freedom2022

Recycles dryer sheets

- Joined

- Sep 24, 2021

- Messages

- 132

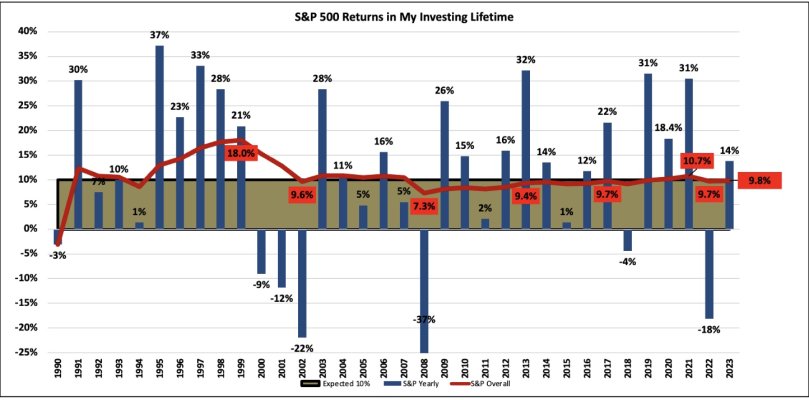

Even though I am in the market over two decades, I am still not a sophisticated investor. I look at simple overall measure of the market: Shiller PE ratio and S&P 500.

S&P 500 reached highest ever in late 2021/ early 2022. Shiller PE ratio reached second highest about the same time. They both kept going down until Fall 2022. Then, S&P 500 kept going up fast until July 2023, however Shiller PE ratio not so much.

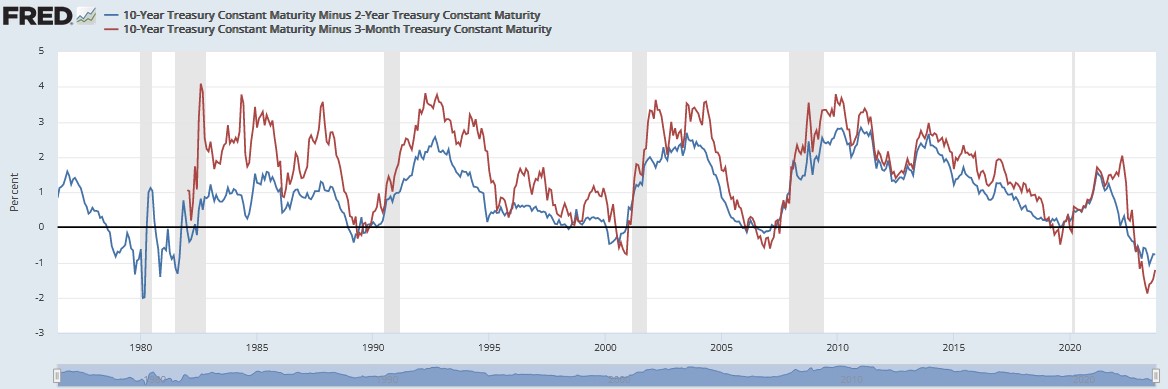

Looks like the market is very optimistic about interest rate will go down soon.

Any thought?

S&P 500 reached highest ever in late 2021/ early 2022. Shiller PE ratio reached second highest about the same time. They both kept going down until Fall 2022. Then, S&P 500 kept going up fast until July 2023, however Shiller PE ratio not so much.

Looks like the market is very optimistic about interest rate will go down soon.

Any thought?