Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

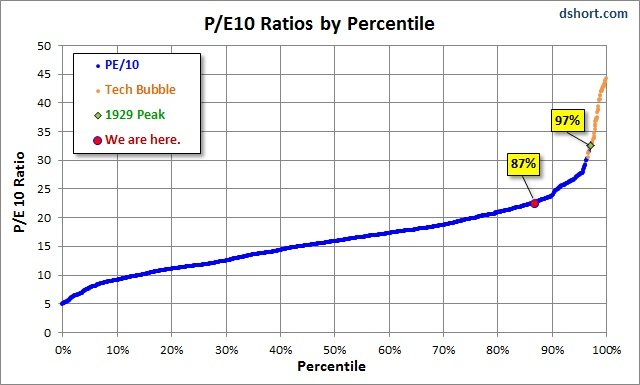

IMO a very good, current article for those who like to monitor P/E ratios...FWIW

Is the Stock Market Cheap?

Is the Stock Market Cheap?

Attachments

Last edited: