corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

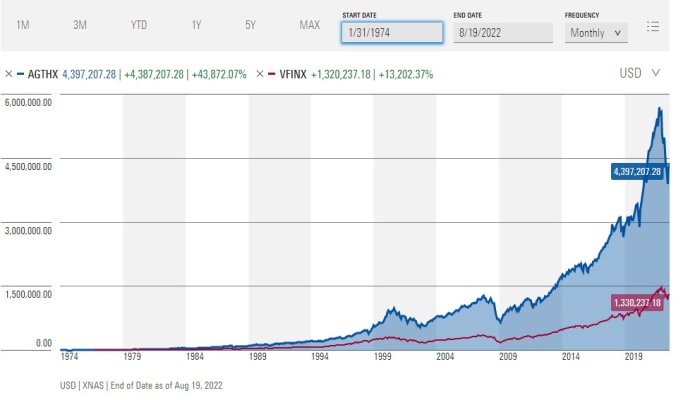

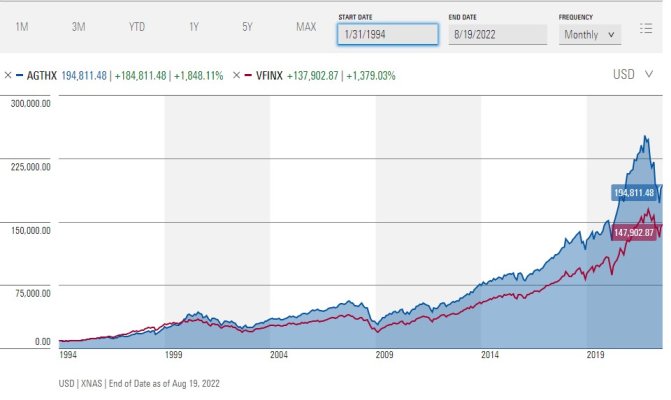

stygz, you can buy American Funds from Fidelity with no load because they're not a full service firm. Like I mentioned earlier, compare what you're considering buying with what you've got already. IF you find you have good funds already, it's likely easy to transfer them. Dumping a fund company because just because you heard "all active funds are bad" is ill-advised. Do your due diligence and do whatever you think is best. If "beating the S&P500 index" is all you're interested in (and I hope it's not) their oldest fund has beat the index since inception, for over 80 years. People can twist numbers around, but that's an impossibility according to many.

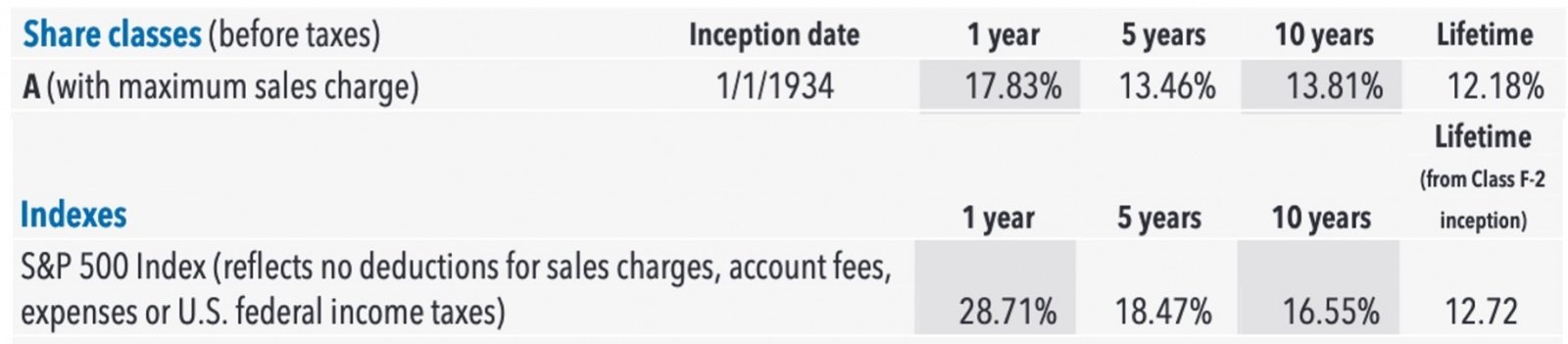

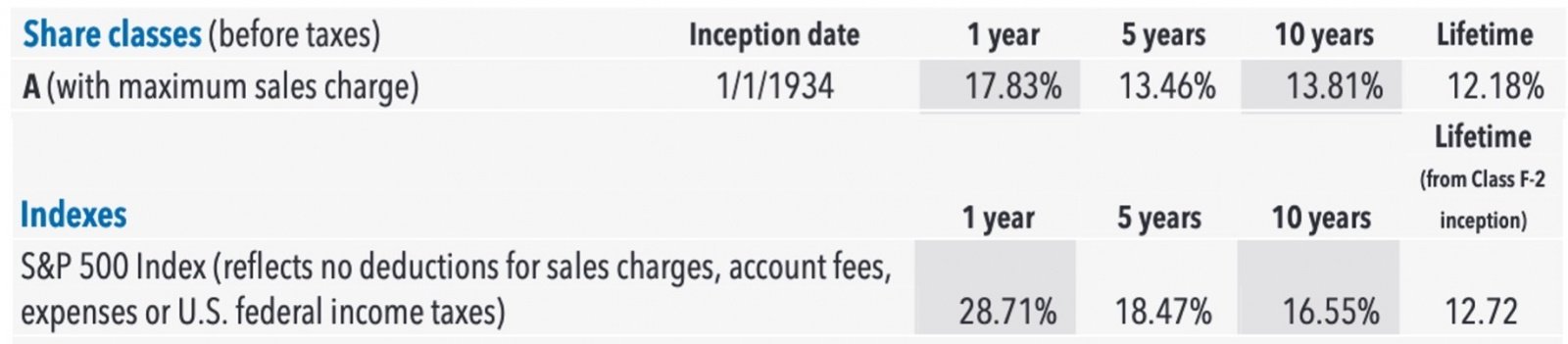

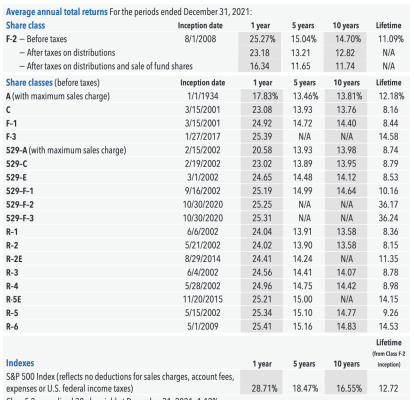

From the American Funds prospectus dated 1 Mar 2022, page 6:

12.18% Class A shares total return since 1/1/1934

12.72% S&P 500 total return since 1/1/1934

https://www.capitalgroup.com/individual/pdf/shareholder/MFGEPRX-004-555421.pdf

And they didn't do any better over 1, 5 or 10 years. And this is from American Funds own prospectus. Data don't lie.

Attachments

Last edited: