aja8888

Moderator Emeritus

I picked up 200 more shares pf CHSCM at a shade over $25 today. Just adding to my collection.

I picked up 200 more shares pf CHSCM at a shade over $25 today. Just adding to my collection.

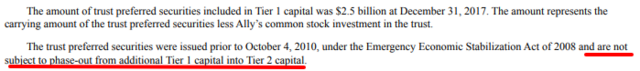

Dirtbag banks like Ally should be able to squeeze a 6.75% QDI in, but allowing for tax break that the trust preferred allows the call and reissue savings could be minimal like you are thinking...However there is a separate fly in the ointment...Those final phase in Basel 3 regs....Most trust preferreds from banks above 15 billion in capital will be disallowed from Tier 1 capital in 2019. I dont quite understand it fully though, but it could be used as Tier 2 if they desire or need it...That is the main wild card.

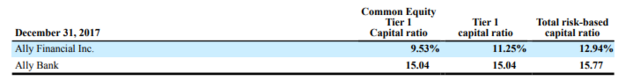

Under U.S. Basel III, Ally and Ally Bank must maintain a minimum Common Equity Tier 1 risk-based capital ratio of 4.5%, a minimum

Tier 1 risk-based capital ratio of 6%, and a minimum total risk-based capital ratio of 8%. In addition to these minimum risk-based capital

ratios, Ally and Ally Bank are also subject to a Common Equity Tier 1 capital conservation buffer of more than 2.5%, subject to a phase-in

period from January 1, 2016, through December 31, 2018.

Im not surprised, Aja. I remember a year or so ago, you still were patiently waiting for another bite of that apple! I bought CHSCN at $25.48 Friday...Should have bought more then as its up already. I will try to good and not flip as I remember complaining selling and not getting a good reentry point... Its good to diversify among sectors and not be over gorged on financial preferreds. I got my mixture better now...Pipelines, insurance, banks, railroad, Ag, utes.

Ally was required to maintain a 15% tier 1 leverage ratio prior to change made last August. Their new ratios requirements:

As of December 2017, from their 10K, they were comfortably within their capital ratio:

And their capital conservation buffer was 4.94%.

Unless something changes significantly I don't see any fly in the ointment.

OK, understand what you were talking about. Does this provide answer?Bob, I do know this though...Banks must submit yearly capitalization plans that get approved. If that document was findable that would show if this issue was to remain outstanding next year. I have never been able to find one though. Just generic articles expressing approval, but never the specifics that are submitted.

Bob that is only the generic stuff. A detailed plan will show where the tier capital resides from. This doesnt mention anything. Banks need to have some reserves of capital on the books. Banks started using trust preferreds to look like capital, but it is actually debt disguised as capital with the debt hidden in trust. Regulators want real capital backing it...Such as common stock or non cumulative preferred stock. They want stronger real capital. There were some exemptions, mainly small banks, but large banks were not.

See Ally could even have an equity offering planned to replace the trust preferred. Unless they got some kind of exemption from Tarp issuance, it wont be allowed sometime next year.

Bob that is only the generic stuff. A detailed plan will show where the tier capital resides from. This doesnt mention anything. Banks need to have some reserves of capital on the books. Banks started using trust preferreds to look like capital, but it is actually debt disguised as capital with the debt hidden in trust. Regulators want real capital backing it...Such as common stock or non cumulative preferred stock. They want stronger real capital. There were some exemptions, mainly small banks, but large banks were not.

See Ally could even have an equity offering planned to replace the trust preferred. Unless they got some kind of exemption from Tarp issuance, it wont be allowed sometime next year.

Bob, where did you read that it isnt subject to phaseout? If that was mentioned somewhere, that really tilts odds in our favor. I have never read that anywhere.

No problem, glad to share as partial payback to knowledge you've shared.So that was part of the Tarp exclusion . Good sluething Bob! I think we r good to go!

I want her to move some over to pref or bonds... probably BB+ or above... some being term dated but I am not picky as I do not think she will ever need to sell.... so, people with some of these holdings, what would you suggest?

