You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

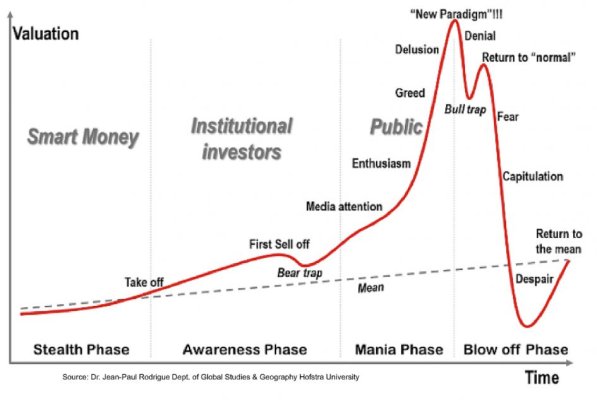

I found this chart trying to explain the market .. what do you think?

- Thread starter cyber888

- Start date

SnowballCamper

Full time employment: Posting here.

- Joined

- Aug 17, 2019

- Messages

- 691

I think it's another reason to have an asset allocation, to rebalance when you're out of whack, and to buy into the market with each paycheck during earning years. As I've learned, any other use for such a chart borders on gambling--- you can usually find a guy with a chart of numbers by the roulette table too.

Of course there are lots of places to find spurious correlations: https://www.tylervigen.com/spurious-correlations

Of course there are lots of places to find spurious correlations: https://www.tylervigen.com/spurious-correlations

Last edited:

Onward

Thinks s/he gets paid by the post

- Joined

- Jul 1, 2009

- Messages

- 1,934

We never hit the "New Paradigm" phase this time around.

I'd say somewhere between Greed and Delusion.

I'd say somewhere between Greed and Delusion.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Oh I thought we definitely hit the new paradigm level looking at CAPE10!

BeachOrCity

Full time employment: Posting here.

- Joined

- Jun 1, 2016

- Messages

- 889

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We are pattern-seeking little mammals. Evolution has made us that way because we cannot evaluate every new situation ab initio. The sabre toothed tigers were too fast for that.

The psychologists tell us that our inclination to find patterns causes us to see patterns in random historical data. That is the essence of technical analysis, which is basically astrology for investors.

The OP chart is one explanation of history. There will be many others with no way to tell which is correct. Useless, IOW.

The psychologists tell us that our inclination to find patterns causes us to see patterns in random historical data. That is the essence of technical analysis, which is basically astrology for investors.

The OP chart is one explanation of history. There will be many others with no way to tell which is correct. Useless, IOW.

BeachOrCity

Full time employment: Posting here.

- Joined

- Jun 1, 2016

- Messages

- 889

We are pattern-seeking little mammals. Evolution has made us that way because we cannot evaluate every new situation ab initio. The sabre toothed tigers were too fast for that.

The psychologists tell us that our inclination to find patterns causes us to see patterns in random historical data. That is the essence of technical analysis, which is basically astrology for investors.

The OP chart is one explanation of history. There will be many others with no way to tell which is correct. Useless, IOW.

I agree we seek patterns. And I tend to always ignore all the two hundred day moving average, “support”, etc methods.

But I find it fascinating that pretty much in every bear market there is kind of a fake recovery that usually happens multiple times. I don’t know if it is human nature or whatever, but it seems to happen during each bear market at some point.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sounds easy. Avoid the fake recovery.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yup. If it doesn't go up, don't buy it.Sounds easy. Avoid the fake recovery.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I agree we seek patterns. And I tend to always ignore all the two hundred day moving average, “support”, etc methods.

But I find it fascinating that pretty much in every bear market there is kind of a fake recovery that usually happens multiple times. I don’t know if it is human nature or whatever, but it seems to happen during each bear market at some point.

It would most likely happen this time, but is competing with the Fed going all out.

The jury is still out.

Similar threads

- Replies

- 25

- Views

- 3K

- Replies

- 35

- Views

- 2K

- Replies

- 26

- Views

- 1K

Latest posts

-

-

-

Best CD, MM Rates & Bank Special Deals Thread 2024 - Please post updates here

- Latest: ShokWaveRider

-

-

-

-

-

-