Totally agree that the “free money”, or zero bound rates, are unhealthy. They indicate a serious imbalance in the economy.I think a little "maintaining the level" would be a very good thing.

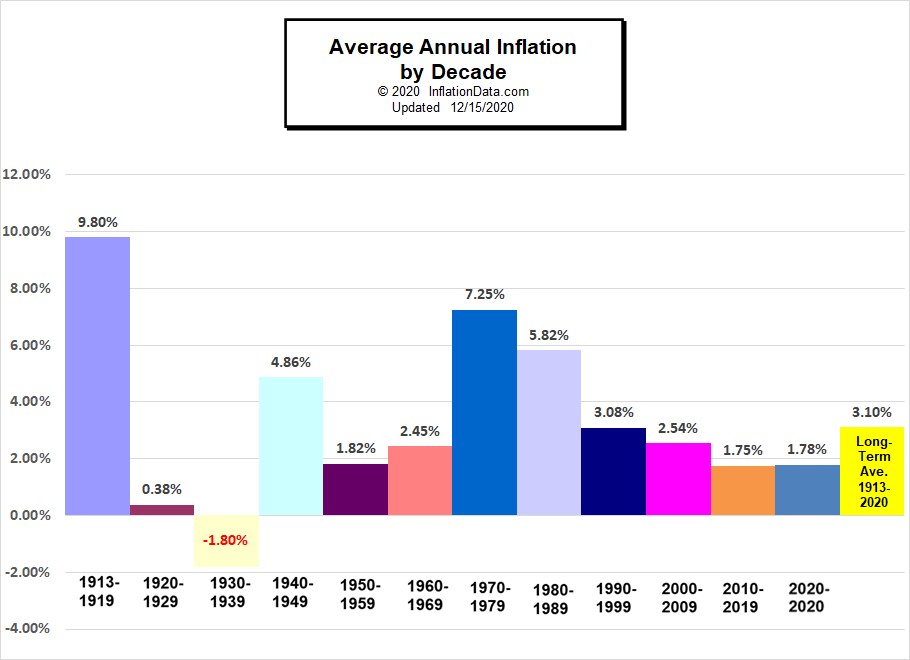

The rates aren't crazy now. People got used to free money. 2009 reinforced the idea that after a quick raise, the rates will crash to zero again. Really, we don't want that because it is bad news. We want stability, then a slow drift down to balance inflation in the 2 to 3 percent range.

We should expect rates to remain at their current level until the economy slows so much it begins to contract or show signs of falling back to 0. Once inflation stabilizes, though, if real rates are too high they could be reduced. That’s critical for a heavily leveraged economy such as ours.