Your conclusion may be correct, but the way you went about it is not. The PCE chart you show is in real terms while the debt chart is in nominal terms. What you want to look at is both in nominal terms (PCE nominal is there on the FRED website).The data does not support an overextended consumer.

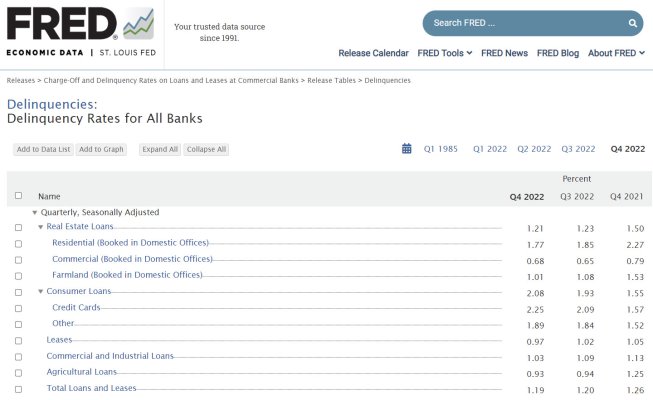

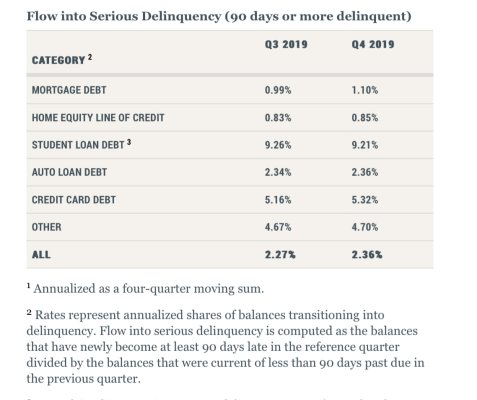

Factoring in a strong job market and high inflation rate, total debt in the US showed little increase in 4Q22, and while credit card debt rose faster than total debt, real PCE was practically flat. So, the increase in CC debt was likely not the result of a strong increase in spending.

Auto loans showed a modest increase, below the rate of inflation, so mo increase in real auto sales.

See the NY Fed report on Household Debt and Credit, here

If you look at both in nominal terms, PCE increased by $1.458 trillion in 2022 while credit card debt increased by $0.13 trillion. Personal income (nominal) increased by $0.511 trillion, so the $0.814 trillion shortfall is barely touched by credit card debt. Where did the money come from? Looks like personal savings which dropped by a staggering $1.588 trillion in 2022 (according to FRED). (Which begs the question "Where did the rest of the money from personal savings go?").

Again, in terms of credit card debt the consumer is probably not overextended. As a percentage of income (which is a proxy for the ability to service debt), EOY credit card debt went from 0.40% of annual income in 2021 to 0.45% in 2022. That doesn't seem particularly extended to me, but who knows?