Without taking a public flogging I'm going to move about 20% of my portfolio that is managed by a friend. This was done at the request of my wife who wanted a local contact that could handle things when I kicked off (not looking to die in the near future). It's been about three years with him and fees were decent for a MM and returns were in line with the market. However this year he has been a disaster and missed January completely. I just did a spreadsheet of returns in all my accounts and showed it to my wife while we're having coffee. Needless to say he cost me a ton of money (overall a great year for me like most of you). It will be painful to do this to say the least but putting it on paper makes it much easier.

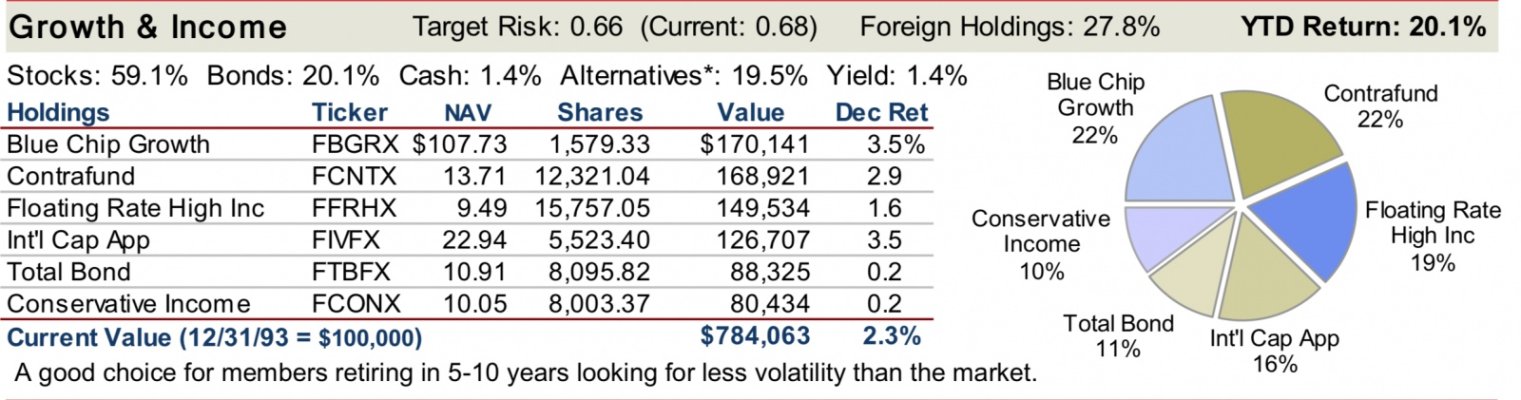

Just over a year ago I changed my AA to 60/40. I'd like to continue with that for the foreseeable future. The two accounts (one IRA and one Taxable) are in Fidelity. Should be an easy transition. After I take a mandatory RMD I'll make the switch mid-January. I would like to throw it out to the gang for advice and I did search for past strings as not to bug you. Thanks in advance for your suggestions.

If it really means anything I have approximately $275k in tax deferred and $170k in taxable.

Just over a year ago I changed my AA to 60/40. I'd like to continue with that for the foreseeable future. The two accounts (one IRA and one Taxable) are in Fidelity. Should be an easy transition. After I take a mandatory RMD I'll make the switch mid-January. I would like to throw it out to the gang for advice and I did search for past strings as not to bug you. Thanks in advance for your suggestions.

If it really means anything I have approximately $275k in tax deferred and $170k in taxable.