't that imply that the better bet is to find a store of value, like a commodity, precious metal, etc. to keep our assets from devaluing?

Anyway, I welcome constructive feedback both from those who disagree with me and those who agree. I want to figure out if I have legitimate blind spots in my thought process.