I want her to move some over to pref or bonds... probably BB+ or above... some being term dated but I am not picky as I do not think she will ever need to sell.... so, people with some of these holdings, what would you suggest?OK... I have help one of my sisters get her finances straight... found out she was a millionaire... did not know it until I added everything up...

BUT, her and her DH are buying common for yield!!!I want her to move some over to pref or bonds... probably BB+ or above... some being term dated but I am not picky as I do not think she will ever need to sell.... so, people with some of these holdings, what would you suggest?

The only one I hold is C-N, but it is over par and I do not want to put her at call risk if I can help it...

Tell her to wait until late November to mid-December. We may get some bargains again. I have my shopping list (posted earlier) ready to go. I owned most of the preferreds and baby bonds on that list and sold them early last December. Many are down about 9-10% from my sale price. It would be great if I could get back in after another 6-8% drop with yields around 6.5%-6.75% for investment grade preferred stocks and about 7%+ for the investment grade baby bonds.

I do not think she is in a hurry...

So what is your list?

Not knowing exactly what future holds, I feel like I am sitting on some good balance. Adjustables, NSS and ALLY-A ...Term dated CNIGO, CNIGP, ASRVP, JBK, PFX ....Perpetual with modified floater, CHSCN, Perpetual AILLL, AGO-B, AWRY, FIISO, MSEXP, GLP-A

My shopping list for preferred stocks and some baby bonds when they drop below par and yields are in the 6.5-6.75 range (preferred stocks) and 7%+ for baby bonds. All are pretty solid companies.

ALL-D

ALL-E

ALL-F

AFC

BAC-C

COF-F

COF-P

COF-C

COF-D

C-S

JPM-H

JPM-E

JPM-B

FRC-E

LMHA

EBAYL

SNHNL

RNR-C

WFE-A

DLR-I

DLR-C

You can get higher yielding lower rated issues now but, the one's above are much safer.

Texas, I wouldnt recommend any of mine, as I think an initial position should be on something they dont have to deal with a redemption risk, or frustration of not knowing how to buy an illiquid..

But I would recommend they know not to fall in love with any particular issue, start out small, and dont just buy financial preferreds. Maintain a little diversity...The CHS issues at right price point are very quality issues. CHSCL was my favorite but Aja’s CHSCM at par he also bought this week like I did with CHSCL is a good one at right price point. Plus they are cumulative, from a very solid 100 year old Fortune 100 company with 2023 or 2024 first call dates.

Um, wow, your common's down 5%? Not sure what you have but DOW only down 1.3%, so not sure what you have.My individual common are down about 5% so far today... my pref is down .11%...

Um, wow, your common's down 5%? Not sure what you have but DOW only down 1.3%, so not sure what you have.

I get your position though, but you can't look at one day to measure your return. I'd guess that the drop today in common are give up from YTD gains. How'd they look on YTD basis?

And not all common div's are bad. As example, here's one of my favorite common div stocks:

ARCC 1/3 - $15.92 Today $16.765 - 7% gain YTD and it also has a current div yield of 9.27%. Calculating the div's paid YTD that's almost 17% return.

Another favorite:

VZ 1/3 - $52.54 Today $55.48 - 5.6% gain YTD and it's also has div yield of 4.38%. Calculating in the div's paid YTD that's a 12% return.

I also like JPM, it's down slightly today, but still up for the year and pays a div (yield 2.79%). YTD return as of today would be about 9.5%.

Comparison, my favorite preferred, ALLY-A. It's basically flat on price has a nice floating rate (currently 7.55%), overall YTD is up about 8%, so below my common w/div.

I'd guess that if you look at some of your preferred's on a YTD basis you'll find they are down from Jan (due to FF rate increase), some maybe barely break even when you factor in their div. I looked back and see you held C-N (don't know if you still do), but it looks like it's down about 3.5% YTD, with it's dividends it's about 4% return YTD. And we'll just ignore what PFH has done.

Point being, I'd be cautious on just giving advise to move to preferred's. It's more about doing the right due diligence and find the right mix.