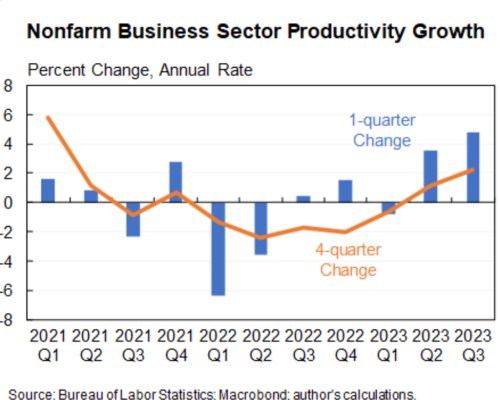

US productivity showed another strong quarterly increase. This is a calculated number and subject to change, but still meaningful. Increases in productivity allow both wages and profits to rise without increasing prices. It’s the primary driver of increases in standard of living.

Here’s the announcement (here)

and below is a chart of the last 2 years compiled by Jason a furman.

Here’s the announcement (here)

Nonfarm business sector labor productivity increased 4.7 percent in the third quarter of 2023, the

U.S. Bureau of Labor Statistics reported today, as output increased 5.9 percent and hours worked

increased 1.1 percent. (All quarterly percent changes in this release are seasonally adjusted annual rates.)

The increase in labor productivity is the highest rate since the third quarter of 2020, in which

productivity increased 5.7 percent.

and below is a chart of the last 2 years compiled by Jason a furman.